Why should Anti-Money Laundering (AML) teams pay attention to graph analytics? In this article we will dive into the problems with today’s AML compliance technology, how it impacts anti-money laundering and how graph analytics can provide a path forward for a more effective detection and investigation of AML cases.

Money laundering is the process of converting proceeds from criminal activities into legal assets, concealing their true origins. According to McKinsey, “recent estimates show that approximately $800 billion to $2 trillion is laundered annually through the global banking system. That’s roughly 2 to 5 percent of global GDP.” Governments have been steadily strengthening AML regulations to prevent those activities. Financial institutions are now required to follow strict AML policies and to report suspicions of money laundering activity. The stakes are high. Money laundering has a huge societal impact: it funds terrorism, human trafficking, drug trafficking and more. Money laundering also represents a huge cost for financial institutions: AML compliance costs $25.3 billion per year in the US alone according to Lexis Nexis. Among the greatest challenges are:

- The increase of false positives that are keeping compliance teams occupied with busy work. This results in resources that are stretched thin across all the stages of the anti-money laundering process.

- The persistence of false negatives with smart criminals who are able to defeat AML processes to commit crimes. It’s estimated that as little as 1% of all laundered money is actually detected.

- The rising costs of AML compliance which forces financial institutions to look for alternatives to their current tools and processes to avoid sanctions and penalties.

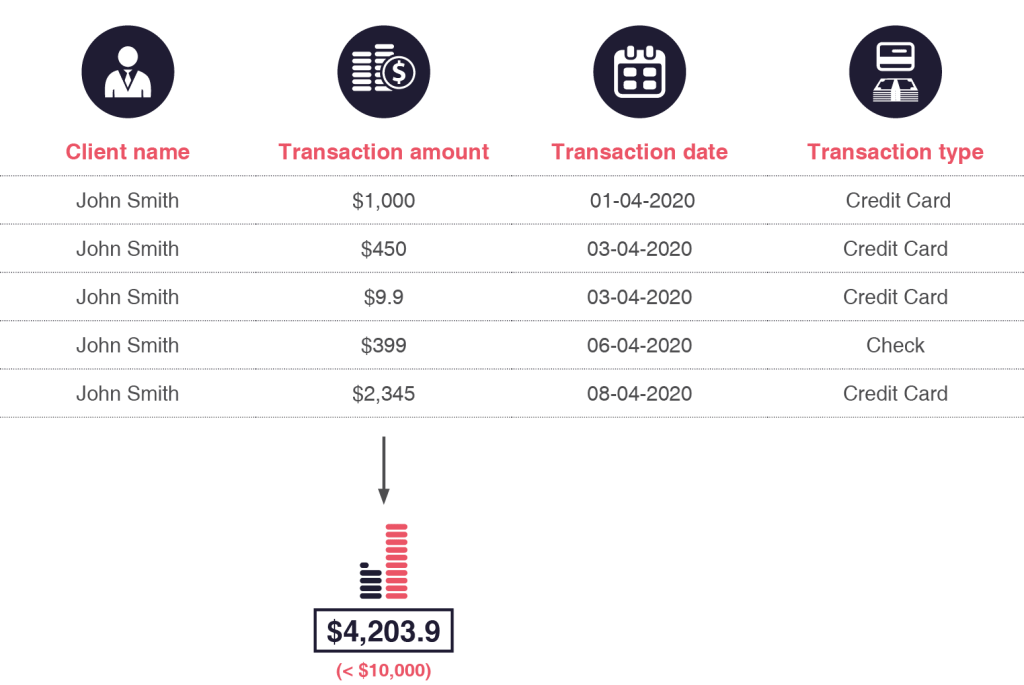

Traditional AML and KYC applications use relational databases to store data. In relational databases, data is stored as rows within tables. This approach is well suited for simple analytics such as computing a sum or an average.

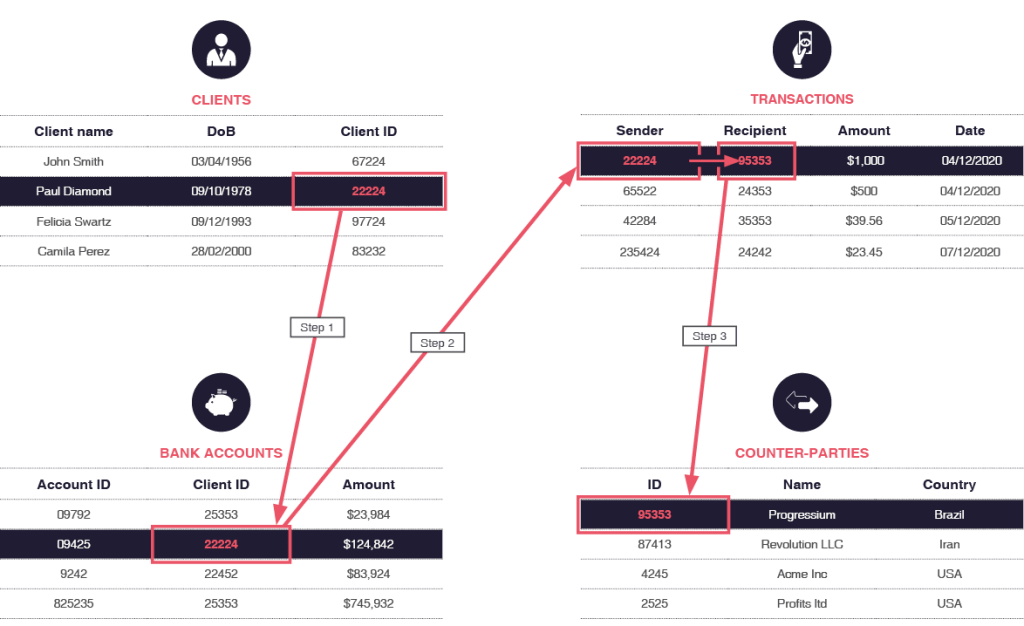

Unfortunately, the table-oriented approach also comes with some technical shortcomings. First of all, going from one table to another to identify connections requires a lot of time. The time for such a query actually increases exponentially compared to the number of hops. What does it mean? Imagine a simple query to find whether or not “Person A” and “Person B” are connected. If Person A and Person B are only separated by a phone number they share, a relational database will provide an almost instantaneous answer. If both persons are separated by 3-4 intermediaries then the answer will be significantly longer, from potentially minutes to hours to uncover. If the number of intermediaries grows further, the answer will quickly become impractical to find (with queries that can take days to return results).

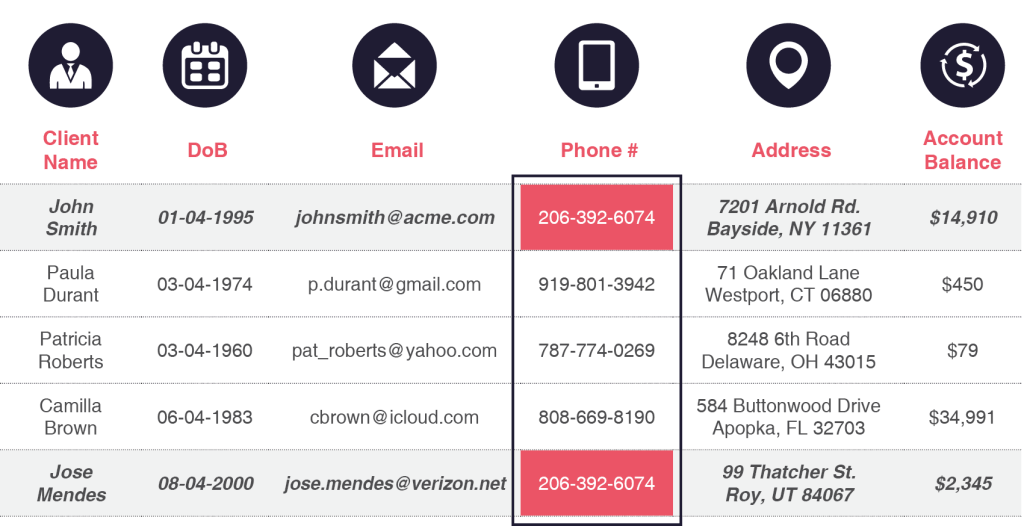

A more insidious issue is that some of the relationships are not even captured, making valuable information inaccessible to AML analysts. Tables are hard to evolve and relationships across tables are complex to manage. As a result, within a given database, some existing relationships are not captured as such. Furthermore, relational databases aren’t adaptable to new and evolving types of entities and relationships.

Why should AML investigators care about the technical limitations of relational based analytics? These limitations have 3 direct implications in terms of AML:

- False positives: relational analytics encourage a focus on simple patterns (how many transactions in the last X days?) that generate a lot of low value alerts

- False negatives: smart criminals are able to evade simple rules which exposes financial institutions to compliance risks

- Operational costs: simply gathering information scattered across different tools and tabs is time consuming and requires manual work

These problems are becoming more and more acute as the level of sophistication of money launderers and the volume of data increases. But graph analytics have the potential to change that.

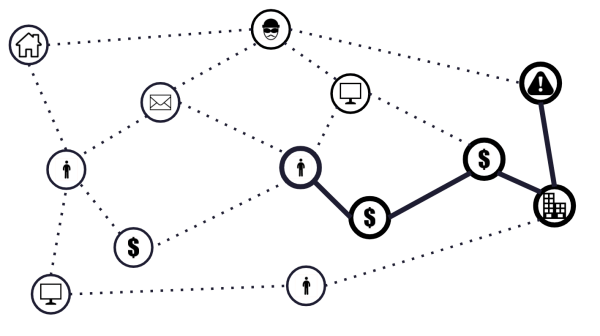

What is a graph? A graph or network is a set of nodes and relationships (oftentimes called edges). Graphs are all around us from the social networks we use to communicate to the supply chain we leverage when ordering from Amazon. Money laundering data is inherently a graph with nodes, such as clients and bank accounts, and relationships such as transactions.

In the 2000’s a new type of database emerged, the graph database. As the name suggests, these databases are optimized for graph data. What does it mean?

First, hopping from one entity to another is very fast. It opens the way for implementing more complex queries that are looking at more entities and more relationships. Secondly, the graph model is particularly flexible. It’s possible to add new entities and new relationships to your data based on your compliance needs.

What does it mean in practice? Graph technology brings 3 concrete benefits to AML professionals:

- Prioritize your current alerts: within the large amount of alerts generated by traditional analytics, there are some low risk and/or low value alerts that may be overlooked. What if within these alerts, that are individually unimportant, there’s an entity (a client, a phone number) that appears multiple times? Graph analytics can help spot these connections across alerts so that these “connected” alerts are prioritized.

- Decrease the number of false negatives: with most of the technical limitations related to detecting complex patterns gone, it becomes possible to add new rules to your arsenal. For example, you can identify smurfing behavior or indirect connections between clients and Politically Exposed Persons (PEPs).

- Accelerate AML investigations: finally with more information being captured about the connections in your data, and with this information made visually accessible via graph visualization, investigators can spend less time on gathering a 360° view of clients and transactions. As a result they can focus on making the right decisions.

Graph analytics are a critical part of modern anti-money laundering techniques. It provides a unique opportunity to turn the complexity of the relationships within your data from an obstacle into an asset. Linkurious Enterprise leverages graph analytics to help compliance teams uncover complex schemes and rely on a more holistic picture of their clients for their investigations. To learn more, please feel free to contact us!

A spotlight on graph technology directly in your inbox.