Money laundering through online gambling: Spotting a criminal scheme

Money laundering through online gambling is attractive to those looking to hide the illicit origins of criminal proceeds. For clever criminals, gambling provides some apparently easy ways to make their funds appear to come from a legitimate source.

Gambling has long been a magnet for bad actors looking to hide the source of their money. This includes casinos, both online and physical ones, but also sports betting and online gaming. The large amounts of money flowing in and out make these businesses especially appealing for criminals hoping to fly under the radar.

Letting criminal activity go unchecked isn’t an option for casinos. Regulators have come down hard on casinos in recent years for failing to prevent money laundering. In 2023, Crown Resorts was fined the equivalent of US$ 300 million for violating the AML/CFT Act. Now more than ever it’s essential for casinos - both online and off - to adopt effective money laundering detection and investigation tools and techniques.

In this article, we’ll explore how gambling can play a part in all three phases of the money laundering process, some common tactics for money laundering through online gambling, and how new analytics technology can help you investigate money laundering faster and more efficiently.

The online gambling market is expected to be worth over $92.9 billion globally by 2023 (1). A huge number of transactions - including many high-value transactions - occur in online casinos and on betting platforms every day. It’s a context where suspicious transactions might easily go unnoticed.

In addition to this, online casinos accept many payment methods. This kind of flexibility is appealing for money launderers.

Online casinos also welcome players from around the world and facilitate international transactions. Players being able to access online gambling from anywhere also means they can take advantage of jurisdictions with less regulatory oversight.

Money laundering often occurs in three phases:

- Placement, when funds are integrated into the financial system or into a legal business.

- Layering, which is the process through which money is distanced from its illegal source. The idea is to make it difficult for investigators to follow the money trail.

- Integration, when money enters the legal economy. After integration, the money appears clean and investigators can no longer tell where it originated from.

All three phases of the money laundering process are at play in online gambling. A player injecting money into their gambling account, using prepaid cards purchased with cash for example, covers placement. Layering might be when a player transfers money to another. And when money from a game is paid out, this is integration. That money now simply appears as the proceeds of a lucky gambling session.

Let’s look at some more specific techniques. Within the massive amounts of money that transit through online gambling platforms, it can be easy to pass off illegal funds as legitimate. There are many different ways to launder money through online gambling. Here are some of the more common schemes investigators look out for.

In a relatively simple money laundering scheme, a user might start by depositing money in a betting account. They’ll have to provide an ID and a bank account number as a verification step. But once that’s completed, they’re free to use any payment method they want to load money into the account. That person will then place a few small bets to make it appear to be a normal account, before cashing out the funds. That money has now passed through a legitimate business - the casino - and its origins can no longer be traced.

A money launderer can also join a virtual betting table in collusion with accomplices. Two or more people working together join the same poker game for example. The accomplice(s) will then deliberately lose so the money in the game goes mainly to one player. That money is now no longer linked to its criminal origins. The players will certainly lose some money using this technique, but they’ll see this as the price to pay for clean funds.

A third online gambling money laundering scheme lets a player clean their money at the same time they receive illegal funds - highly efficient, from a criminal point of view. In this scenario, a buyer and a seller of illegal goods (drugs, for example) participate in the same game. Through a game or bet, the buyer will transfer funds to the seller, who then collects the funds from their payment account in exchange for the goods. The gambling account essentially acts like a bank account. And since the money technically came to the seller through betting, it can’t be easily traced to illicit activity.

Casinos, both online and the brick and mortar variety, are required in many jurisdictions to comply with AML regulations.They are required to report on suspicious customers and transactions. Beyond these obligations, they also have an interest in avoiding doing business with criminals to avoid reputational damage, and damage to their business relationships. All good reasons for these establishments to put in place robust AML compliance programs.

Part of a good AML compliance program is putting in place effective detection and investigation tools and techniques. Graph technology is emerging as a powerful asset to investigate even the most complex money laundering schemes.

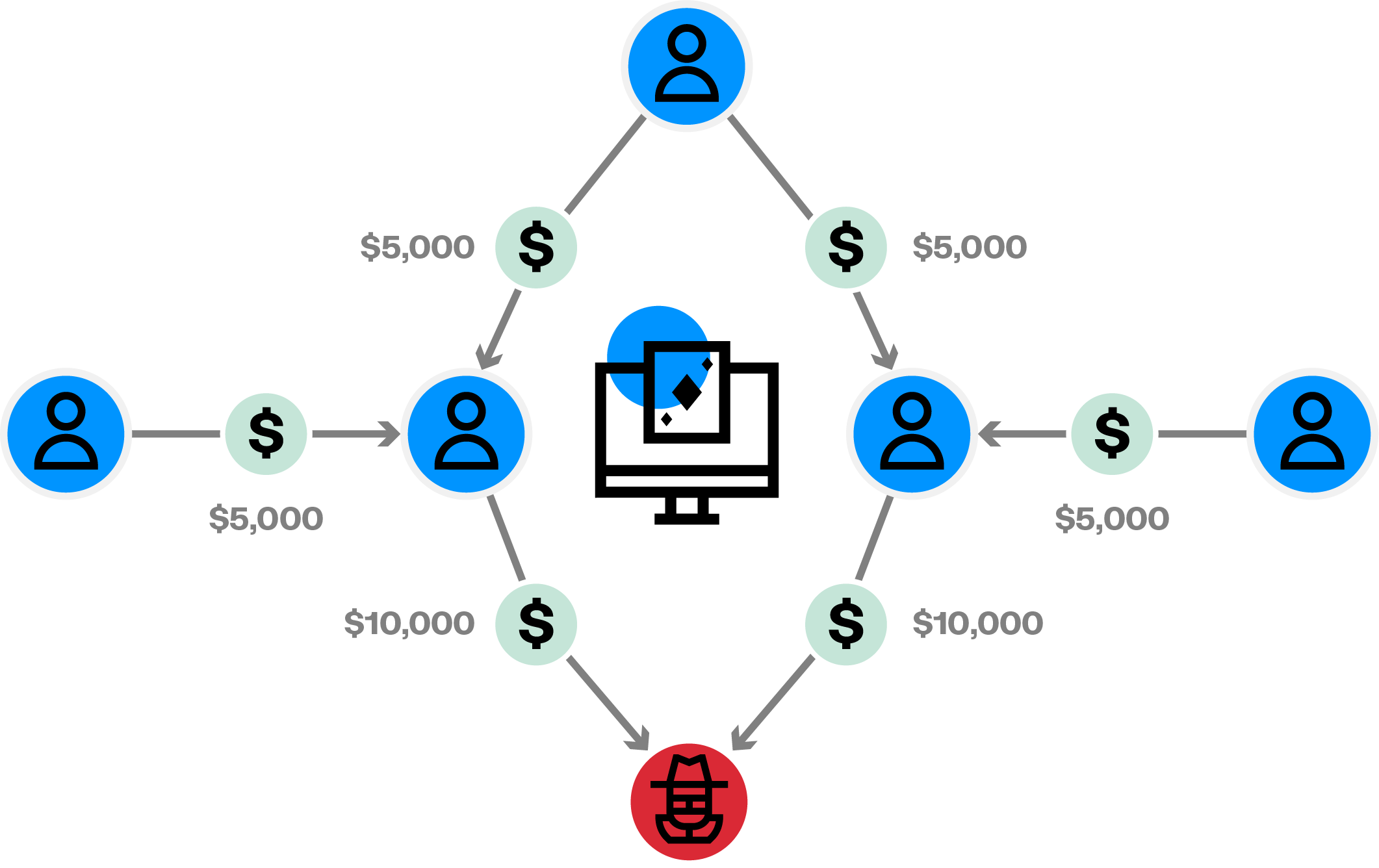

Graph analytics, with its focus on not only individual data points but also the relationships within the data, is an ideal tool to track town money laundering patterns. Graph technology is based on a data structure that consists of a set of nodes and edges (or relationships). Each node represents an entity, such as a person, a bank account, an address or any other piece of data. Each edge represents how two nodes are linked to each other. And with an investigation tool like Linkurious Enterprise that uses graph visualization, it’s easy to understand money flows and networks of entities.

You can see at a glance, for example, if money is consistently flowing to one player in particular. This pattern could be indicative of a group of accomplices laundering funds through an online gambling platform.

You can also visualize the data to see if the same two players have a consistent pattern of winning and losing by seeing where the money is flowing and at what frequency. This could be part of a scheme like the third one mentioned above.

Graph visualization also allows you to see all your data and connections in one place. This helps you see at a glance if suspicious activity is isolated or if it seems to be connected to a wider network that requires further investigation.

Graph analytics is a powerful tool for detecting more money laundering and financial crime, and to speed up investigations. Learn how graph can help fight back against financial crime in our white paper.

(1) https://www.statista.com/statistics/270728/market-volume-of-online-gaming-worldwide/

A spotlight on graph technology directly in your inbox.