SEPA instant payments: Managing fraud risk & sanctions screening with new EU regulations

Significant new EU instant payment regulation is coming into effect, with banks and payment service providers required to comply with major milestones across 2025. The Instant Payments Regulation (IPR) establishes mandatory requirements for SEPA instant payments, pushing financial institutions and payment service providers (PSPs) across Europe to upgrade their infrastructure and operations to comply with these new standards.

These regulations present particular challenges for risk management, especially in the areas of fraud prevention and sanctions screening. The speed of instant payments leaves minimal time for traditional risk assessment. But this regulatory shift also presents an opportunity for organizations to modernize their technology and operational frameworks to better manage risk while maintaining positive customer experiences.

In this article, we explore the details of the new SEPA instant payment regulation and look at how advanced technologies such as graph analytics and visualization can help banks and payment service providers address the challenges posed by the IPR.

SEPA (Single Euro Payments Area) offers various types of transfers, but the new regulation specifically concerns SEPA Instant Credit Transfer (SCT Inst). This service distinguishes itself from other SEPA transfers through:

- Speed: Fund transfers are settled within 10 seconds or less, compared to traditional transfers that may take one or more business days.

- Availability: SEPA instant payments are available 24/7, including weekends and holidays.

The Instant Payments Regulation, which officially entered into force in April 2024, aims to accelerate the adoption of instant payments across the European Union. The core requirements of the IPR include:

- Mandatory instant payments: EU banks and payment service providers must be able to both send and receive euro-denominated instant payments within 10 seconds, enabling real-time transfers across the entire SEPA region.

- Equitable pricing: Fees charged for SEPA instant payments cannot exceed those for other similar types of transfers.

- Verification of payee (VOP): Payment service providers must implement a VOP service to verify that the transaction IBAN matches the intended recipient's name, reducing the risk of misdirected payments.

- Regular sanctions screening: Payment service providers are required to perform regular (at least daily) sanctions screening on their users.

The implementation of the IPR follows a phased approach, with most provisions coming into effect by October 25, 2025, giving banks and PSPs time to prepare their systems and processes for compliance.

The new SEPA instant payment rules present some specific challenges for risk management and compliance, particularly in the areas of fraud management and sanctions screening.

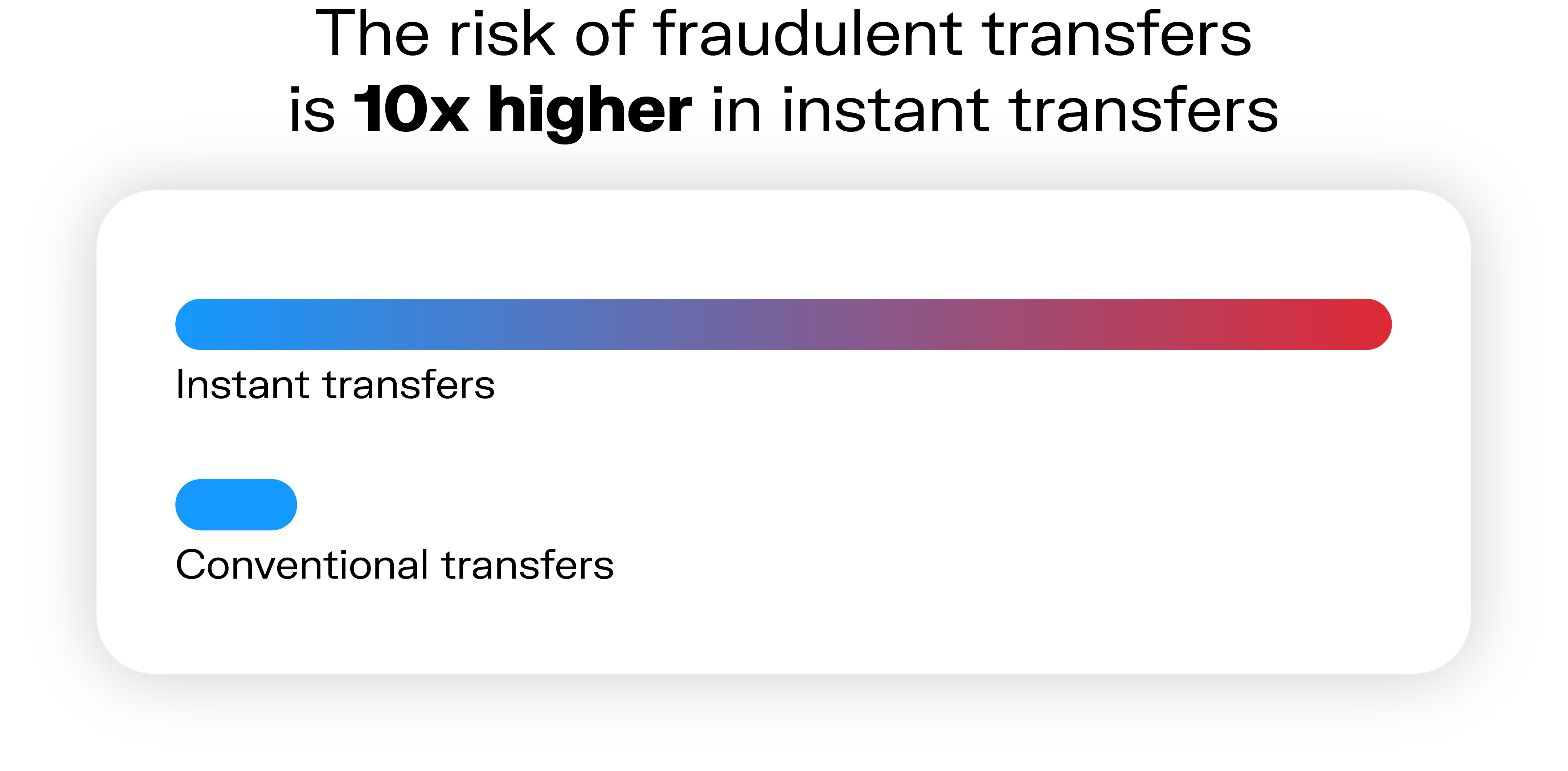

Fraud represents a particularly acute challenge in the context of instant payments. According to the European Banking Authority's (EBA) assessments, the risk of fraudulent transfers is up to 10 times higher in instant credit transfers compared with conventional credit transfers. This underscores the need for proactive risk management strategies by banks and payment companies.

The nearly instantaneous nature of these transfers means that once a fraudulent transaction is processed, recovery of those funds is extremely difficult. This reality places significant pressure on banks and PSPs to detect and prevent fraud before transactions are completed.

The new regulation underscores two key areas for fraud risk mitigation:

- Organizations must have systems in place for real-time fraud monitoring.

- They must also address new fraud risks through strong authentication processes and transaction-level risk assessments.

These two requirements aim to create a more secure environment for instant payments without compromising the speed and convenience that make these transfers valuable to users.

As with any transactions, banks must ensure they are not processing payments involving sanctioned entities. This means banks and PSPs have to be able to immediately identify sanctioned persons.

To remain compliant, these organizations need to enhance screening processes for new customers against EU sanctions lists. As mentioned above, under the IPR, payment service providers are required to perform at least daily sanctions screening on their users, creating an additional operational requirement to be integrated into existing compliance frameworks.

For banks and payment service providers looking to strengthen their compliance and risk management capabilities to meet the challenges of the IPR, graph analytics and visualization solutions offer powerful advantages for their technology stack.

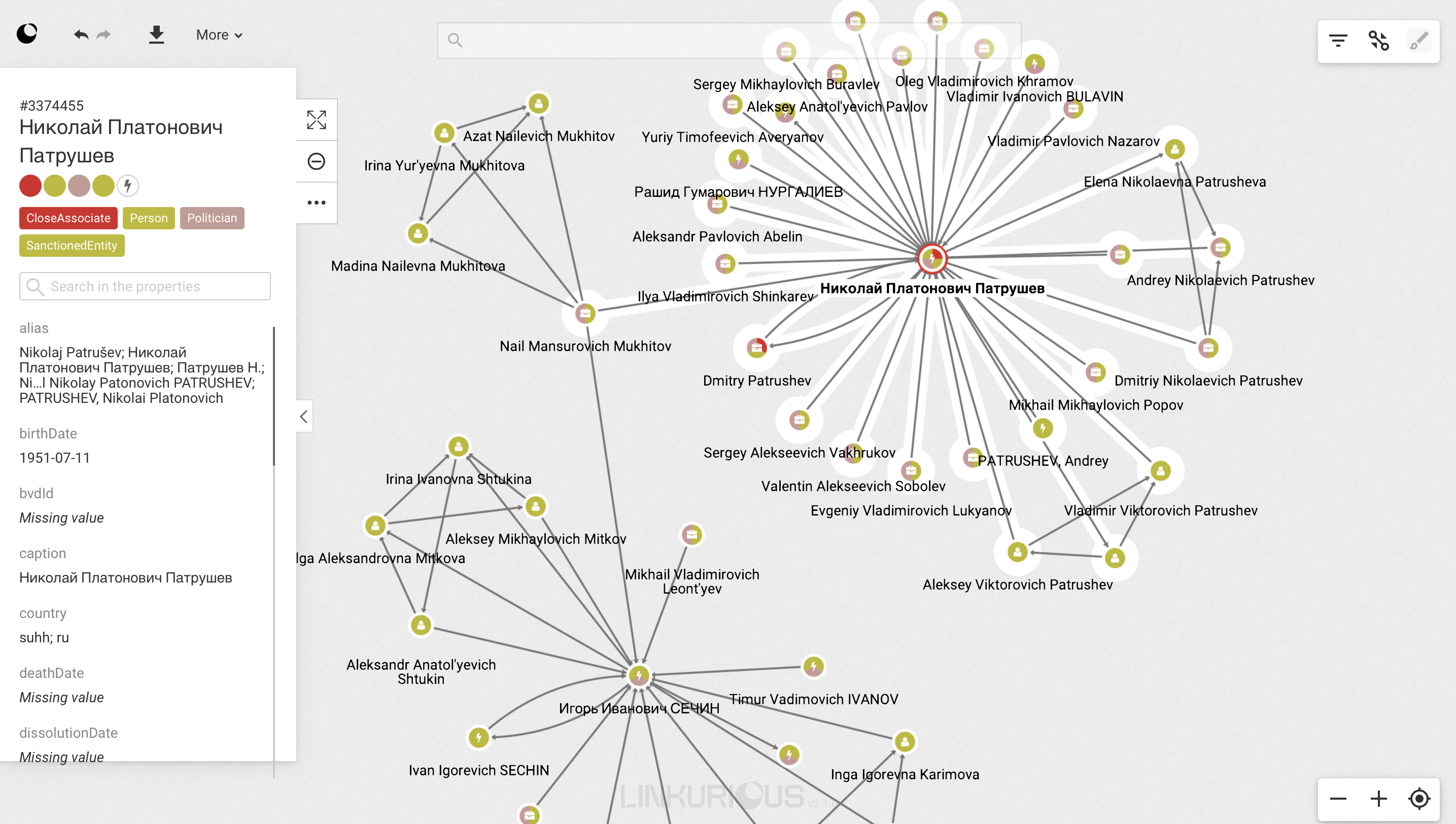

When analyzing or visualizing data as a graph, the relationships between entities become as important as the individual data points themselves to form a network of connected data. It makes it particularly suitable for KYC, sanctions screening and transaction monitoring, that require a clear and deep understanding of the context around entities and their relationships.

This network-centric approach provides several significant benefits for compliance and anti-fraud operations:

- More effective detection: Graph analytics can swiftly identify complex patterns of suspicious behavior with fewer false positives, improving both accuracy and efficiency

- Intuitive investigation: Investigators can explore and analyze suspicious networks, including those surrounding sanctioned entities, in a visual and intuitive manner

- Hidden connection discovery: The ability to uncover non-obvious relationships at multiple levels of separation, revealing complex risk patterns that might otherwise remain hidden.

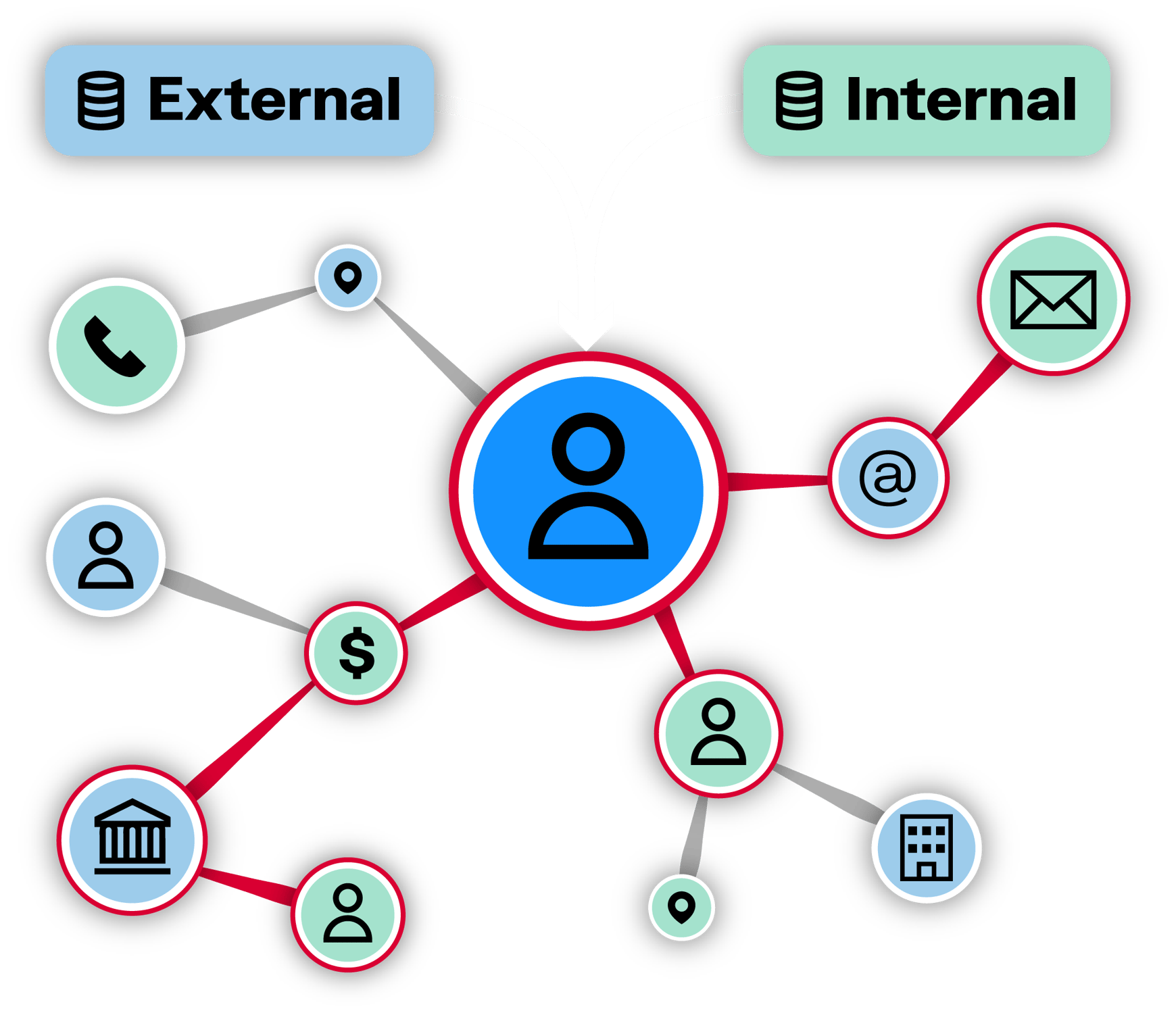

Graph technology also excels at combining and connecting data from multiple sources, such as customer databases, transaction records, and sanctions lists, providing a comprehensive view of all relevant information in one environment. This integration capability:

- Creates a single source of truth for risk assessment and compliance,

- Enables more holistic analysis of customer and transaction risks,

- Supports faster, more informed decision-making.

When combined with technologies like entity resolution AI, graph technology can deliver a unified data foundation and a clean, clear picture of data even when it originates from disparate sources with varying data quality. This results in more accurate matching against sanctions lists and more precise identification of potential bad actors and fraud patterns, at scale.

A solution like the Linkurious decision intelligence platform comes with native graph technology and unparalleled entity resolution AI built in to accelerate its implementation and enable swift, accurate decision-making.

Native graph analytics can process and analyze large volumes of data in near real-time, making them particularly well-suited for the demands of instant payments:

- Transaction patterns can be analyzed within milliseconds

- Risk scores can be generated before a payment is processed

- Suspicious transactions can be flagged for review or automatically blocked

- Daily sanctions screening can be performed more efficiently and thoroughly.

By leveraging the power of graph analytics and visualization, banks and PSPs can better navigate the challenging balance between speed and security that the new SEPA instant payment regulations demand.

As the European Union advances toward a more integrated and efficient payment ecosystem through the Instant Payments Regulation, financial institutions face both challenges and opportunities. The increased fraud risks and sanctions compliance requirements associated with instant payments necessitate new, more effective approaches to risk management and compliance.

Graph analytics and visualization technology stands out as a particularly effective solution to these challenges, offering the speed, accuracy, and holistic view needed to manage risk in the context of instant payments. By adopting these advanced analytical capabilities, banks and PSPs can not only meet their regulatory obligations but also transform their risk management processes to be more cost effective and efficient.

As the October 2025 deadline approaches, forward-thinking organizations are already exploring how technologies like graph analytics can help them thrive under the new instant payment rules. Those who successfully implement these solutions will be well-positioned to offer their customers the benefits of instant payments while effectively managing the associated risks.

A spotlight on graph technology directly in your inbox.