Money laundering is a crime with serious social and economic consequences like corruption and inequality. Laundered funds are used to finance crime like drug trafficking, environmental crime, terrorism, etc.

Many businesses and industries can get caught up in money laundering schemes (take the real estate industry, for example.) But financial institutions have traditionally been the primary targets of criminals looking to launder dirty money and have fallen under increasing scrutiny from regulators. Compliance regulations require them to take action to prevent money laundering, including performing customer due diligence (CDD) and KYC.

Compliance rules also mean that when activity that may be linked to money laundering, terrorist financing, or other financial crimes occurs within a financial institution, they must take action. A bank can officially signal suspicious behavior to a financial intelligence unit (FIU), like FinCEN in the US, through a suspicious activity report (SAR).

Before filing a SAR, however, a bank needs to conduct an AML investigation to justify the report, tracking down all evidence of suspicious activity. Anti-money laundering investigations can be complex as investigators follow the money to track down the full extent of sophisticated criminal schemes. Let’s look at AML investigations in more detail.

An AML investigation is a process conducted by financial institutions to track down cases of suspected illicit activities like money laundering and terrorist financing. It involves analyzing any information that might help identify suspicious patterns and potential sources of illicit funds: financial transactions, customer behavior, and other relevant data.

Sometimes an AML investigation will conclude that no money laundering activities are taking place. But the investigation is an essential step in ensuring compliance with AML regulations and making sure criminal networks don’t slip through the cracks.

A company’s AML compliance program will outline the kinds of behavior or activity that might merit further investigation. These types of patterns will often be detected through monitoring software. Reports from employees or external sources can also initiate investigations.

Some money laundering red flags that might trigger an investigation include:

- Rapid transfers with no explanation

- Large cash transactions

- Complex or layered transactions

- Inconsistent customer behavior

- Transactions with high-risk countries or industries

- Funds that quickly move into and out of an account

- Refusal by a customer to provide identification information

- Transactions that are inconsistent with a customer’s source of income or wealth

An AML investigation must be conducted quickly, since financial intelligence units impose strict deadlines for filing suspicious activity reports. In the United States, for example, banks have 30 calendar days to file a SAR, which may be extended to a maximum of 60 calendar days in certain cases.

The AML investigation process typically involves the following steps:

- Alert Generation: Automatic monitoring systems generate alerts based on predefined transaction monitoring rules to flag potentially suspicious transactions or activities.

- Alert Verification: AML investigators review the alerts to determine their legitimacy. Traditional rules-based detection systems often have high rates of false positives, so many alerts can be quickly dismissed without further investigation.

- Data Gathering: If an alert appears legitimately suspicious, investigators gather relevant data and information about the customer or transaction.

- SAR Submission: AML investigators submit a SAR to the Financial Intelligence Unit (FIU) if deemed necessary.

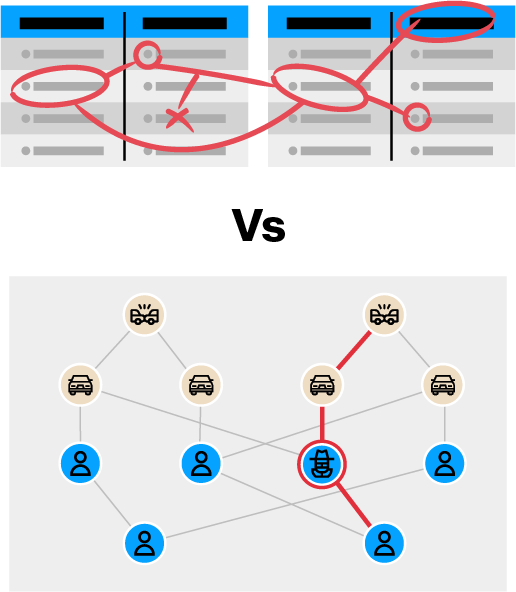

- Manual Investigation: Traditionally, investigators engage in manual work, such as sorting through multiple databases, to find relevant information. This process can be time-consuming and inefficient.

- Evidence Collection: AML investigators search for evidence of money laundering or terrorist financing, which may require sifting through various databases and connections to uncover hidden activities.

Traditional anti-money laundering investigative methods can be inefficient in this process, and let criminal activity slip through the cracks, since monitoring systems generate high levels of false positives: around 95% of all alerts, sometimes more.

Money laundering schemes and terrorist financing are designed to stay hidden, so finding the right evidence can be challenging. Conducting manual investigations using traditional relational databases means going tab through tab to find the right data. It’s easy to miss important connections that paint the full picture of the crimes that might be occurring.

Graph analytics is emerging as a powerful solution for AML investigations. In a graph, data is structured as nodes (individual data points) and edges (the relationships between those data points). The networked nature of graph data makes it easy for investigators to swiftly and efficiently track down all the elements that indicate a money laundering pattern.

Running queries shows investigators in a few clicks information that might have otherwise taken days or weeks to track down. And graph technology displays data in a visual format that shows the connections between data points, making information easy and intuitive to understand at a glance.

Beyond AML regulatory compliance, efficient AML investigation tools help financial institutions do a better job of catching criminality within their organizations. Swiftly recognizing emerging patterns is essential to stop criminals in their tracks. It also creates precious information on the kind of behaviors organizations should monitor moving forward.

Once the investigator has gathered sufficient evidence from their investigation, they must decide whether the initial suspicion holds up. If it does not, the case is closed. But if it does, they submit a SAR to the FIU in the country where they are operating. After that, it’s up to the authorities to decide whether and how to criminally pursue the case.

Graph-powered next-generation financial crime detection and investigation software can help detect more fraud and money laundering schemes and significantly speed up investigations. Learn more in this latest white paper.