Designed to bridge the gaps in your data and support context-based decisions

Our Decision Intelligence Platform is the only fully modular solution powered by native graph technology and AI. Build the solution you need for your organization and turn siloed, fragmented data into valuable insights.

Providing a future-proof solution to your most pressing data challenges

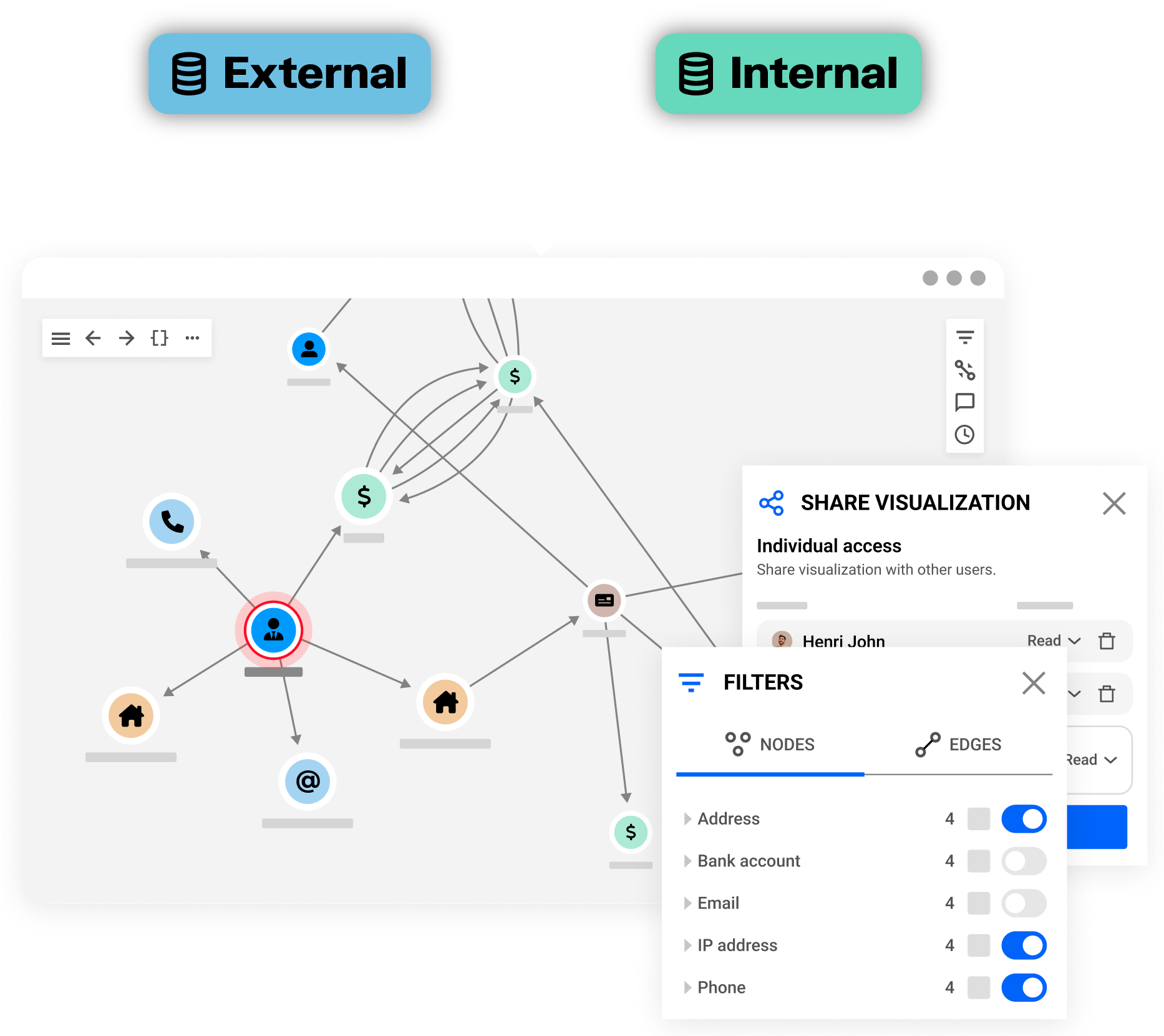

Whether you’re looking to unify your internal or external data sources and reveal relationships for more context-based decisions or simply need to visualize and analyze your graph data at scale, our off-the-shelf modules can be tailored to your unique needs and quickly integrated into your existing tech stack.

Unify & enrich

Build one single source of connected truth

Build a contextualized single source of truth combining internal and external data in a native graph database

Resolve duplicates and reveal relationships with explainable Entity Resolution AI

Enrich your data with context-based risk scores, detect communities, and more with 65+ graph and AI algos

Detect

Automate detection of complex patterns and networks

Detect complex patterns and suspicious connections with graph powered alerts

Review and process alerts with a case management interface

Analyze and decide

Harness augmented graph data, speed up time to hidden insights

Large scale, high performing graph visualizations even with billions of entities

Collaborative investigation and decision making capabilities

Turn repetitive workflows into simple forms or buttons with Queries

Unify and enrich your data

Unify disparate internal and external data sources, no matter their size or complexity, with graph technology and Entity Resolution AI. Enrich your data using machine learning and graph analytics to augment decision making.

Detect complex patterns

Keep up with complex anomaly detection and evolving patterns in connected data with graph-powered detection capabilities. Combine multiple rules into a single alert to reduce false positives and negatives, and reduce the workload of your team to focus on what really matters.

Analyze and decide

Empower teams of both technical or non technical users to collaborate in a single user-friendly workspace to perform advanced network analysis. Ultimately uncovering insights that may have previously gone unnoticed up to 10x faster and making more informed decisions with rich contextual information.

20%

Detect up to 20% more suspicious cases

10x

Investigate sophisticated activities up to 10x faster

30%

Reduce time spent on alerts by an average of 30%

Why Linkurious

How it works

Built with interoperability in mind, each core module consists of off-the-shelf software that seamlessly integrates with one another and your existing tech stack through a powerful API. This ensures rapid, autonomous implementation and secure deployment, either in the cloud or on-premise, supporting scalability and future growth.