How to facilitate PEP screening and reduce compliance risk with network analysis

One of the cornerstones of any AML compliance program is understanding who your organization is doing business with. And PEP screening - identifying politically exposed persons (PEPs) - is an essential part of those KYC activities. By identifying customers in positions of power or close to individuals of influence, banks and other financial institutions can minimize the risk of financial crimes related to money laundering and corruption.

Screening for PEPs is not always a straightforward activity, though. In this article, we’ll look at the ins and outs of PEP screening, what the challenges are for financial institutions, and how using graph analytics can help gain in speed and accuracy.

Financial Action Task Force (FATF) guidance considers a politically exposed person to be anyone with an important public function, either domestic or foreign. This may include:

- Government officials

- Military officials in high-level positions

- Members of other government institutions

- Senior executives of state-run entities

- Judges

- Etc.

PEPs hold positions of power, have influence over the disbursal of public funds, and run a higher risk of being involved in bribery or corruption.

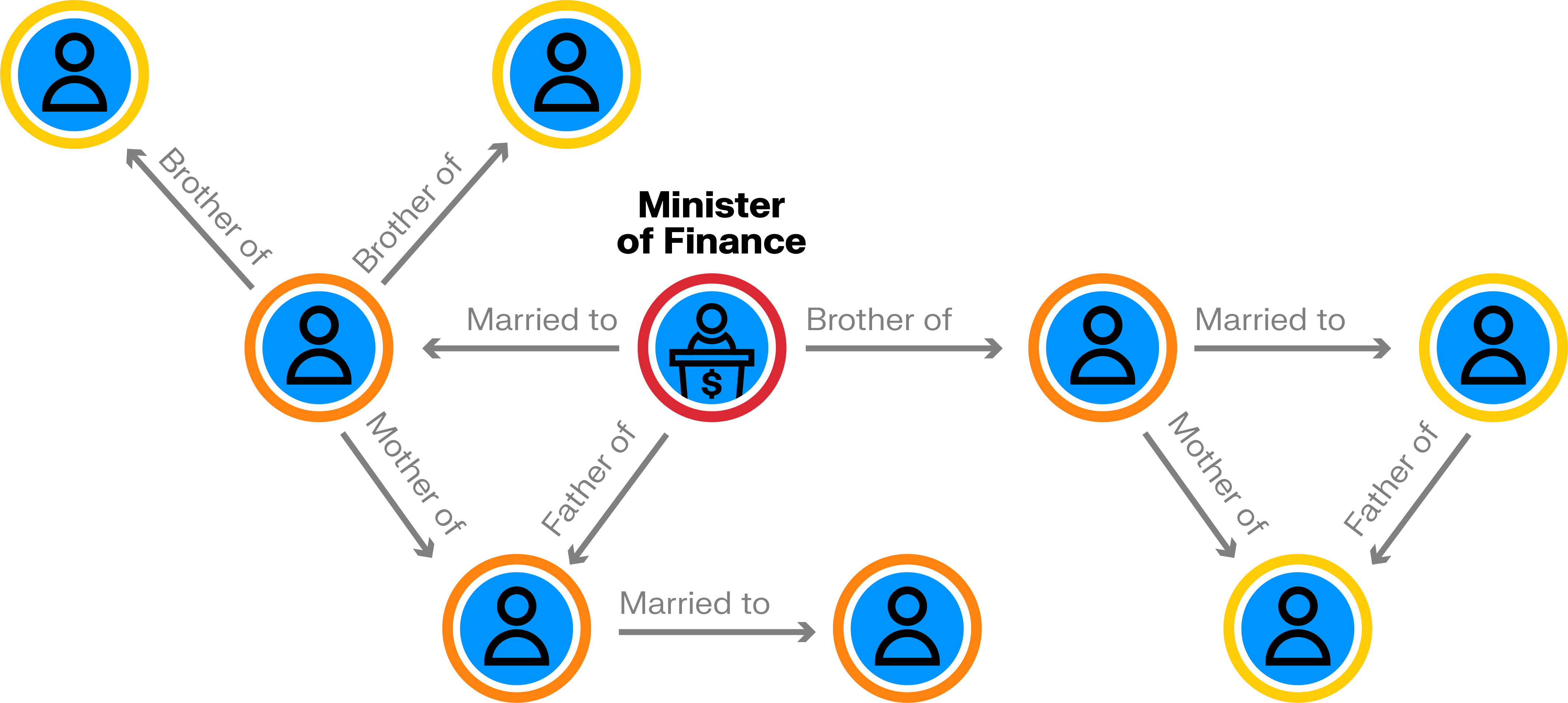

The family members and close associates of these individuals are also considered PEPs. The number of people a financial institution needs to identify and keep track of can therefore be huge.

PEPs carry different risk levels depending on the position they hold. A head of state would be considered high risk, for example, while a member of city government would be lower risk.

Once a PEP, always a PEP?

If someone is labeled as a PEP, how long do they need to stay on your radar? There isn’t a single answer, but different regulators have issued different guidelines. For example, the FATF encourages continuous examinations based on the individual's previous public role rather than issuing specific time limits. On the other hand, the Financial Conduct Authority (FCA) in the UK recommends a thorough investigation of former PEPs for at least 12 months post-public office.

At the end of the day, it’s best for organizations to take a risk-based approach to PEP screening.

Unlike with sanctions screening, financial institutions are allowed to do business with a politically exposed person. But these organizations are legally required to minimize the risk of money laundering and other financial crimes.

As such, PEP screening plays a few important roles:

- Mitigating risk: Failure to identify PEPs can result in transactions linked to bribery, corruption, organized crime, and more. The only effective way to mitigate these risks is through rigorous screening processes.

- Compliance: Screening PEPs and sanctions lists is a fundamental aspect of AML and KYC regulatory requirements. Failure to identify high-risk clients such as PEPs can expose a financial institution to heavy compliance penalties.

- Avoiding reputational damage: When a financial institution lets criminal activity slip through the cracks, it can damage its reputation with customers and the general public. We saw this in action in the aftermath of the Panama Papers investigation.

Once PEPs are identified, financial institutions can exercise appropriate due diligence controls to minimize the risk of those business relationships.

Accurately screening for PEPs presents some unique challenges. “PEP screening is more difficult than sanctions screening. With sanctions screening, you use 20 or so different sources and that’s it,” says Friedrich Lindenberg, founder of OpenSanctions, which combines sanctions lists, databases of politically exposed persons, and other information about persons in the public interest into a single, open and free dataset. With PEP screening, “you have to look at all parts of government, at military personnel, state-owned companies, diplomats, and it needs to be done nationally.”

Effectively, there isn’t one source of truth - no single, authoritative PEP list that financial institutions can rely on.

Because there isn’t a single definitive PEP list, financial institutions generally find themselves using data from various sources that are more or less comprehensive, and sometimes of variable quality. Integrating those sources with internal data - and finding the connections between them - is no small task.

With each election and each new administration in any given country, region, or city, the list of individuals considered to be PEPs is susceptible to change. The customer who wasn’t a PEP when he opened his account may one day become one.

PEP screening isn’t a one and done exercise, but instead requires ongoing monitoring of known PEPs and regular screening for new names.

These things can change fast. In 2024, nearly half of the world’s population will head to the polls, which means an enormous batch of new PEPs to screen. (1)

The fact that there is no single, defining PEP list organizations can rely on is one challenge in accurately identifying these high risk individuals.

Another challenge is that the people close to them - family members or business partners, for example - may also be considered PEPs carrying varying degrees of risk. It’s easy to identify a head of state, but her niece might also be a beneficiary to unexplained wealth or illicit assets. Identifying these connections can be challenging and time consuming, meaning risky individuals may fly under the radar.

The graph analytics approach is a model in which data is structured as a network. Information is stored as nodes, which are connected to each other by edges that represent the relationships between them.

An investigation software solution natively powered by graph analytics like Linkurious Enterprise solves many of the problems financial institutions face in PEP screening. A graph database easily integrates multiple data sources and a graph analytics and visualization solution facilitates exploration between them. This means you can query and explore external PEP lists and your own internal data at the same time.

Graph technology thrives on connected data, showing both individual data points and the relationships between them. In a couple clicks, you can see at a glance if a new or existing customer is connected to a PEP and requires additional due diligence themselves.

Experience a new way to search, visualize and analyze millions of open data records in one single interface to uncover hidden relationships around PEPs or persons of interest, sanctions targets and their networks, in just a few clicks. Try OpenScreening for yourself (it's free!)

(1) https://time.com/6550920/world-elections-2024/

A spotlight on graph technology directly in your inbox.