AML and real estate: Preparing for new beneficial ownership rules in the US

“In the popular imagination, the money-laundering capitals of the world are small countries with histories of loose and secretive financial laws,” said Janet Yellen, US Secretary of the Treasury at the Summit for Democracy in December 2021. “But there’s a good argument that, right now, the best place to hide and launder ill-gotten gains is actually the United States.”

The United States real estate sector has effectively provided a haven for criminals, kleptocrats, and other bad actors from around the world to launder their money for decades. Now, that’s finally set to change. After announcing in 2023 a proposal for new compliance rules that aim to put a stop to anonymous, all-cash real estate transactions nationwide, the US Treasury has finalized those new regulations.

We’re taking a look at what’s changing, what these new real estate AML rules entail, and what new regulatory requirements professionals in the real estate sector will have to comply with.

We’ll also take a look at how graph technology can be a powerful asset in efficiently meeting new beneficial ownership requirements.

The real estate sector in general is highly attractive to bad actors looking to hide illicit funds. And the real estate market in the US is particularly vulnerable to money laundering due to a legal loophole. Cash transactions have not historically been subject to AML rules, allowing these types of property purchases to be carried out anonymously. This is in contrast to financed real estate transactions, where financial institutions offering mortgages are bound by due diligence and AML rules that require them to vet each customer.

Why is this? The 2001 Patriot Act strengthened several parts of the Bank Secrecy Act (BSA). The legislation included requiring businesses and agents in the real estate sector to comply with AML rules, but the industry was granted a temporary exemption that remains in place today. Certain specific geographic areas that are considered high risk - such as New York or Miami - are subject to geographic targeting orders (GTOs) that impose reporting requirements for cash transactions. But GTOs must be renewed frequently, and the result is a patchwork that leaves plenty of holes in the net.

As the rules stand, agents and others involved in a real estate transaction are not obliged to identify customers, monitor transactions, or report suspicious behavior in cash deals. Buyers with something to hide are free to use shell companies to dissimulate their identities - which plenty of them do. The result is that as much as $2.3 billion has been laundered through the US real estate market between 2015 and 2020, according to the US Department of the Treasury.

That reality is set to change. In August 2024, the US Treasury announced that following a change originally proposed in 2021, it was introducing a pair of regulations to shine a light on anonymous real estate acquisitions. One of the new rules requires that real estate professionals such as title agents report the identities of the ultimate beneficial owners (UBOs) in anonymous all-cash sales and non-sale transfers of residential properties to the Financial Crimes Enforcement Network (FinCEN). The rule is something like an expansion of the existing GTOs.

The second regulation stipulates that some investment advisors will also need to adopt risk-based anti-money laundering and counter-terrorism practices (AML/CFT), including filing suspicious activity reports (SARs).

The goal of the new regulations is to provide better information to the agencies fighting financial crime. Based on the existing information about GTOs, the new regulations are likely to succeed in meeting that goal. A 2020 report by the Government Accountability Office (GAO) found that nearly 7% of GTO reports identified individuals or entities connected to ongoing FBI cases.

The new rules will effectively change how real estate professionals across the country conduct their business. Whereas previously, professionals in roles such as title agents have only had reporting requirements if they were dealing with transactions in locations subject to GTOs, those requirements will now extend to the whole country. Agents will have to be able to identify the beneficial owners in real estate acquisitions and report them to FinCEN, even if those transactions bypass financial institutions.

There will likely be challenges ahead as the real estate sector adapts. Some individuals - often those with the most to hide - go to great lengths to avoid being identified. It will mean sifting through sometimes complex layers of ownership to track down the information required to stay compliant.

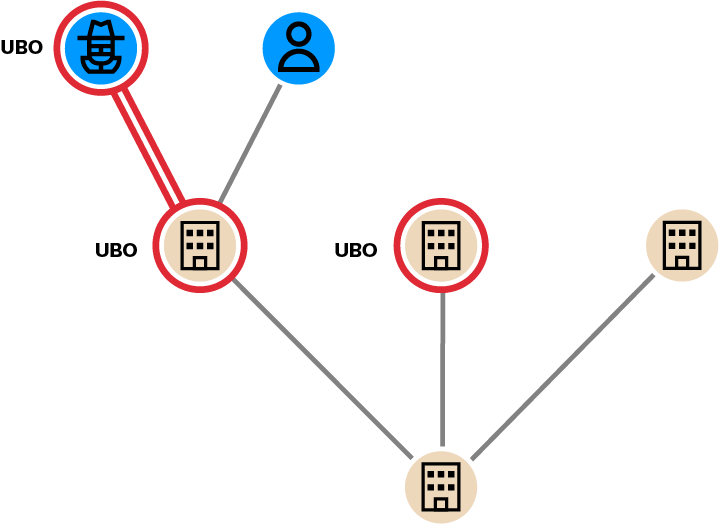

Real estate professionals who previously had few AML requirements to comply with will soon have to start digging into the sometimes murky world of beneficial ownership. UBOs may be concealed beneath several layers of ownership, behind shell companies, etc. When undertaken manually, the process can be very time consuming.

Having the right tools in your arsenal can greatly facilitate this work. Graph visualization and analytics, for example, can make fast work of UBO identification in even very complex corporate structures, be it for real estate transactions or for other regulatory purposes.

Graph technology is based on a data structure that consists of a set of nodes and edges (also called relationships). Each node represents an entity, such as a person, a bank account, an address or any other piece of data. Each edge represents how two nodes are connected to each other.

Because a graph data model naturally represents networks, analyzing and understanding relationships is much easier than with tools based on traditional data models. This makes it an asset for tracking down UBOs, since it can quickly show you how different entities in the ownership structure relate to one another.

Built to facilitate AML investigations, Linkurious Enterprise graph visualization and analytics tool has built-in features to simplify UBO identification.

Query templates automate investigation workflows by turning repetitive actions into a button or form. Several query templates available in Linkurious Enterprise can help save a lot of time in tracking down UBOs. Using a single graph query, you can visualize a complete ownership structure to quickly identify a UBO. A “Find shortest path” query will indicate the most direct path between two entities. And the “Find indirect connections” query will show you everyone and everything your entity of interest is connected to indirectly.

Money laundering is a crime with serious consequences. It funds gangs, trafficking of all kinds (drugs, humans, wildlife), and terrorism. New real estate AML regulations coming down the pipeline won’t be without challenges for industry professionals, but they’ll contribute to catching some of the worst offenders. And with the right tools and techniques to help, new regulatory changes can be met with ease.

Article originally published September 12, 2023, updated August 29, 2024.

A spotlight on graph technology directly in your inbox.