Seeing the big picture: Mastering third-party data in AML investigations

Firms can’t comply with international anti-money laundering and counter-terrorist financing (AML/CFT) regulations without using third-party data. From the moment a customer onboards, compliance and investigation teams depend on external information. Multiple stages in the customer lifecycle depend on it, from know your customer (KYC) and risk assessments to investigation and reporting. Crucial third-party data includes things like adverse media, politically exposed person (PEP) databases, sanctions lists, and ultimate beneficial ownership (UBO) data – which provide a more comprehensive picture for KYC, screening, and investigations teams.

But the quality of that data – and how it’s used – can make or break a firm’s ability to detect, prevent, and act on risky entities and behaviors.

If data fails in any of the above points, it can create serious repercussions. In 2021, the UK's Financial Conduct Authority (FCA) fined HSBC £63.9 million for failing “to check the accuracy and completeness of the data being fed into, and contained within, monitoring systems,” among other compliance breaches. And in October 2024, it fined Starling Bank £29 million after discovering that it had only been screening against a partial sanctions list since 2017.

Fines like these are sobering, but they’re only the start. Firms can’t protect their reputation or respond to serious, well-hidden crimes like human trafficking, extortion, violence, and environmental crime without clear insights into what’s going on behind client accounts. They can end up unknowingly aiding egregious acts like terrorism or child sexual exploitation (CSE).

On the flip side, firms that arm themselves with robust third party AML data – and use it well – can help lead the fight against all these ills. Their reputation can help them set the course for other organizations, improve their standing with customers, and go beyond compliance to cultivate a positive relationship with regulators.

Better data – and better tools to analyze it – means better risk management, investigations, and interventions. It also means doing more with less, maximizing efficiency – and budgets. Let’s dig into what that looks like in practice.

Deloitte presented several case studies surrounding banks that tested innovative approaches to their AML/CFT processes. Among these were three that decided to broaden, de-silo, or improve their data analysis. Notice the changes they made – and how this impacted their processes.

- Better datasets – In one pilot study, a global bank’s Hong Kong subsidiary manually broadened which data it accessed for investigations. The result was a more complete picture that revealed unexpected connections that traditional approaches would have missed. For example, IP addresses shared by different accounts let the team pinpoint otherwise obscure relationship clusters.

- Structuring data well – In another case, the bank in question corrected a problematic data structure. Traditionally, siloed data had to be accessed with multiple time-consuming requests – which were then fulfilled manually. This caused costly inefficiencies for investigations. To solve this problem, the bank designed a special consolidated repository so FIU and AML teams could access what they needed in real time, all at once. This didn’t just improve efficiency. It also meant the risk team could see patterns across datasets and identify hidden suspicious relationships.

- Effectively analyzing data – Finally, another bank’s Hong Kong subsidiary implemented advanced technology to improve its screening alerts analysis. This enabled more comprehensive data analysis that yielded more accurate results more efficiently (reducing manual review by roughly 35-50% depending on the use case). In turn, human analysts were free to concentrate on “higher value alerts.”

In each of these scenarios, banks enabled a more holistic approach to data, significantly improving their ability to interpret patterns effectively. This, in turn, allowed more targeted interventions. The key was a tailored, experimental approach to adopting integrative data.

This illustrates how crucial it is that teams base their AML oversight and investigations on a complete, well-structured, holistically analyzed data set – which should include authoritative internal and third-party data sources.

So what are the best sources of third-party data for AML/CFT? How can firms best integrate and analyze that data to supercharge their investigations?

Given these core concerns around data quality, structure, and analysis, the best third-party providers must:

- Offer high quality data – The content of the data should be complete, reliable, and useful. By useful, we mean data that’s pertinent to a team’s use cases – irrelevant data categories may create congestion and undermine effectiveness. Firms can and should think outside the box in terms of the data types they use. But they must continually assess that data for pertinence and usability.

- Integrate with a firm’s internal data – A firm’s data structure is crucial. Teams need access to all relevant information, regardless of source, to effectively see the big picture. Even complete third-party data will have limited use if it’s siloed away from other datasets that could collectively contribute to a more complete picture.

The AML/CFT industry has long trusted certain well-established, respected providers for access to third-party data. The Chartis 2023 KYC Data and Solutions report, for example, ranked several household names including Moody’s (which topped the list), Dun & Bradstreet, Dow Jones Risk & Compliance, and LexisNexis Risk Solutions. These and other up-and-coming solutions were ranked from “best-in-class” to “meets industry requirements” in the following categories:

- Sanctions & watchlist data

- Negative news & PEPs

- Traditional ID

- Electronic and digital ID

- Corporate structure

- Entity relationships

- Trade-related financial crime risk

- High-risk business

While all scored best-in-class for at least one, no provider won the designation for every category. This highlights the importance of layering more than one provider to ensure broader strong points covering a range of use cases – such as clear entity relationships for investigations and comprehensive adverse media data for KYC. Firms may also want to consider open-source intelligence (OSINT) sources such as the United Kingdom’s (UK) Companies House or Offshore Leaks.

It’s worth reiterating: regardless of provider, firms will get the best use out of tools that present the data around a firm’s entities of interest in an intuitive way, connecting key information to tell a story. The most effective solutions will also seamlessly integrate into firms’ existing structure – which itself must be well-designed to get the most out of internal and third-party data.

We’ve established that even the highest-quality data needs to be presented effectively. That is, it’s not just about having the right information; it’s about being able to see important connections between data points. That context is what allows teams to piece stories together and discover the truth.

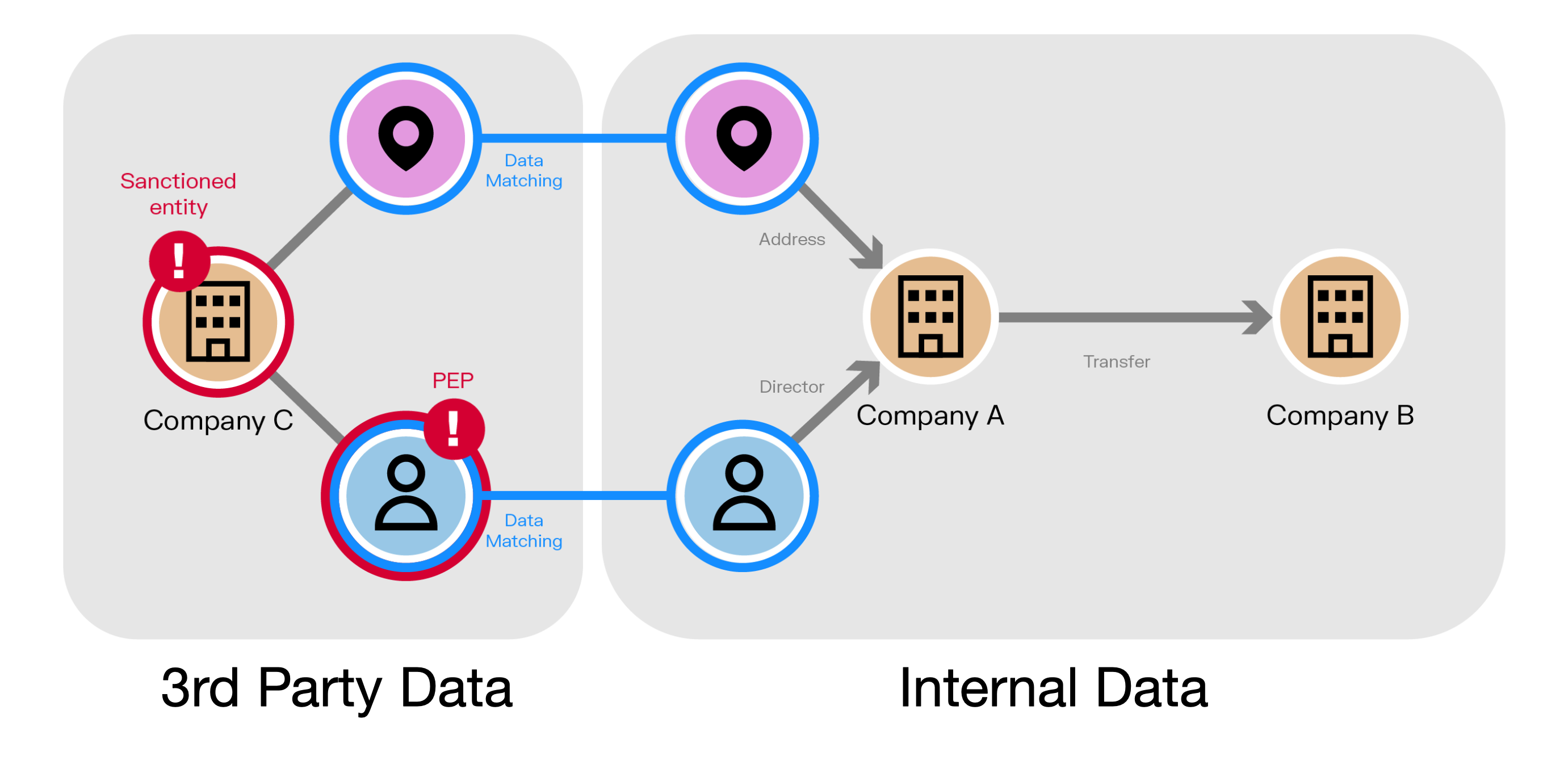

Graph-based analytics tools serve this purpose beautifully. They integrate a firm’s internal and external data into one big picture – giving investigators access to all the relevant connections they need to tell a complete story. Rather than relying on arbitrarily siloed information, investigators can explore multiple interconnected relationships in one place - and do so visually and intuitively.

Imagine a bank flags Customer X for multiple wire transfers after a large deposit. Traditionally, the analyst can easily access just a fraction of the data on this customer. They might check for previous flags and the past couple months’ transactions. If nothing jumps out, the alert may be dismissed as a false positive.

What the analyst can’t know is that they’ve just dismissed a false negative, not a false positive.

Now imagine that the analyst can access a graph solution. It shows that the customer has been transferring money to a company that shares an address with a sanctioned entity. This leads to a deeper investigation, revealing a web of relationships and mirrored patterns that can be reported to the authorities.

The same data with a graph presentation can transform an investigation.

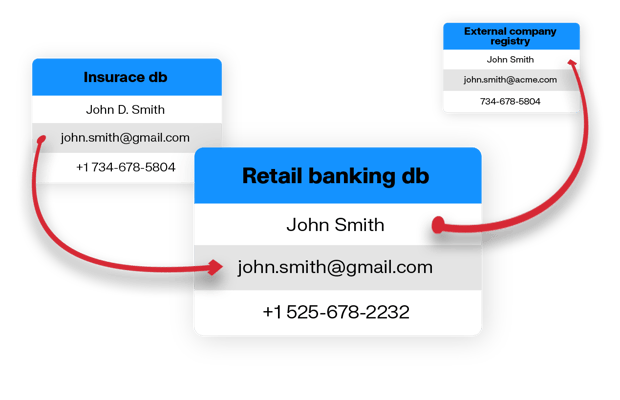

Getting to this big picture view can be difficult when a firm is using multiple internal and external data sources. Comprehensive data can mean millions or billions of data points on entities and behaviors, including redundant and overlapping information comprising different languages, spellings, and even data quality.

Without a clean dataset, analysts can’t visualize networks or work efficiently, so these points have to be unified and streamlined. Yet these variations in quality and composition make data unification as much of a challenge as a necessity.

Entity resolution addresses this redundancy. It resolves potential confusion by aggregating data linked to the same real-world entities, such as a person or organization. AML teams’ ability to get to the big picture quickly and reliably is heavily dependent on a tool that provides this function. Without reliable entity resolution, organizations can’t fully benefit from even the most complete dataset.

Platforms such as Linkurious boast powerful features to fill this need.

Firms can seamlessly integrate third-party AML data for a complete picture using graph native decision intelligence tools like Linkurious. This allows AML teams to transform their investigations by building a single source of truth from internal and external data. Here are just a few ways that’s possible with Linkurious:

- Built-in entity resolution. The software can resolve entities from any number of data sources, with real-time, AI-driven accuracy – and no entity resolution expertise. The result? Crystal-clear graph analytics for intuitive investigations.

- Third-party data plugin. Investigators can import third-party data in just a couple of clicks to enrich nodes in their graph – seamlessly bringing in exactly the sources they need, where they need them.

- Custom actions. Need to enrich Linkurious insights with external tools and resources? No problem. Call on third-party sources without integrating them into your database. A Custom Action takes information from a node or a relationship and uses it to generate a dynamic URL based on a template you provide.

A spotlight on graph technology directly in your inbox.