Sanctions on Russia: how graph analytics can help you stay compliant

Updated June 15, 2022

This year has seen a flood of new economic sanctions on Russia following the country’s military aggression in Ukraine beginning on February 24. Sanctioning bodies across the world, including the US Office of Foreign Assets Control (OFAC), the European Union, the United Kingdom, and Canada have imposed several rounds of new sanctions. They target individual oligarchs, banks, and Russian goods, but also entities considered Russia allies in places like Belarus.

As the war in Ukraine has pressed on, the Russian sanctions situation has continued evolving. As of April, the EU has already imposed five sanctions packages, and governments around the world continue to impose new restrictions nearly every week. Financial institutions and other organizations must keep up with evolving regulations to stay compliant and mitigate risk in the very volatile current context.

Technology - and graph technology in particular - can be a major asset to see the full picture of your customers, their transactions, and their relationships to ensure your organization stays compliant, even in a challenging sanctions context.

Economic sanctions are penalties or other measures governments or international bodies impose as a means to influence behavior or stop illegal activity. They may be broad and comprehensive or target certain activities or industries. They may also target individuals or political groups.

In the case of Russia, governments and sanctioning bodies started imposing major sanctions beginning in 2014 after Russia annexed Crimea. In early 2022, with a full-on, violent Russian military invasion of Ukraine, sanctions have become one of the main tools for Western nations are relying on to push back. In a matter of days, OFAC, the EU, the UK and others greatly expanded their Russia sanctions to include financial institutions, politicians, numerous Russian elites, and more.

Here are just some examples of the many sanctions levied in 2022:

- OFAC sanctioned the two largest Russian financial institutions, Sberbank and VTB Bank, making it illegal for these entities to process payments through the US financial system.

- OFAC has also designated individuals close to Putin that benefit from the regime’s kleptocracy

- The EU sanctioned all 351 members of the Russian State Duma who voted to recognize the independence of Donetsk and Luhansk - one of the official pretexts for the Russian invasion.

- The EU also excluded major Russian banks from the SWIFT payment messaging system

We’ve already seen these vast new sanctions in action: countries around the world have frozen the assets of designated individuals and seized yachts and real estate of those on sanctions lists.

As of June 2022, many countries and regions have expanded their sanctions on Russia. Europe imposed its sixth sanctions package, which bans imports of Russian oil and petroleum products by sea (1). Germany and Poland will also stop importing Russian oil by pipeline by the end of the year.

On the other side of the Atlantic, the US has banned all Russian oil and gas imports. And the UK is phasing out oil and gas imports by the end of 2022.

Sanctions screening is high-stakes work - governments take sanctions breaches very seriously and may levy huge fines for non-compliance. But sanctions screening is time-consuming, and sanctions lists need to be updated regularly. Screening must be done on an ongoing basis to verify new customers and cross-check existing clients and ongoing transactions against any new sanctions. An important part of the screening process is also understanding if any entities in your network are indirectly in contact with a bad entity, since indirect connections too can pose compliance or money laundering risks.

Contending with a raft of new sanctions on Russia has only magnified sanctions screening challenges for banks and other organizations. They have had to keep carefully up to date and swiftly update databases with new sanctions as they go into force.

Updating sanctions data can be easier said than done. Organizations need to make sure they’re working with the right data. In theory, sanctions data is available to everyone. Anyone can look up newly sanctioned Russian entities on OFAC’s website, for example. But in reality, there are hundreds of different available sources with variations like addresses written in different ways, multiple spellings for names, etc. Organizations need to ensure they have access to comprehensive data.

Financial institutions also need to be able to integrate many data sources to effectively screen for Russia sanctions or entities directly or indirectly connected to those that are sanctioned. Here is an extensive list of tools and information on Russia sanctions compiled by ACFCS.

The sanctions themselves have been issued by multiple sanctioning bodies. Organizations need to be able to cross-check that information with internal data sources like customer databases. Without the right solution to manage these multiple data sources, organizations can end up with too many false positives or false negatives, creating customer friction or exposing the bank to excessive risk.

In a graph technology approach, data is structured as a network. Individual data points are stored as nodes, which are connected together by edges that represent the relationships linking that data.

An investigation software solution powered by graph analytics like Linkurious Enterprise can be a powerful asset in screening for Russia sanctions. The relationships between entities in a graph are as important as the individual data points, making it an ideal solution to understand if a sanctioned individual or business is somehow connected to a customer.

Graph is also particularly well suited for understanding indirect connections. By enabling you to display and explore entire networks of relationships, it becomes easy to identify if any of your clients or transactions are directly or indirectly connected to a risky entity.

Finally, it’s also easy to integrate multiple data sources in a graph. In a context when Russia sanctions are evolving fast, this is an essential feature for a screening tool.

To get an in-depth look at how graph analytics works for sanctions screening, watch the replay of our webinar with OpenSanctions.

OpenScreening is a new interactive tool that combines the user-friendly interface of Linkurious Enterprise with open sanctions and PEP data from OpenSanctions and the International Consortium of Investigative Journalists (ICIJ). OpenScreening is free to use.

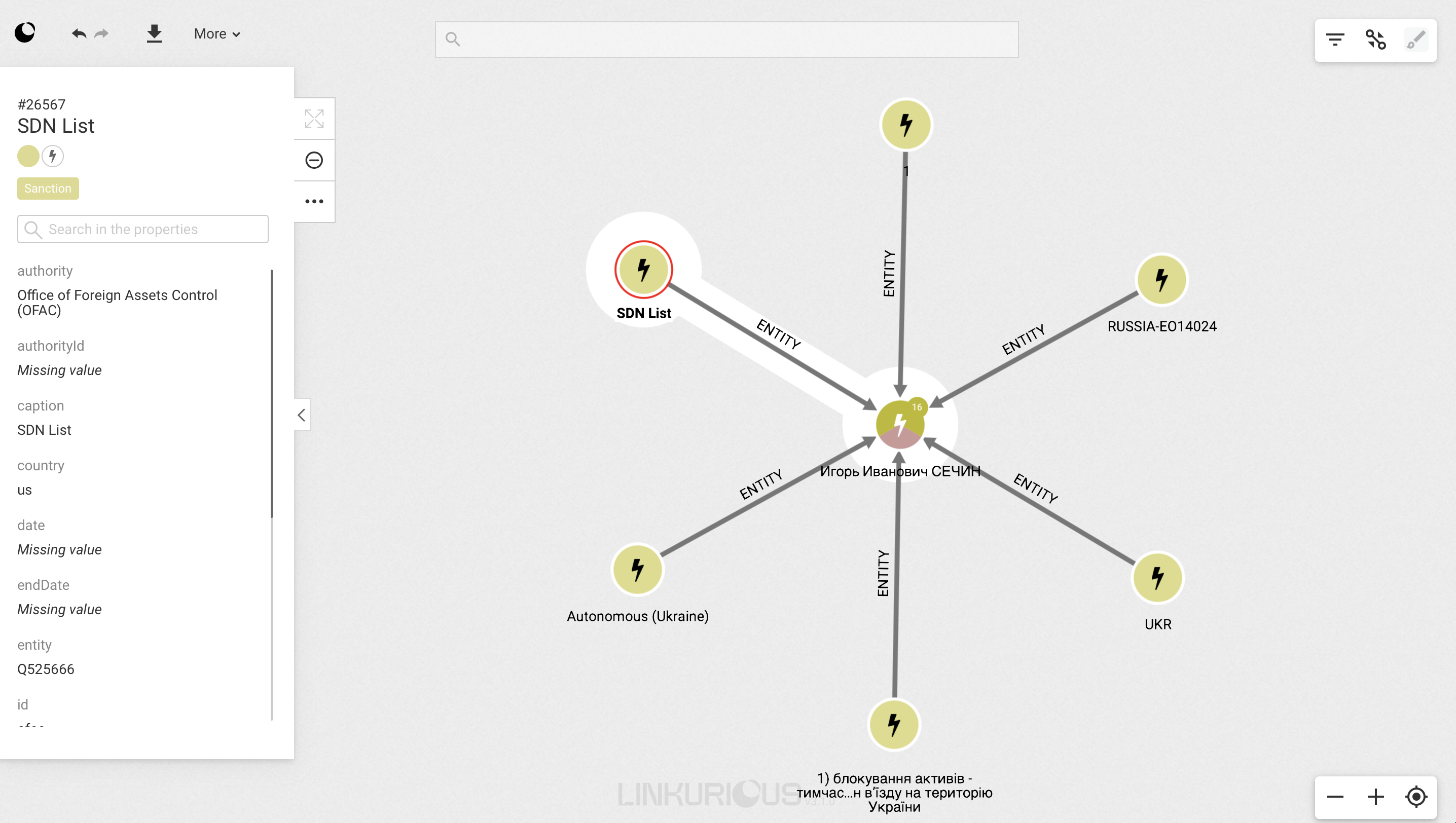

You can use this tool to quickly see Russian sanctioned entities and their networks. Let’s take the example of Igor Ivanovich Sechin, CEO and Chairman of the Board of oil giant Rosneft and former Deputy Prime Minister. After looking him up, you can expand sanctions nodes, for example, to see which entities have sanctioned Sechin. Here, for example, you can see he is sanctioned by OFAC, among others.

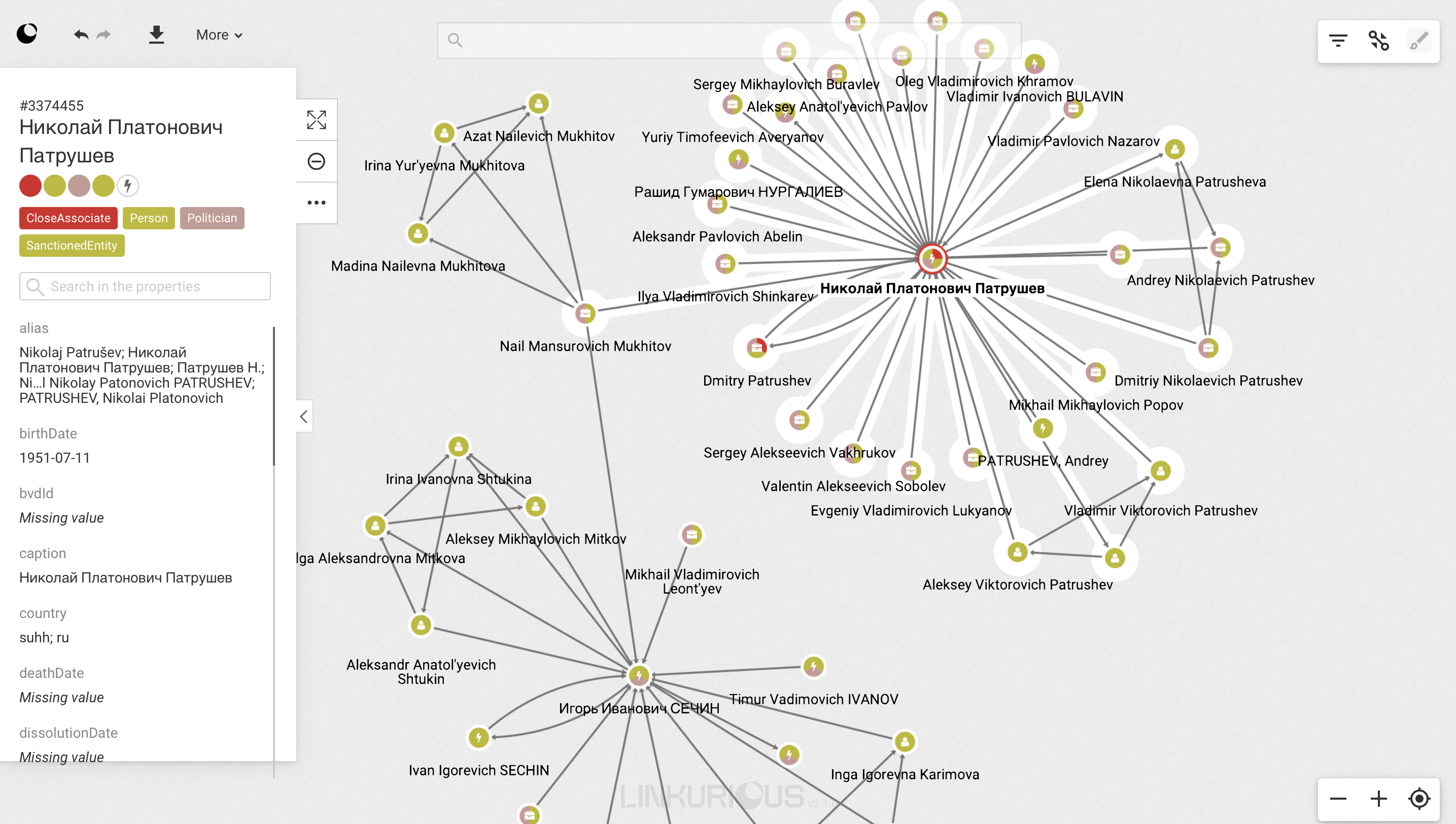

In a few clicks you can also see all the individuals he’s connected to, how they are connected, and who they are connected to. You can quickly expand a large network of relationships around this sanctioned individual to visualize all his direct and indirect relationships.

You can try out OpenScreening for yourself to get the big picture around sanctioned entities in Russia and around the world.

(1) https://ec.europa.eu/commission/presscorner/detail/en/IP_22_2802

A spotlight on graph technology directly in your inbox.