The FIU intelligence gap: Why graph technology is key to AML investigations

Financial Intelligence Units (FIUs) are central to global efforts to combat money laundering, terrorist financing, and related crimes. Every year, they process millions of reports, turning fragmented raw data into actionable intelligence that supports law enforcement and safeguards the financial system.

But the battlefield has changed. With exploding alert volumes and evolving criminal tactics, most FIUs are struggling to keep pace and often lack the ability to operate effectively. Besides, most of them still rely on fragmented, manual workflows that were not built to handle today’s scale, data complexity, or investigative speed requirements.

What FIUs need now is a smarter way to connect the dots, faster. That’s where graph analytics and entity resolution provide a strategic advantage. They unify fragmented data, uncover complex schemes, and help analysts analyze and close AML cases in hours, not days.

FIUs serve as national hubs for collecting, analyzing, and disseminating financial crime intelligence. They receive various types of reports (STRs, SARs, UTRs, threshold or cash transactions reports etc.) from regulated entities such as banks, fintechs, casinos, even accounting and legal professions, whenever they spot red flags. The FIU investigates and enriches these reports with all sources of information, determining whether a case requires escalation to prosecutors or international partners. In addition, FIUs handle a growing volume of cross-border information exchanges with foreign counterparts, adding further complexity to their already demanding investigative workload.

For Financial Intelligence Units, asset recovery is more than a legal formality, it’s a strategic lever to disrupt criminal networks and reinvest in the public good. Every dollar confiscated weakens organized crime and strengthens national resilience.

Yet, despite decades of global coordination and increasing regulatory pressure, asset recovery remains the weak link in the AML chain. Trillions of dollars in illicit funds flow through the global financial system each year. But according to the IMF and World Bank, less than 1% is ever recovered.

Why? The 2020 FinCEN Files leak laid this bare: thousands of suspicious activity reports were filed by banks, often repeatedly, involving the same actors, however few led to decisive action. This disconnect revealed the limits of current global AML systems: fragmented data, siloed investigations, and slow, manual workflows.

For FIUs, this isn’t just a troubling statistic. It’s a clear signal that the tools, data models, and investigative approaches they rely on must evolve, quickly.

Financial Intelligence Units are under intense pressure from all sides. The volume of suspicious activity is surging, criminal tactics are evolving fast, and regulatory expectations are tightening. Yet most FIUs are constrained by flat budgets, legacy systems, and siloed data.

Modern money laundering is borderless, fast-moving, and structurally complex. Criminals now operate through privacy coins, blockchain mixers, nested correspondent accounts, and layered shell companies. But these are only part of the picture. Increasingly, they exploit trade-based laundering, synthetic identities, and widespread mule networks - operating simultaneously across financial institutions, geographies, and digital platforms. Investigating these schemes often requires multi-hop, multi-channel analysis that traditional tools simply can’t support.

In 2024, the total number of all reports received by FIUs part of the Egmont Group reached a record of 591,180,017 reports according to a survey. Many of these reports are filed as a precaution, driven by low thresholds and aggressive de-risking. The outcome? Analysts and investigators must sift through millions of low-quality alerts to find the few that matter.

Financial Intelligence Units worldwide are grappling with resource constraints, including limited staffing, skills and outdated technological infrastructure. These challenges hinder their ability to effectively process and analyze the growing volume of reports and adapt to evolving financial crime typologies.

FIUs often work with incomplete or siloed information. While they receive large volumes of reports, access to complementary intelligence such as the FIU’s own data, government-held data, open-source intelligence or even additional data from the reporting entities is often limited or fragmented. Institutional and legal barriers can also slow cooperation across agencies and borders, making it harder to understand the full scope of suspicious networks in time-sensitive cases.

Even when access exists, information is not always structured in a way that supports effective analysis. As a result, FIU analysts may lack the full picture needed to identify the true scale or nature of a suspicious activity.

Financial crime, and in particular money laundering or terrorism financing, is not linear. It moves through networks of individuals, entities, and accounts that are deliberately structured to avoid detection. Traditional approaches primarily leave AML analysts and investigators examining data in isolation. A new generation of technology powered by graph technology empowers them to connect the dots, analyze networks of data and understand the full context around suspicious activity.

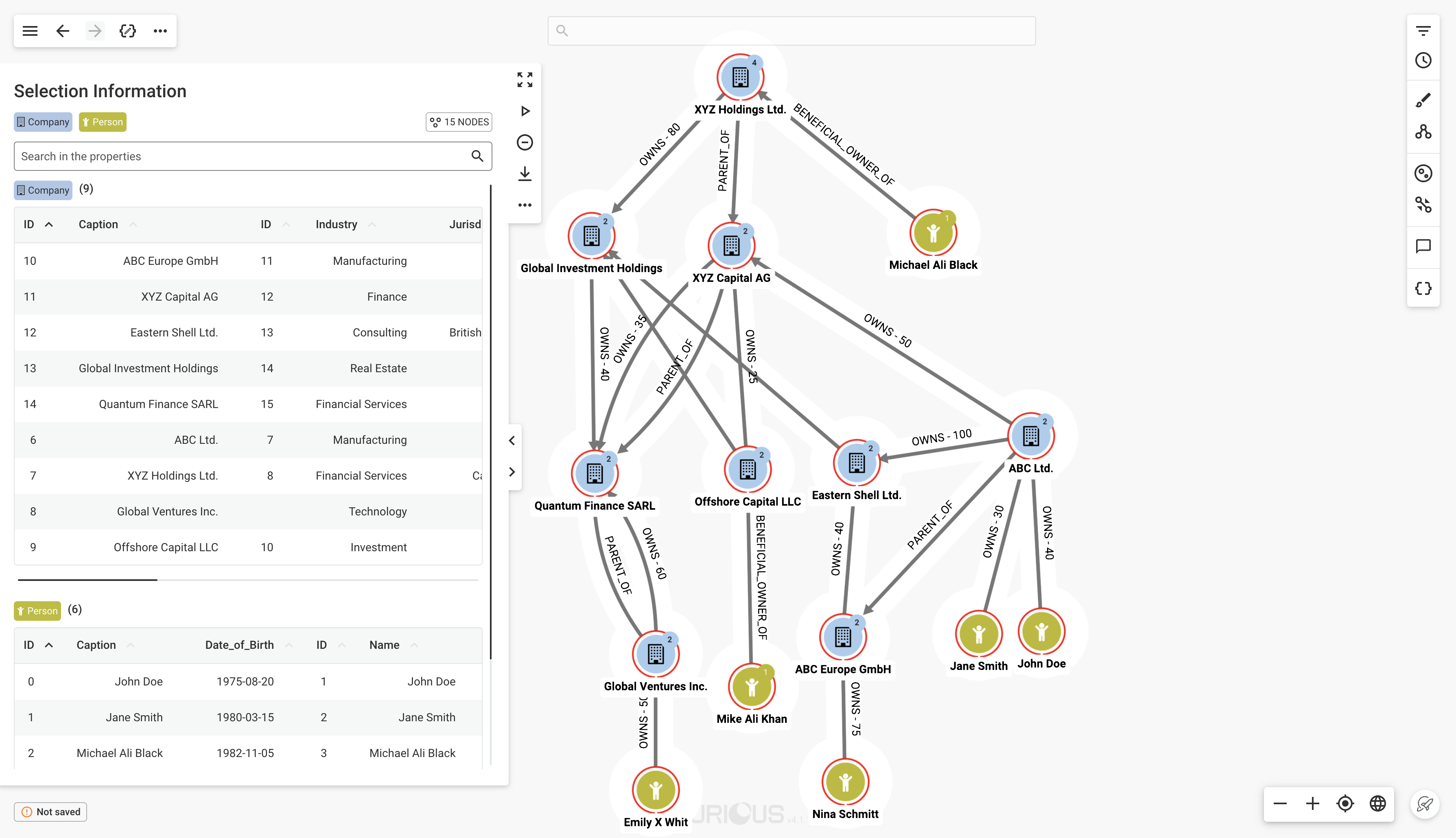

A graph approach allows Financial Intelligence Units to build a centralized knowledge graph that brings together data from multiple sources - such as Suspicious Activity Reports, company registry, financial transactions and more - into one connected system. In a graph model, every individual, company, transaction, or phone number is a node. The links between them are edges. Unlike relational databases, analysts can explore all relevant entities and relationships in a single, unified view. This not only improves consistency and investigation speed, but also helps ensure that everyone in the FIU is working from the same trusted, up-to-date intelligence.

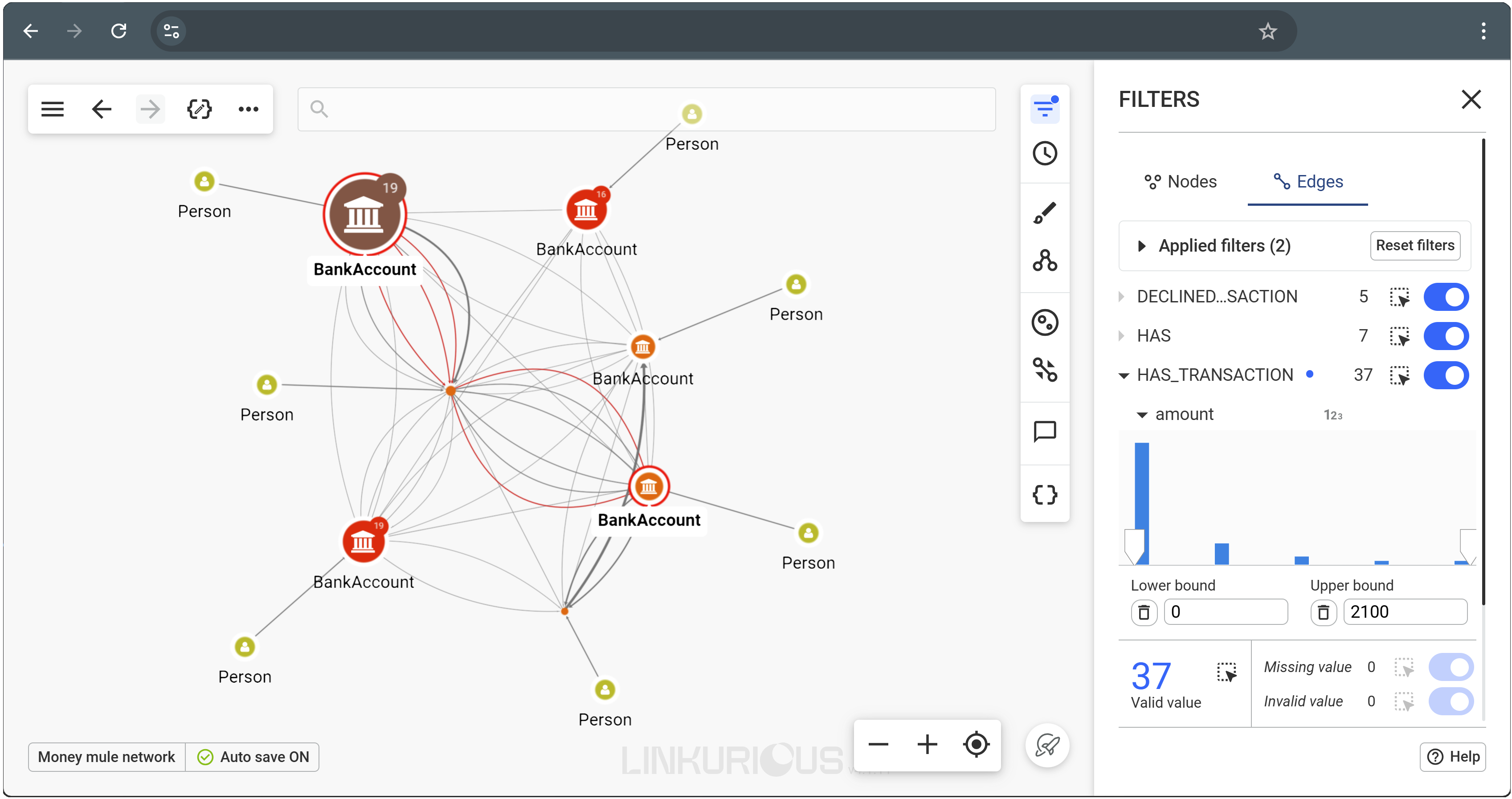

Graph based technology is optimized to surface indirect relationships at scale in milliseconds. Analysts spend less time stitching CSVs together and more time qualifying reports. FIUs using graph analytics can reveal hidden relationships, reduce case triage and investigation times from days to hours, especially for complex cases involving shell entities, circular flows, or layered transactions.

Advanced graph analytics help FIUs move beyond manual link analysis and basic keyword searches. They provide investigative teams with objective, quantitative ways to explore suspicious networks and assess risk.

- Centrality scoring reveals hidden facilitators or "super nodes" behind seemingly minor accounts.

- Community detection helps flag clusters of collusive actors, like mule account rings or trade-based laundering cells.

- Pathfinding uncovers indirect transfer chains across jurisdictions, intermediaries, or blockchains.

These techniques aren’t just fast, they uncover red flags that help FIUs prioritize which networks deserve deeper scrutiny and which cases warrant escalation.

Financial Intelligence Units need more than CSV exports and case notes. They need a clear, navigable view of financial networks.

Investigative technology leveraging graph visualization and analytics provides this. It allows analysts and investigators to interact directly with the connected data around a suspicious activity or transactions and surface patterns, relationships, and potential laundering typologies.

From a single alert or entity, they can dynamically explore linked accounts, transactions, companies, and individuals, visualizing how they interconnect with each other. It allows AML investigators to test hypotheses, prioritize leads, and spot bad actors within seconds.

This visual, contextual analysis helps FIUs make faster, better-informed decisions about which reports need escalation, whether to domestic prosecutors or foreign counterparts.

A graph is only as good as its nodes and edges. If the data is riddled with duplication, missing connections or inconsistencies, the result is a cluttered, unreliable network that hides rather than reveals risk.

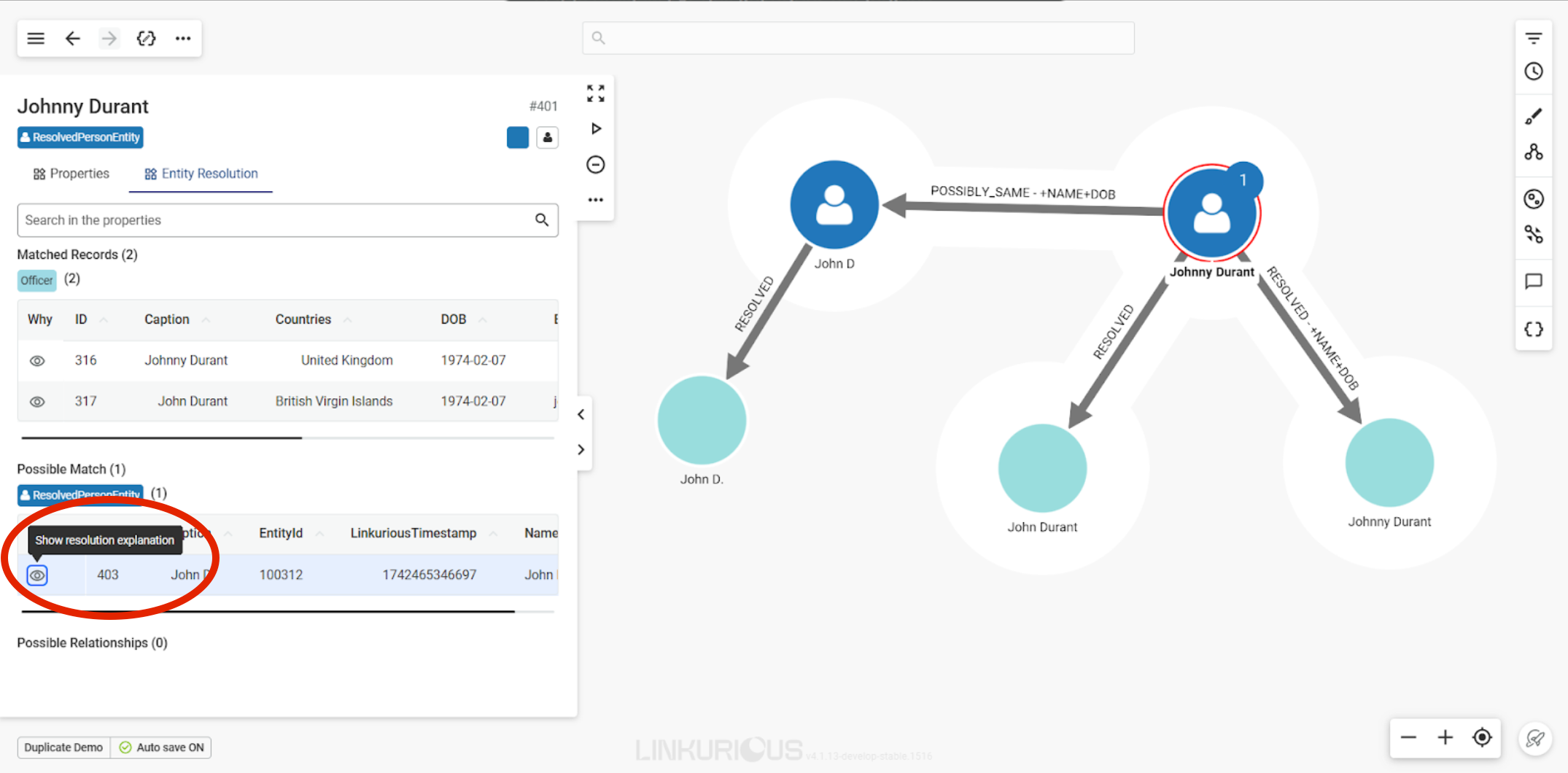

Entity resolution is the process of identifying and merging records that refer to the same real-world entity - whether a person, address, or company. In AML and CTF investigations, data generally comes from multiple sources with slight variations. For instance, a single individual might appear in data as “J. Smith,” “John Smith,” or “Jonathan A. Smith,” using different addresses or identifiers.

In addition, FIUs often receive multiple reports - from different regulated entities and jurisdictions - that refer to the same individuals or networks. Without entity resolution, these records remain disconnected across datasets, fragmenting the intelligence picture and concealing the true scope of suspicious activity.

Entity resolution reconciles these records by recognizing shared attributes, even when the details are incomplete or formatted differently. For FIUs, this is critical.

With entity resolution, FIUs can:

- Unify scattered records into clear, complete profiles,

- Eliminate redundancy, improving focus and reducing investigation time,

- Enhance network analytics like centrality scoring or anomaly detection,

- Strengthen trust in visualizations and investigative insights.

The Linkurious Decision Intelligence Platform is designed to help Financial Intelligence Units investigate complex AML cases faster and with greater clarity. It brings together graph analytics, advanced graph visualization, and smart entity resolution AI in one unified environment, designed to help analysts make faster, better-informed decisions.

Linkurious enables Financial Intelligence Units to:

- Unify fragmented data into a centralized knowledge graph, connecting STRs, internal databases, watchlists, and more into one coherent view.

- Resolve duplicate and inconsistent records using built-in entity resolution, ensuring analysts work with accurate, consolidated profiles.

- Analyze complex relationships across multiple hops and data sources, surfacing hidden facilitators, collusive structures, or transaction flows that would otherwise remain invisible.

- Investigate visually, interactively, and collaboratively with intuitive tools that allow users to generate contextual insights around entities of interest.

- Document and share findings easily, with investigation workspaces that support annotations, case linking, and audit-ready reporting.

By providing a structured, network-oriented approach to financial intelligence, the Linkurious platform enables investigative teams to scale their efforts without compromising precision.

Entity resolution, graph analytics and advanced visual investigation tools are no longer “nice-to-have” AML tools for Financial Intelligence Units, they’re essential.

Together, they transform fragmented, disconnected data into a reliable source of intelligence. They reduce analyst fatigue, reveal the hidden structure behind suspicious activity, and allow FIU teams to focus their time and attention where it matters most.

For FIUs tasked with turning financial data into actionable insight - and collaborating across borders - they offer not just a tactical upgrade, but a strategic advantage.

A spotlight on graph technology directly in your inbox.