Discover our user stories and learn about the challenges they overcame with Linkurious solutions. In this post read how BforBank’s risk and compliance unit is dismantling check fraud rings with a bank fraud solution relying on graph technology.

BforBank is an online bank launched in 2009 by Crédit Agricole Group. With more than 180,000 customers, it’s one of the leading financial institutions in the French online banking market. The company provides services such as checking, debit and security accounts, life insurances, home loans and consumer credits.

Within the bank, the risk and compliance unit ensures that the financial institution complies with applicable laws, regulations and rules. The team supervises fraud detection and investigation to preserve the financial integrity and the reputation of the bank.

The unit oversees the fight against money laundering, market abuses, first and third-party fraud, Politically Exposed Person (PEP) screening, customer protection and compliance reporting.

Every day, BforBank’s database management systems collect large amounts of data. From transactions and money flows to Know Your Customer (KYC) documents, this information represents important volumes of structured and unstructured data distributed across multiple silos. The monitoring of this data is critical to lower risk and financial losses.

To investigate flagged customers, transactions or behaviors, the compliance team’s was using a bank fraud solution built upon relational technology. As a result, querying connections within the data to confirm fraudulent activities or uncover fraud rings was a tedious, long and, sometimes, unsuccessful process.

« “A request could take from 2 minutes to several hours when querying for connections across multiple relational tables. Cross-field queries could take several days” explained Alexandre Dressayre, Compliance Officer at BforBank. »

Complex cases required access to information scattered across data silos. Investigators had to request additional technical resources, slowing down the fraud investigation process and occasioning larger losses.

« “Some types of fraud, such as phishing, required the intervention of the IT Department, increasing the processing time and deteriorating the investigation” described Alexandre Dressayre. »

To improve fraud detection and reduce investigation time, the risk and compliance unit and the IT Department decided to implement a graph analysis and visualization layer with Linkurious Enterprise on top of a graph database.

« For Alexandre Dressayre “several factors motivated the choice of the Linkurious solution, notably the bundle offered by the company. An off-the-shelf visualization and analysis software along with the Neo4j graph database solution was a perfect fit for us.” »

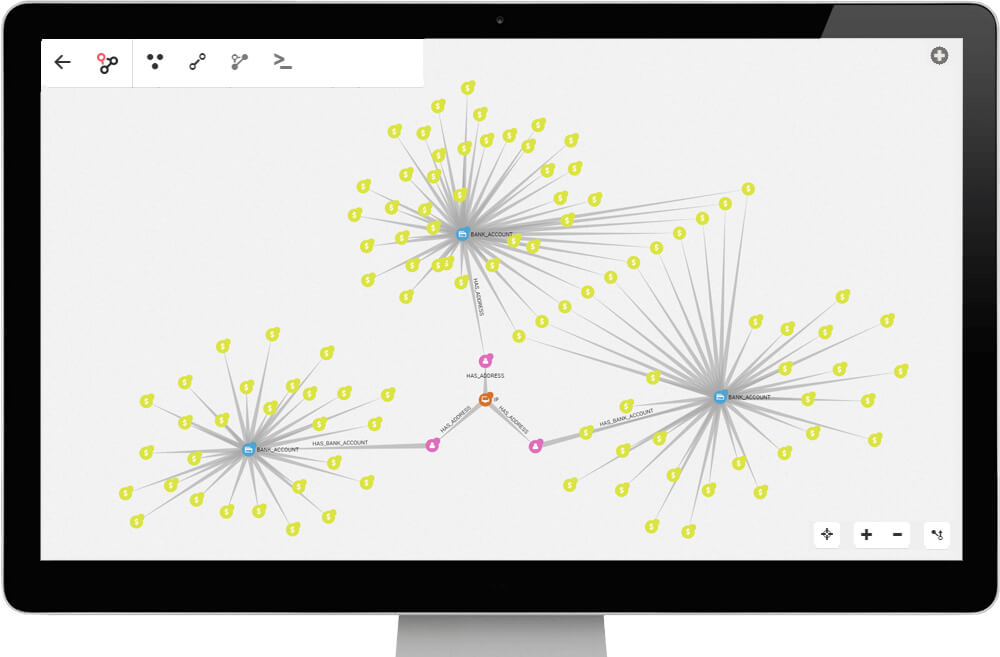

The team started by designing a data model compiling together customer data, bank transfer orders, check cashing activities and IP addresses that were loaded into Neo4j. By combining their information into a graph, the team got an exhaustive overview of their data.

The graph data was then instantly available in Linkurious Enterprise, providing an easy way to visually explore the connections between entities. This approach reduced the blind spots due to siloed information. It provided the team and occasional users with an intuitive interface to investigate the hidden connections of suspicious clients.

« “Thanks to the available network of data, we can spread out the connections and try to find if a fraudster is connected to other clients, through IP, postal or email addresses for example. This helps us detect fraud rings or identity theft fraud” declared Alexandre Dressayre. »

Having access to its data in one aggregated view, the BforBank team was also able to detect new fraud patterns that were too complex to identify in the past. The bank fraud solution built on graph technology allowed to search for complex scenarios within the data, involving multiple level of connections.

« “The first pattern we set up was one related to phishing fraud. The system reports cases where clients have multiple and suspicious connection behaviors.” »

As new fraud schemes are identified, members of the team can set up additional alerts tailored to efficiently oppose the threats faced by their institution on the go.

Immediately after deploying Linkurious Enterprise, the risk and compliance unit was able to unveil complex fraud scenarios that had stayed undetected until this point. 20% of fraud attempts stopped in its tracks wouldn’t have been reported without this new approach.

The ability to easily query connections and specific patterns within the data allowed the BforBank team to detect new fraud situations independently and faster. The team recorded a drastic decrease of the average investigation process duration, leading to quicker decision executions and faster regulatory reporting transmissions.

« “The processing time to identify fraud rings was divided by 10” declared Alexandre Dressayre. “In a recent investigation, a ring of 11 fraudsters was detected and identified within half an hour. Because of its complexity, a similar case would have taken several days to complete before the implementation of Linkurious.” »

A spotlight on graph technology directly in your inbox.