Understanding who they are doing business with is indispensable for banks and other financial institutions to mitigate the risk of money laundering and other financial crimes. That’s where Know Your Customer (KYC), also called Customer Due Diligence (CDD) process, comes in.

KYC processes are part of standard AML compliance obligations in most places. It’s a set of activities and procedures that starts during onboarding to help ensure a bank knows who their customers are and if they pose a risk for money laundering schemes. This also helps determine what normal behavior looks like for a new customer. Having a baseline of normalcy helps flag anomalies down the road.

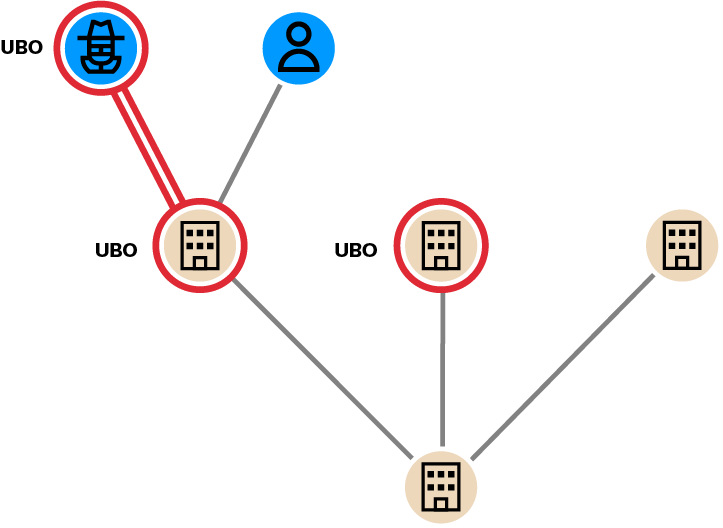

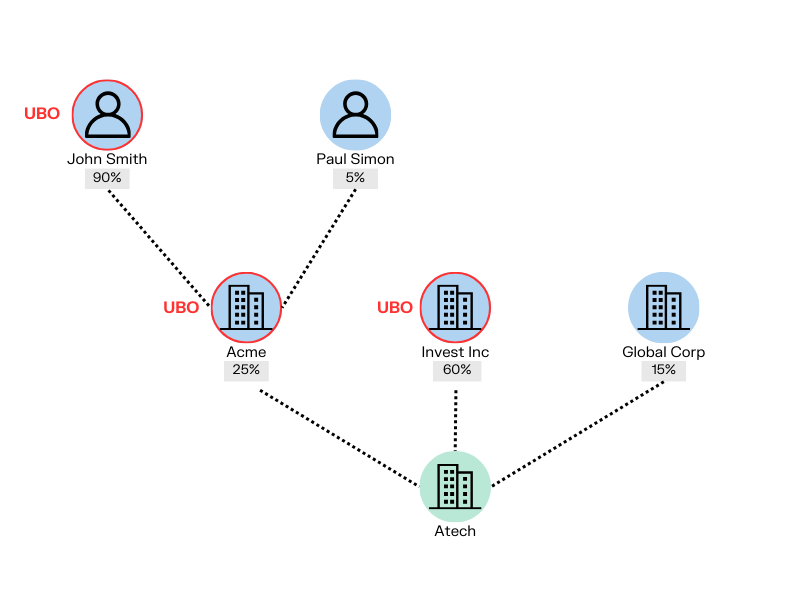

AML KYC involves screening key data and information to establish and verify a customer’s identity. Banks must also determine the ultimate beneficial owner (UBO) of any companies they’re working with, which may involve peeling back multiple layers of ownership.

AML KYC involves screening key data and information to establish and verify a customer’s identity. Banks must also determine the ultimate beneficial owner (UBO) of any companies they’re working with, which may involve peeling back multiple layers of ownership.

Politically exposed persons (PEPs) or individuals and businesses on sanctions lists must also be identified, since they can pose a higher risk for money laundering or other financial crimes.

Enhanced due diligence (EDD) is also an important part of AML KYC processes. When questions arise based on the information banks gather during standard KYC, EDD may involve gathering additional documentation. Enhanced due diligence often involves gathering additional materials to verify customer identity, verifying the source of funds, additional transaction screening, and ongoing monitoring procedures.

KYC changes over time based on anti-money laundering regulations where a given bank operates, and on financial crime trends and risks.

KYC is not without its challenges. Particularly today, when banking is increasingly online, it can be difficult to gather all the information needed to verify a customer’s identity and screen for risks.

Graph technology structures data in a way that enables you to easily understand the connections between your data. Using a graph technology investigation platform can speed up and simplify some key KYC processes.

An ultimate beneficial owner (UBO) is the person or entity that controls a company by owning more than 25% of the shares, or on behalf of whom a transaction is made.

Regulations in most places require financial institutions to identify UBOs at onboarding as part of KYC for AML. The verification process can involve navigating through long and complex ownership structures.

Manually identifying the UBO of a company with a complex ownership structure can be time consuming and lead to errors. Using graph technology, on the other hand, the analysis can be done through a single graph query, effectively automating the process.

It would be great if every individual and every company within an organization’s databases were unique. But that’s probably not the case.

A bank might have three individuals within its database that share the same name, but each one has a different ID on record. Entity resolution enables you to figure out if they are indeed one and the same. And understanding exactly who each person or business is makes for more robust KYC.

Avoiding duplication is a complex problem in an IT system with different silos.

Graph technology, on the other hand, can help quickly identify potential duplicates. If those three individuals with the same name but different IDs all share the same date of birth, chances are they are the same person. Graph analytics can show you all that information in a few clicks.