Towers of cash: investigating money laundering through real estate

Two Ukrainian oligarchs acquired many, many properties between 2007 and 2013. They had money to hide: billions of dollars stolen from PrivatBank, the largest financial institution in Ukraine. And using a series of shell companies, laundering that money through real estate turned out to be relatively easy. They bought office towers and parks, factories and steel plants. And instead of maintaining those properties, they let them go to waste, leaving a trail of economic destruction and unemployment.

The oligarchs are named Ihor Kolomoisky and Hennady Boholyubov, and they weren’t stashing away their money in a place most of us think of as a tax haven; they hid their ill-gotten cash in the American midwest. Their story was exposed by the ICIJ’s reporting on the FinCEN Files, and this kind of money laundering scheme is more the rule than the exception.

Real estate transactions have been a popular money laundering scheme for a long time. And even jurisdictions that have the reputation for strict regulatory requirements for banks and financial institutions often have loopholes in their laws that let some criminals go unchecked. Those loopholes can also make money laundering investigations even harder.

In many places, though, the authorities are starting to crack down. And banks and financial institutions need to be able to effectively track down evidence of money laundering through real estate when those transactions flow through their organizations. This article explores the ins and outs of money laundering through real estate. We also look at how next-generation analytical technology can be your best asset in investigating these schemes.

There are many examples of money laundering through real estate beyond the Ukrainian oligarchs cited above. That’s because there are a number of features that make real estate particularly attractive for those looking to stash ill-gotten funds.

Compared to other money laundering techniques, real estate transactions are a relatively easy way to integrate illicit funds into the legitimate economy. You can launder a lot of money in one go by purchasing some luxury homes, for one thing.

It’s also easy to manipulate the price of real estate, for example by overvaluing a property. And laundering through real estate can generate additional profit for the owner through rental income or resale.

Finally, launderers playing at their own dodgy version of House Hunters International benefit from poor regulatory oversight in many jurisdictions. Let’s look at the example of the United States. Much of the real estate sector there isn’t subject to the Bank Secrecy Act (BSA) - the foundational anti-money laundering legislation in the US - or AML regulations that financial institutions must comply with. Real estate brokers and agents, title insurance company reps, closing agents, appraisers, inspectors, attorneys… all of them are exempt from money laundering regulations and none are required to perform due diligence.

That many blind eyes look really attractive to someone trying to hide their money.

People or groups laundering money through real estate take certain steps to conceal their true identities and the source of their funds. Often, they use trusts and shell companies. Hiding behind sometimes complex corporate structures makes it very difficult to track down any criminal activity associated with a purchase.

Some of the common schemes bad actors rely on to hide illicit funds through real estate include:

- Use of nominee purchasers

- Purchases involving obscure legal entities to conceal the true beneficiary of the property ownership

- All-cash sales that exclude mortgage lenders from the process

- Property sales between complicit criminals

- Property sales to facilitate money transfers to politically exposed persons, individuals involved in organized crime, etc.

The gatekeepers mentioned in the section above - attorneys, notaries, real estate agents, etc. - are often complicit in these schemes, helping bad actors for the right price.

Real estate is a vehicle for money laundering all over the world. But certain countries, notably the United States and the United Kingdom, have come under particular scrutiny in recent years. Let’s zoom in to take a look at these two countries.

In the US, the 2001 Patriot Act strengthened the AML policies established by the BSA. It states that businesses and agents involved in real estate have to comply with AML rules, but the industry was granted a temporary exemption that remains in effect today. Furthermore, cash deals bypass the need to rely on mortgage lenders who are subject to AML rules. These make up some 22% of real estate transactions in the country.

In these cash deals, agents and others involved are not obliged to identify customers, monitor transactions, or report suspicious behavior, making it easy for unscrupulous professionals to turn a blind eye.

To sweeten the deal even further for buyers with something to hide, certain states make it easy to conceal one’s identity. It’s easy to set up anonymous shell companies in Delaware, Nevada, and Wyoming, and North Dakota offers an anonymous trust structure that can also be interesting for those who want secrecy.

Some markets are especially attractive to investors who want to keep their identities hidden, notably Miami and New York, where 62% of property purchases of more than $2 million by international clients are made in cash. FinCEN, realizing there was a problem, issued a Geographic Targeting Order (GTO) for Manhattan and Miami that requires agents and affiliates to report on beneficial owners for purchases exceeding a certain threshold. These GTOs have been extended to a handful of other regions.

Regulations are in the process of changing in the US. In August 2024, the US Treasury announced that following a change originally proposed in 2021, it was introducing a pair of regulations to shine a light on anonymous real estate acquisitions. The new rules require that real estate professionals such as title agents report the identities of the ultimate beneficial owners (UBOs) in real estate transactions - including all-cash transactions - to the Financial Crimes Enforcement Network (FinCEN). The rule resembles a nation-wide expansion of existing GTOs. Some investment advisors will also need to adopt risk-based anti-money laundering and counter-terrorism practices (AML/CFT), including filing suspicious activity reports (SARs).

The UK has also been accused of turning a blind eye to shady foreign investments, particularly in London. In March 2022, Transparency International released a report finding that since 2016, some £1.5 billion worth of property was bought by Russians accused of corruption or links to the Kremlin.

Just this year, the British government launched the Register of Overseas Entities in a step towards transparency. Now anonymous foreign companies owning or looking to purchase land or real estate must reveal their true identities. The register applies retrospectively and entities failing to comply face stiff penalties.

For investigators at financial institutions or in law enforcement, tracking down money laundering through real estate transactions can be challenging, since these schemes can involve many layers and networks of companies and individuals.

Investigating real estate transactions for money laundering can be a demanding process. At a minimum, it involves performing PEP and sanctions screening, checking ultimate beneficial ownership, and verifying the origin of funds. All of these can be complex operations.

Criminals and money launderers also use numerous schemes to hide their funds through real estate. Here are some common red flags:

- An anonymous buyer, whose purchase is covered by a trust, a shell company, etc.

- Use of third parties or shell companies by either the buyer or seller to conceal ownership.

- Manipulation of the value of the property. Overvaluation means the criminal can take out a larger loan, allowing them to legitimize more funds as they pay their mortgage. And undervaluation can mean that some illegal cash is being paid to the seller under the table.

- Discrepancies between the income or assets of the buyer and the value of the real estate. Buyers with little or no income and no documented wealth purchasing expensive real estate should be considered suspicious.

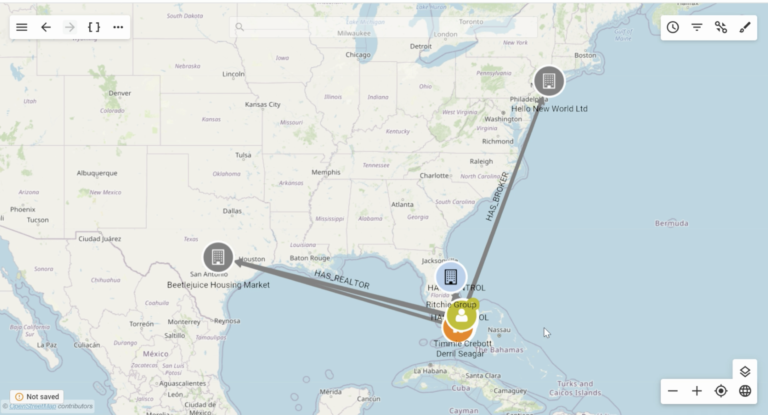

- Colluding real estate professionals such as realtors and mortgage brokers with geographic mismatch.

- Purchases by family members of politically exposed persons, sanctioned individuals, etc. merit extra scrutiny.

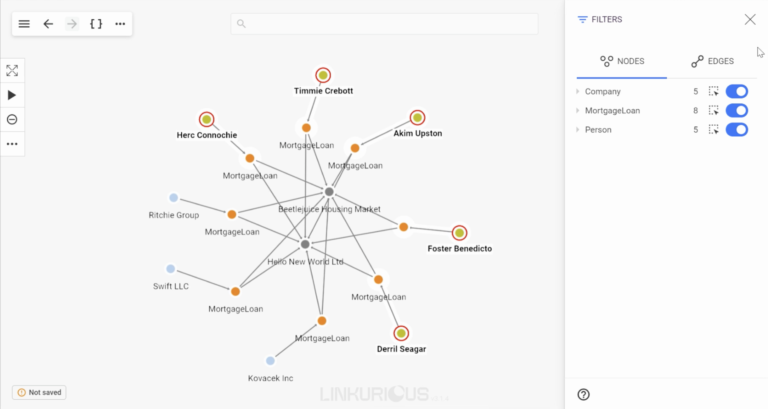

Graph analytics, a relatively new type of technology, has proven highly effective in investigating even the most complex money laundering cases. Graph technology is based on a data structure that consists of a set of nodes and edges (or relationships). Each node represents an entity, such as a person, a bank account, an address or any other piece of data. Each edge represents how two nodes are linked to each other.

Analyzing and understanding relationships is much easier than with tools based on traditional data models.

An investigation solution such as Linkurious Enterprise that is built on graph technology makes it easy to quickly uncover the kinds of patterns and relationships that indicate that money laundering may be occurring through real estate transactions.

Say you are a financial security analyst working for a mortgage lender. You might be investigating to understand if realtors and mortgage brokers are working in collusion to facilitate clients laundering money through real estate transactions, financed by mortgages with your organization.

In Linkurious Enterprise, you can set up a query that will find brokers and agents who have multiple clients in common, enabling you to see in just a couple of clicks who is connected to whom and how. A geographic layout feature shows you on a map where entities are located, helping you easily understand geographic patterns and see anomalies. This is a particularly interesting feature in a real estate use case.

Checking the beneficial owners of the companies involved in suspicious transactions is also easy. Using custom actions, you can check against external ownership databases in just a click. And within Linkurious Enterprise you can run queries to check ultimate beneficial ownership or see if other companies are registered to the same address as a company of interest, for example.

Visualizations are easy to save and share for easier reporting and collaboration within your team.

Sign up for one of our live AML demos to see in action how Linkurious Enterprise can help you track down real estate money laundering faster and more easily.

A spotlight on graph technology directly in your inbox.