Transparency is a critical asset in the fight against money laundering and other financial crimes. Client onboarding and KYC establish exactly who you are doing business with, reducing risk and making it harder for bad actors to conceal wrongdoing. Ultimate beneficial ownership (UBO) transparency is an essential tool to help accomplish these goals.

Regulators know that, too. Around the world, everyone from the FATF to local regulators has focused on UBOs in recent years with the objective of closing loopholes and eliminating anonymity that can empower bad actors. This can mean more KYC work for financial institutions - but the good news is there are solutions to simplify the process of UBO verification.

Let’s take a deep dive into the process of UBO identification. We take a look at current legislation, the challenges around UBO verification, and how leveraging graph-native technology can simplify and accelerate the process.

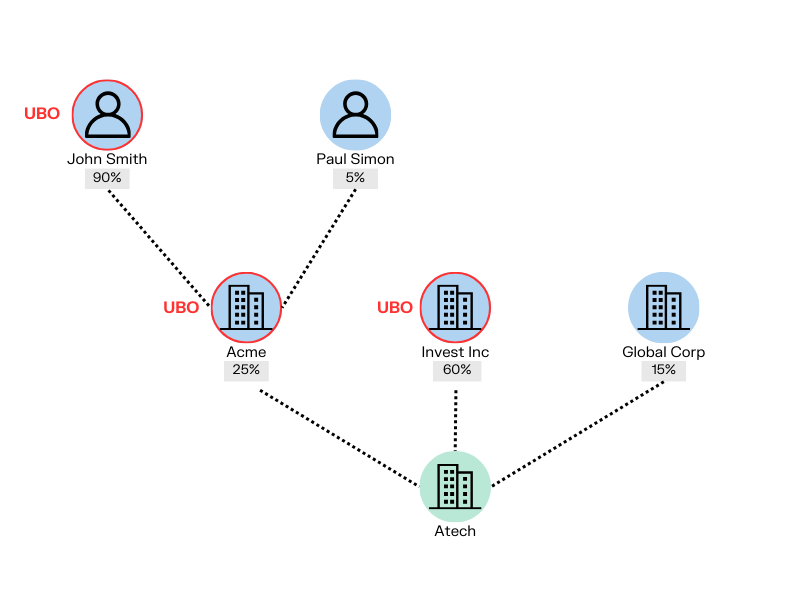

The ultimate beneficial owner is the person or business who ultimately has power over and reaps profit from a legal entity or a transaction. The UBO may be hidden under complex and multilayer ownership structures of several companies and legal entities. UBOs are typically identified when their ownership stake or control exceeds a certain threshold, commonly set at 25%.

Understanding who is an ultimate beneficial owner, though it can require some investigation, lets organizations know who they are actually doing business with. UBO identification and verification has also become a part of standard KYC and customer due diligence (CDD) requirements. It plays a key role in reducing risk for organizations:

- Money laundering risk: Companies that operate in anonymity can be used to move and disguise illicit funds.

- Compliance risk: Financial institutions and other regulated industries are responsible for performing due diligence to prevent money laundering or other financial crime happening via their organization. Identifying UBOs is a key piece of the puzzle here. UBO identification is also a regulatory requirement in many jurisdictions (more on that below).

- Reputational risk: Doing business with risky or compromised entities - such as those linked to financial crime - can do serious damage to a business’s reputation.

Establishing better transparency through UBO identification and verification also advances global anti-money laundering efforts. It can also help combat corruption and tax evasion. The anonymity provided by secretive offshore centers makes it easier to hide illegal activity. Major investigations within the last few years, like the Panama Papers, have demonstrated the power of secret offshore structures and shell companies in concealing funds.

In January 2021, the United States enacted the Corporate Transparency Act (CTA) as part of the 2021 National Defense Authorization act, in an effort to better crack down on shell companies. These have been a huge challenge for organizations fighting money laundering in the US.

The CTA establishes a national registry of ultimate beneficial ownership for corporations. The legislation has been in and out of court, and there is current debate about its enforcement, but it would effectively create a new resource financial institutions could rely on for customer onboarding and ongoing due diligence.

In Europe, both the 4th and 5th Anti-Money Laundering Directives imposed new regulations on UBOs. 4AMLD established the definition of a UBO as having more than 25% control of shares and voting rights in a legal entity, or having power over management boards, or being the ultimate beneficiary of a transaction. It also required European countries to keep ownership information in a central registry. 5AMLD, which came into effect in January 2020, reinforced those regulations and put a timeline on the creation of UBO registries.

The Economic Crime (Transparency and Enforcement) Act of 2022 requires UK companies and limited liability partnerships to create and maintain a register of people with significant control. As for overseas entities owning property in the UK, they must disclose their beneficial owners to the Register of Overseas Entities.

There are a few basic steps to verify an ultimate beneficial owner. Let’s take a look at each of them in depth.

The initial step in UBO verification involves gathering comprehensive data about the company in question. This includes basic information like the company's name, address, legal form, and registration details. Additionally, collecting information on the company's directors, shareholders, and any public financial statements is essential. This foundational data sets the stage for a deeper investigation into the company's ownership and control structure.

The next step is to analyze the company’s ownership structure. This involves understanding the percentage of shares held by each shareholder and the hierarchy of ownership, especially in complex structures involving multiple layers or subsidiaries.

The goal is to trace the chain of ownership to determine who ultimately has control over the company. This step often requires navigating through various corporate layers, possibly across different jurisdictions, to reveal the true owners behind indirect holdings.

Based on the analysis of the ownership structure, you can identify the beneficial owner(s). The identification involves determining who ultimately has the power to make significant decisions in the company or has a significant economic interest. The specific criteria to identify the UBO may vary slightly from one jurisdiction to another.

After identifying the beneficial owner(s), it's essential to conduct AML and KYC checks to assess the risk profile of the beneficial owners. They involve verifying the identity of the UBOs, screening them against global sanctions and watchlists, and assessing their risk of involvement in financial crimes. This step is critical for compliance with regulatory requirements and for protecting against reputational and financial risks associated with illicit financial activities.

These steps may look straightforward, but it’s not always the case. UBO identification and verification can be a truly challenging process.

UBOs can be concealed by layers of complex structures that are designed to hide who is behind a legal entity. This means doing the work of UBO verification and keeping that information up-to-date to stay compliant can eat up a lot of time. It often requires finding and cross-checking information from multiple sources. But falling short on the task can let criminals slip through the cracks and expose your organization to regulatory penalties.

If a company is owned by a single shareholder, it’s easy: that shareholder is the UBO and that’s the end of the story.

It gets tricky when the number of ownership layers, and the number of owners per layer, increases. Essentially, it means financial institutions must determine the ownership of each layer. On top of that, because beneficial ownership can be exercised in different ways, the complex process of determining the UBO must usually be done on a case-by-case basis.

Manually investigating the ownership structure of each company to identify its UBOs and repeating the process until there are no new UBOs is a time-consuming and error-prone process.

An additional challenge is that sometimes, UBOs don’t want to be found. Shell companies are a popular way for beneficial owners to conceal their identities. The Pandora Papers investigation, mentioned earlier in this article, uncovered over 810,000 shell companies, holding some 8% of global wealth. Many of those have been linked to tax evasion or other crime. (It’s important to note, though, that not all shell companies are linked to criminal activity!)

True ultimate beneficial owners may also hide their financial interest in a firm by using nominal directors or shareholders. They are used as a front for the true UBOs who can access company profits without actually being listed in the paperwork.

Graph analytics and visualization make the whole process much easier and faster.

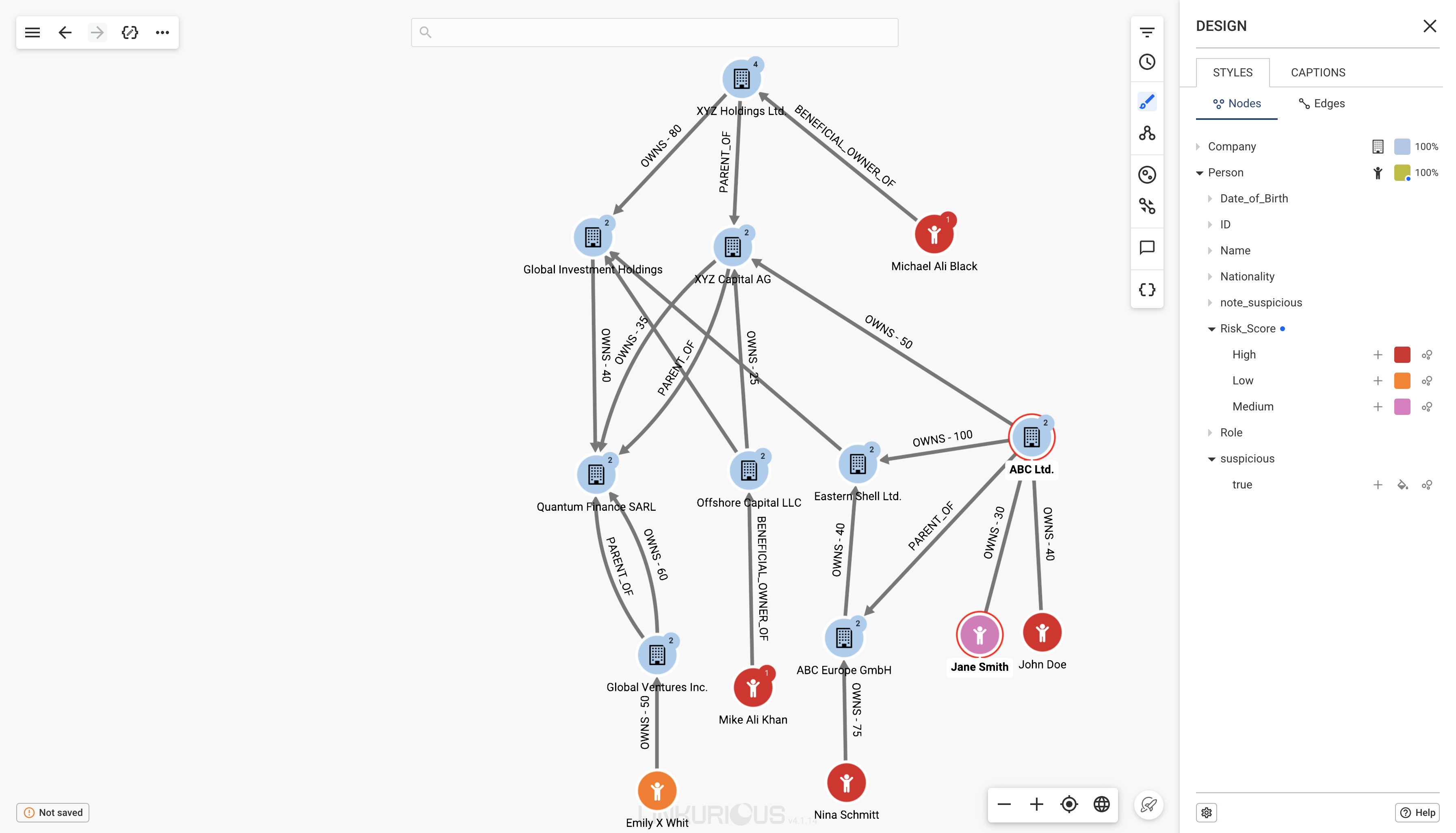

What exactly is a graph? The graph technology approach is a model in which data is structured as a network. Information is stored as nodes, which represent individual data points. They are connected to each other by edges that represent the relationships between them. Graph is actually a very natural way to think about UBO structures. In this use case, nodes are corporate and legal entities, and edges represent ownership structures.

With graph technology, understanding sophisticated beneficial ownership structures can be translated into a single graph query to automate the process, yielding results quickly. An advanced platform like Linkurious also allows you to run real-time alerts, perform risk-based filtering and more. See how quickly you can verify ultimate beneficial owners - and how you can immediately leverage that information - in the demo below:

Compliance analysts can look into the overall ownership graph to identify where a problematic UBO sits, for example. Since the results are visual, they are easy to understand and share.

By visualizing the entire ownership structure, you can see the big picture at a glance, ensuring nothing suspicious goes unnoticed.

- Importance of UBO transparency: UBO transparency is crucial in the fight against financial crimes like money laundering, corruption, and tax evasion. Identifying UBOs is integral to client onboarding and KYC processes, helping organizations understand who they are doing business with and reducing risks associated with illicit financial activities.

- Global regulatory focus on UBOs: Regulators worldwide, including the FATF and local bodies, have intensified their focus on UBOs. Legislation like the Corporate Transparency Act in the U.S. and the 4th and 5th Anti-Money Laundering Directives in Europe mandate up-to-date information on UBOs to combat financial crimes, highlighting the global trend towards tighter UBO regulations.

- Challenges in UBO identification: The process of identifying UBOs can be complex, especially with entities that have multilayer ownership structures. It involves gathering company data, analyzing ownership structures, identifying beneficial owners, and conducting AML/KYC checks. These steps are essential but can be time-consuming and prone to errors, particularly when multiple layers and owners are involved.

- Graph visualization and analytics as a solution: Graph technology simplifies UBO identification by structuring data as a network of nodes (representing corporate and legal entities) and edges (representing ownership structures). This approach allows for automated queries, quick results, and visual representation of ownership structures, making the process more efficient and less prone to errors.

Keeping the dirty money out of the financial system and identifying high risk customers are critical to ensure compliance and mitigate risks for your business. OpenScreening is a free tool that combines open data sets for PEPs and sanctions screening unified into a single database with an interactive and intuitive investigation interface powered by cutting edge graph technology. See it in action!

A spotlight on graph technology directly in your inbox.