How the ICIJ used Linkurious to reveal the secrets hidden in the Swiss Leaks data

On February 8 CBS, Le Monde, The Guardian and more than 50 news organizations around the world revealed how one of the world’s biggest banks, HSBC, profited from doing business with tax dodgers and criminals around the world, helping over 100 000 customers hide $100bn in Switzerland. It was the end of a 6-month investigation led by the International Consortium of Investigative Journalists (ICIJ) involving some 150 journalists around the world. The project has just received the prestigious Data Journalism Award, given by the Global Editors Network. Here is how they used Linkurious to reveal the secrets hidden in the Swiss Leaks data.

In 2014 two journalists from Le Monde, Gérard Davet and Fabrice Lhomme received access, through a contact in the French government, to financial data from the Swiss branch of HSBC. The data, stolen by Hervé Falciani, a former systems engineer working for HSBC, was potentially explosive. It contained detailed information about the bank accounts of more than 100.000 HSBC customers and shed light on the secretive Swiss banking world.

The two journalists had over the years made a career of investigating French political scandals like Karachi, the Tapie settlement or the Kazakhgate. However, they now faced a new challenge. The Swiss Leaks dataset was simply too large to be analysed manually by two persons. Soon, a small team at Le Monde was assembled. “When the project started, it was just a few people: 4 investigative journalists including one financial investigation expert and me” explains Alexandre Léchenet, a data journalist involved in the project.

Le Monde’s team had access to 60.000 files containing the names of HSBC’s clients in dozens of countries and details of the amounts held in their accounts. Their first goal was to identify high profile personalities (criminals, politicians or artists) among HSBC’s customers. Who were the people using the bank to store their assets? Were they involved in corruption, laundering money or evading taxes? The investigators looked for potential connections between the Swiss Leaks dataset and lists of personalities coming from Interpol, DBPedia and other data sources.

The size and complexity of the data proved to be a challenge. Le Monde also recognized that the Swiss Leaks story was truly global and that the newspaper didn’t have the expertise to investigate all the names. HSBC’s customers were located in more than 200 countries and collectively held $100bn in the bank. Giving the subject, the level of reporting it deserved would require assembling a worldwide team and get access to better data analysis tools.

In May 2014, Davet and Lhomme reached out to the International Consortium of Investigative Journalists (ICIJ), a global network of more than 190 investigative journalists in more than 65 countries specialized in in-depth reporting of high profile, cross-border issues. In April 2013, the ICIJ had published the Offshore Leaks, a report disclosing the true owners behind more than of 100.000 offshore companies.

Davet and Lhomme hoped to leverage the ICIJ’s worldwide network of investigative journalists and the organization’s expertise in mining data leaks. “Working with the ICIJ, we could tackle the technical challenges associated with the project with other news organizations. It also meant that the story would get better exposure” says Léchenet. With ICIJ’s help, the investigation went from mobilizing a few persons in Paris to a collaborative project with more than 150 journalists around the world. Experienced journalists from CBC/Radio Canada, Haaretz (Israel), La Nación (Argentina) or The Guardian pooled their knowledge and resources to analyse the Swiss Leaks data.

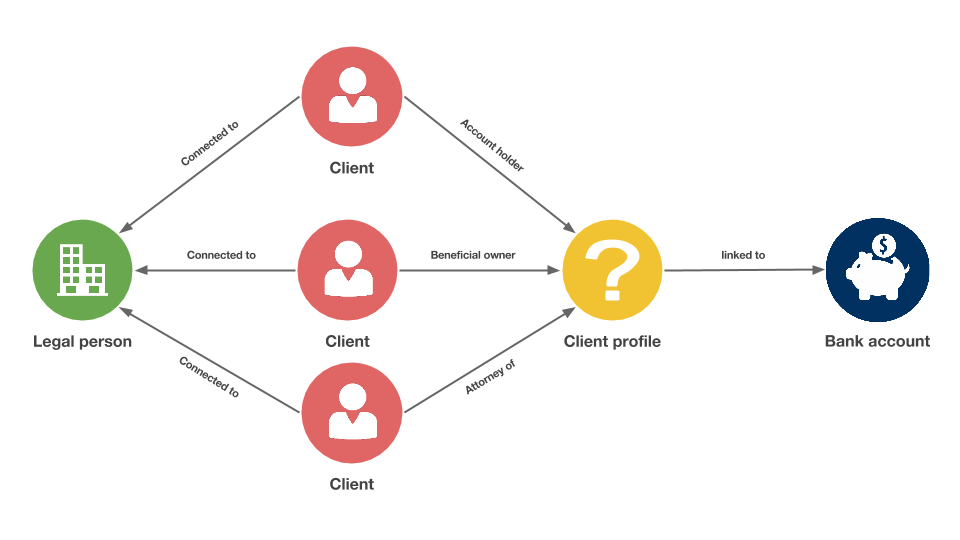

But just adding more human resources was not enough. Through its Data & Research Unit, the ICIJ provided a much need data analysis expertise to the project and created the tools to make the leak searchable to reporters. They first had to recreate the HSBC client database from plain Excel files. Secondly, they used computer programming techniques to connect every name to one or several countries. And then, the most important step: to be able to turn the data into a graph format to explore the connections between clients.

“While working on Offshore Leaks, I learnt how important graph analysis is when investigating corruption”, says Mar Cabra, editor of the unit. “Connections are key to understand what the real story is and who’s doing business with who. We decided early on that we needed to use a graph-based approach for Swiss Leaks.”

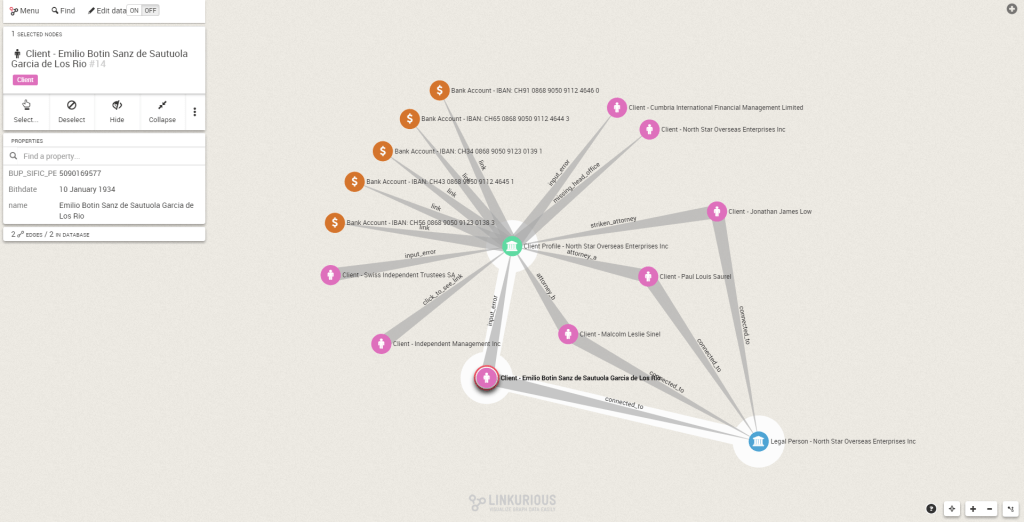

ICIJ wanted a graph visualization platform that would allow its large team to easily search, explore and visualize complex graphs from anywhere in the world. It decided to use Neo4j and Linkurious Enterprise, which provided a simple interface for any journalists — tech-savvy or not– to work.

ICIJ’s Data & Research Unit was able to transform the original Swiss Leaks files into a single Neo4j graph database. With this graph database, ICIJ could identify how all the persons and bank accounts in the data connected to each other. More importantly, it tracked who controlled which accounts.

“With Linkurious you can understand a complex database of relationships in a glance, it is easy to use, very functional, efficient, attractive and too easy to install” says Rigoberto Carvajal is ICIJ’s data expert.

Most of the journalists involved in the investigation were not data science experts or developers. They did not know about graph analysis, but the easy-to-use graph visualization capabilities of Linkurious Enterprise gave them a deeper understanding of the Swiss Leaks data. It revealed an underlying network. Instead of looking at obscure individual financial statements, they could search for persons and see what assets they controlled through which relationships.

Linkurious Enterprise was also used by the journalists to fact-check their articles before publishing. Thanks to it, they were able to search for the persons they were writing about and know precisely how many accounts they were connected to, in which capacity, how much money they had in them and if they shared it with somebody else. It allowed the ICIJ’s investigators to investigate quickly and precisely and to avoid making mistakes.

“Linkurious Enterprise allowed our remote team of dozens of reporters to easily sift through complex financial data to uncover persons of interest and potential stories — all in a visual and very intuitive way”, Cabra explains.

Banks have a legal obligation to perform due-diligence on their customers. These obligations exist to prevent banks from being used by terrorists and criminals looking to launder money. The Swiss Leaks investigations revealed that HSBC’s Geneva branch, ignoring these rules, helped people accused of drug-running, corruption, money-laundering or arms-dealing conceal billions of dollars in Switzerland.

Among the names revealed by the Swiss Leaks investigation are:

- Rami Makhlouf, whose cousin and close associate, Syrian President Bashar al Assad, over the past three years has helped cause the deaths of tens of thousands of his citizens in the country’s civil war.

- Katex Mines Guinee, a company fingered by the United Nations as a “possible provider of weapons” in Liberia’s civil war;

- Erez Daleyot, a Belgian-Israeli diamond tycoon, connected to arms trafficking, blood diamonds and bribery

- Jeffrey Tesler, a lawyer and key participant in the $182-million Halliburton Bribery Scandal;

- Rachid Mohamed Rachid, the former Egyptian trade minister who fled Cairo in February 2011 amid the uprising against Hosni Mubarak. Rachid was convicted in absentia for alleged profiteering and squandering public funds.

- Vladimir Antonov, a Russian banker accused of looting £400m from the Lithuanian Snoras bank.

(Read all of ICIJ’s stories here)

Tax authorities across the world have used the Swiss Leaks files to identify tax fraudsters. The United Kingdom for example has collected $236 million from some of the 3,600 Britons identified as using the Geneva branch of HSBC according to the NYT. France has launched 103 legal actions targeting some of the 3,000 French residents identified in the Swiss Leaks data.

Moreover, the SwissLeaks project has stirred a worldwide debate on the role of offshore banking in money laundering. Minutes after the investigation published the #swissleaks hashtag trended on Twitter for days. The huge public reaction created pressure for a swift response from governments and authorities, who would in the weeks to follow announce criminal prosecutions and parliamentary inquiries, including the first ever raid by Swiss authorities on a Swiss bank and a criminal investigation against HSBC in France.

You can see a demo of Linkurious now and discover how to visualize the connections hidden in your data.

A spotlight on graph technology directly in your inbox.