The German car manufacturer admitted cheating emissions tests. Which companies are impacted directly or indirectly by these revelations? James Phare from Data To Value used graph analysis and open source information to unravel the impact of the VW scandal on its customers, partners and shareholders.

Since September 18 when VW admitted to modifying its cars to disguise their true emissions performances, the news has made headlines worldwide. In all this noise, it’s difficult to piece together the important information necessary to assess the event’s impact.

Our partner Data To Value helps organisations turn data into their most valuable asset. Using a combination of semantic analysis and Linkurious, the Data To Value’s team were able to investigate the ramifications of the VW scandal and show how it impacts its customers, partners, suppliers and shareholders.

To do this Data To Value used open source intelligence (OSINT) from sources like newspapers, social media and blogs. Semantic analysis helps analyse that type of vast volume of unstructured or semi-structured data to extract:

- relevant entities (persons, companies, locations, etc.)

- sentiment (is a blog post sympathetic or aggressive?)

- topics (is this article related to the production of apples or to the company Apple?)

The resulting data can be represented in various ways. For example, Data To Value built a visualization to show the evolution of the general sentiment toward VW during the crisis.

This approach is useful but doesn’t help us understand how various entities linked to VW (directly and indirectly) are impacted by the scandal. Traditional tools and techniques are ill adapted for that type of questions. That’s where graph analysis is useful. It helps see relationships which are hard to find using other techniques and other data structures.

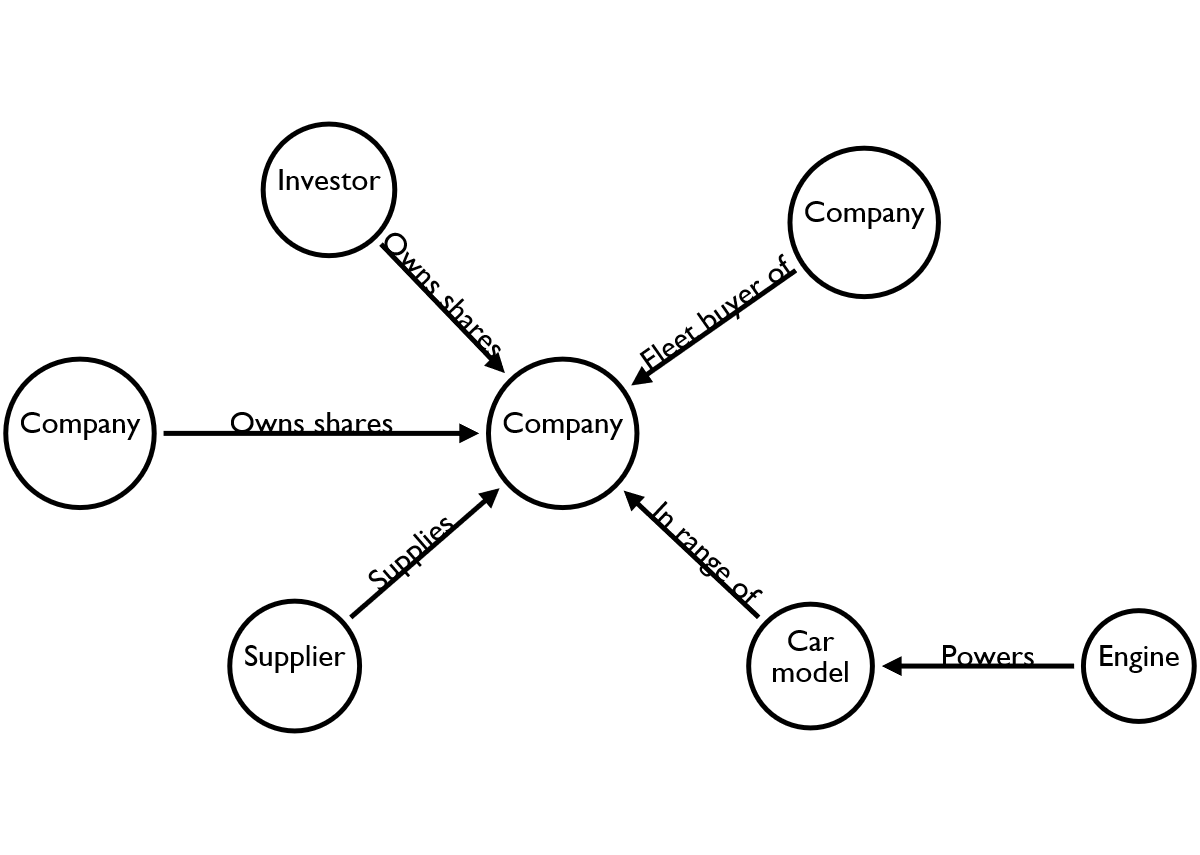

In our case for example, Data to Value chose to represent the data collected about the VW crisis in the following graph model:

In the picture above we see how some of different entities are linked:

- a company or an investor own shares of another company

- an engine powers a car model

- a car model is sold by (in the range of) a company

- a company is a fleet buyer of another company

- a supplier supplies a company

The graph model gives a highly structured view of the information. We can now use it to start asking questions.

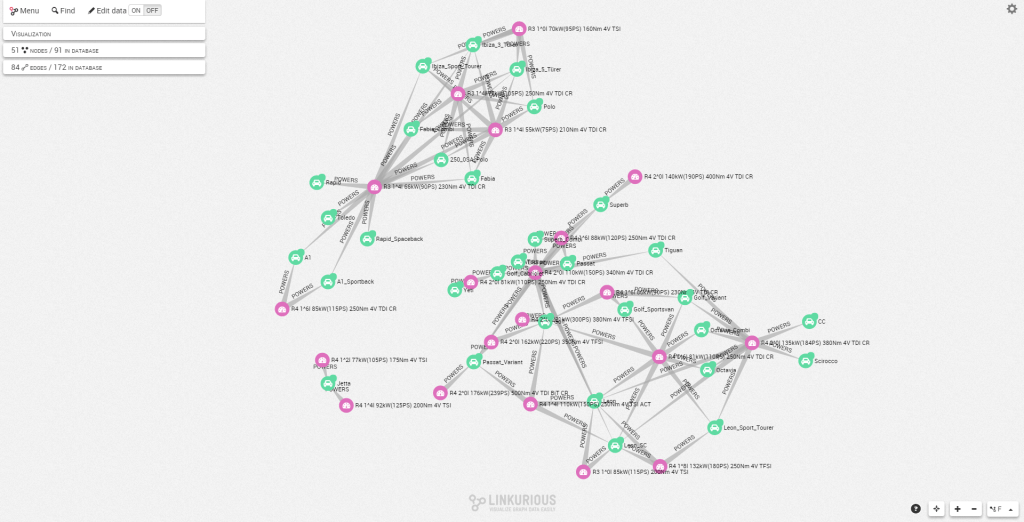

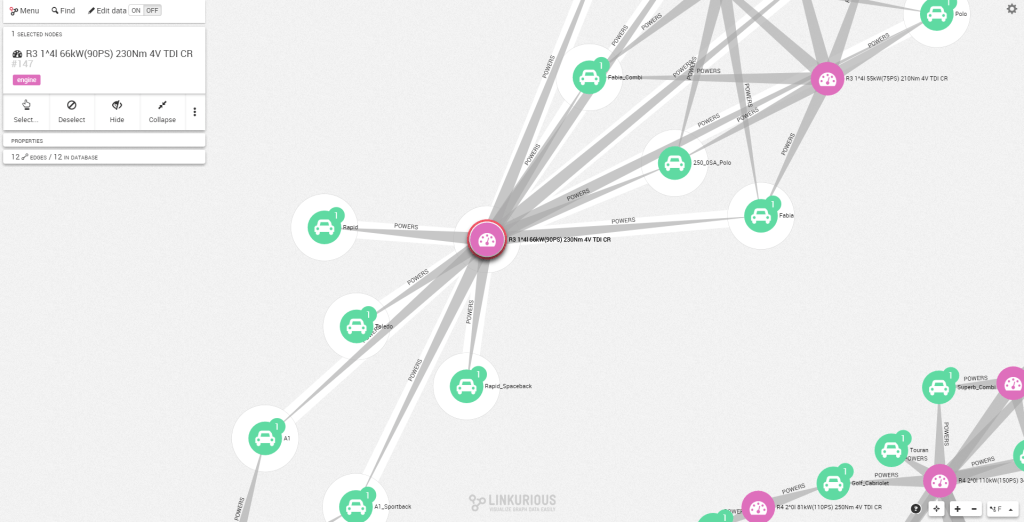

First let’s start by visualizing the motors involved in the scandal and in which car models they are used.

We can see how a single motor can be used in many car models. The “R3 1^4l 66kW(90PS) 230Nm 4V TDI CR” motor for example is being used by the Rapid Scapeceback, Toledo, A1, A1 Sportback, Fabia, 250 OSA Polo, Fabia Combi, Polo, Ibiza Sport Tourer, Ibiza 3 Turer, Ibiza 5 Turer.

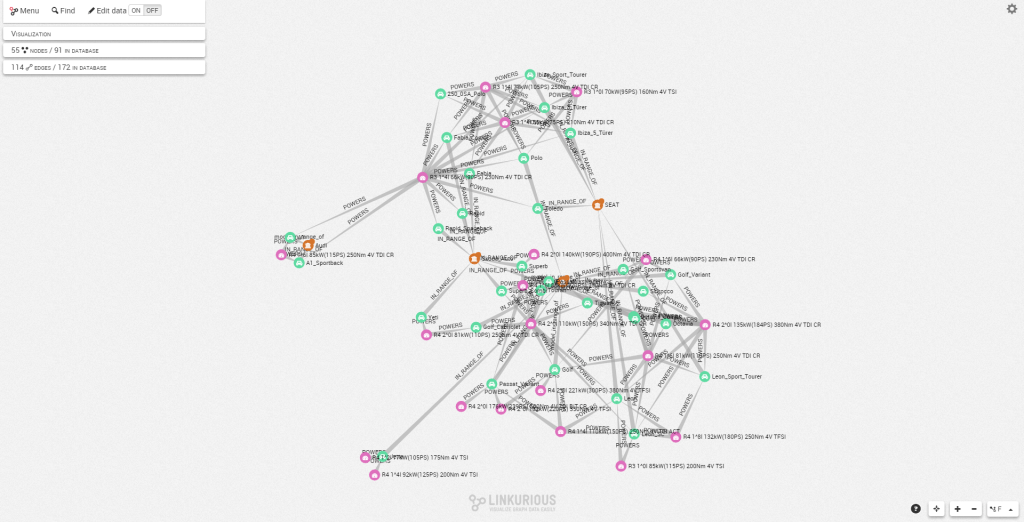

The Linkurious graph visualization helps us make sense of how the motors and car models are tied. Now that we understand this, we can add an extra set of relationships. The relationships between the car models and the manufacturers.

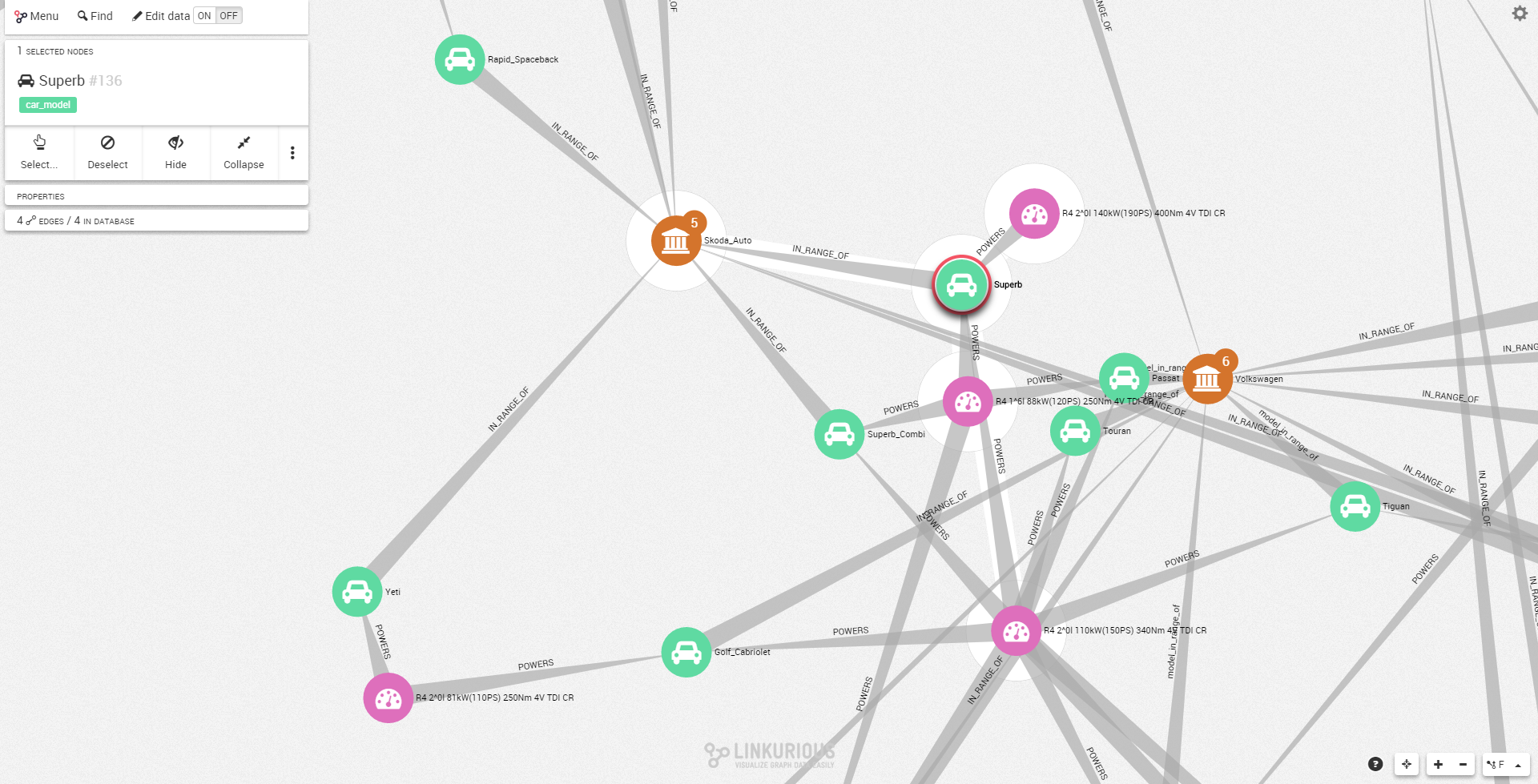

At this point, we can notice that a car like Skoda’s Superb is using 3 motors involved in the scandal.

Although most customers don’t associate Skoda’s cars with Volkswagen we can see that there are relationships between the two car manufacturers. Two other car manufacturers also appear in the data: Seat and Audi.

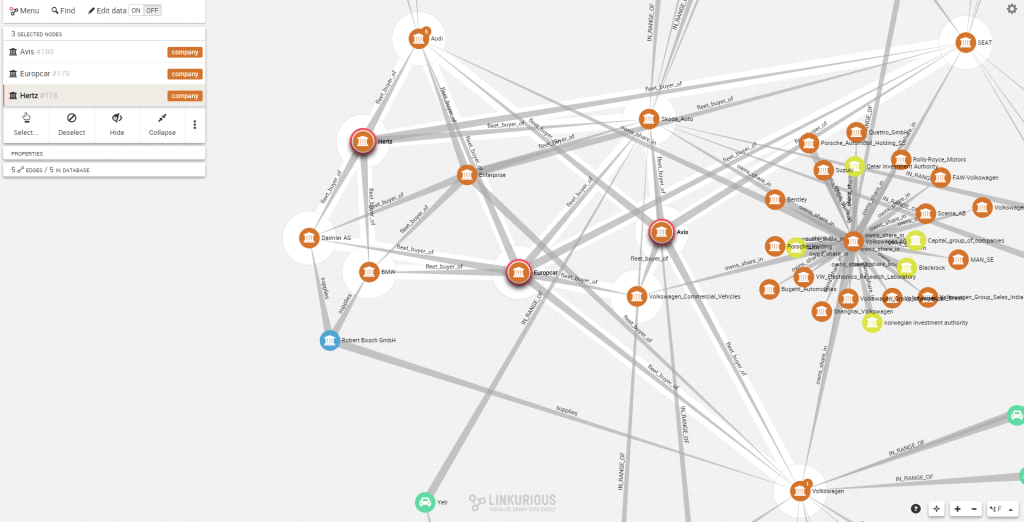

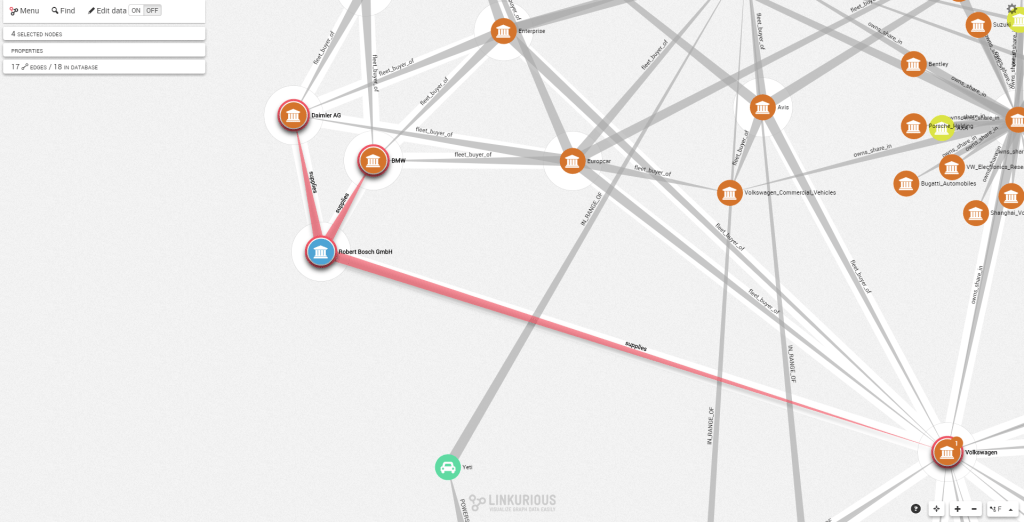

Let’s expand the relationships of our car manufacturers to reveal more information. A few new details emerge.

Various car rental companies are major customers of Volkswagen. Companies like Hertz, Europcar and Avis are buying cars manufactured by Volkswagen, Audi, Skoda and Seat.

Daimler and BMW, the other German car manufacturers use Robert Bosch, a VW supplier and a company also involved in the scandal. Although to date these companies have denied using the software illegally in the same way as VW.

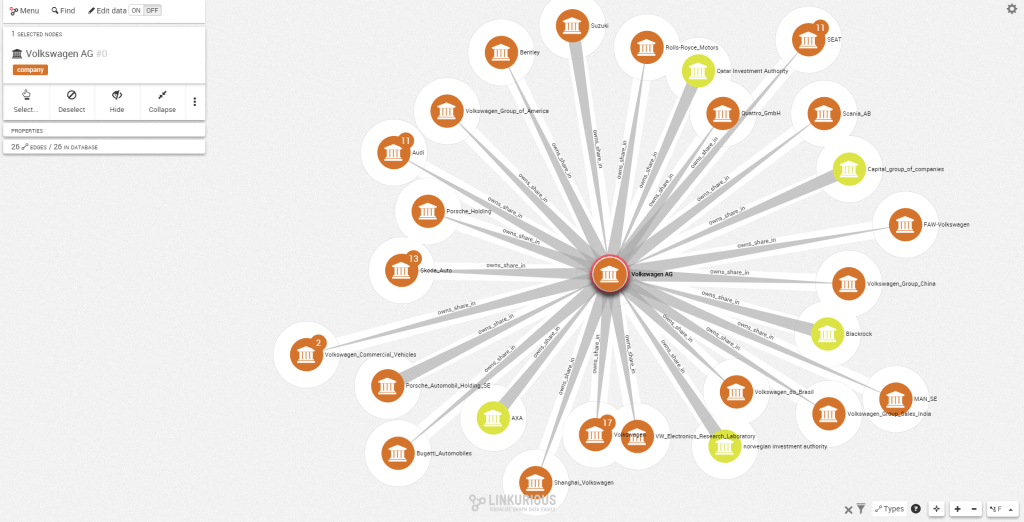

Let’s filter the graph to focus on the shareholding relationships now.

Audi, Seat, Skoda and Volkswagen are all owned by Volkswagen AG. Investors in Volkswagen AG include hedge fund Blackrock and sovereign funds Qatar Investment Authority and Norwegian Investment Authority.

Data to Value’s research in the VW scandal has applications both in the long only asset management space and also in the hedge funds space for both managing risks and also identifying investment opportunities or developing a graph-based trading strategy. For example, based on the insights uncovered, the shares of indirectly affected companies could be shorted in order to achieve returns. Although not directly exposed to the crisis, these companies are indirectly affected by the reputational impact, decline in profitability of VW and unplanned costs if the matter is not resolved effectively e.g. fleet buyers bearing modification costs themselves or seeing reduced demand for VW rentals.

“The same insights could also help a risk manager understand a portfolio or entire investment manager’s risk profile associated with systemic or counterparty risks. Graph technology is perfect for performing these types of network analysis” explains Phare.

Research processes are traditionally very manual and document driven. Analysts look at broker’s reports, newspapers, market data. This makes sense when the velocity of the information is low but doesn’t scale up to today’s high data volume. Techniques like machine learning and semantic analysis can automate a lot of this work and make the job of analysts easier. Combined with this kind of self-service graph analysis enabled by Linkurious this presents an innovative approach for investment managers.

A spotlight on graph technology directly in your inbox.