Fraudulent activities are on the rise and it's important for organizations to stay informed of the latest schemes that criminals devise in order to separate innocent victims from their hard-earned money. First-party fraud is a type of financial scam that can take many forms, but all involve an individual taking advantage of their own accounts or using false identities or documents. In this article, we'll explore what first-party fraud is (as opposed to third-party fraud), how it works, and 10 common types of first-party fraud schemes so you know how to spot them.

First-party fraud is when an individual or an organization purposely misrepresents their identity or provides incorrect information to gain an unfair or unlawful advantage. This may involve using a synthetic identity.

First-party fraud is relatively common in applications for credit or a bank or government loan as people attempt to get lower rates by misrepresenting their employment status or income. Insurance providers also frequently encounter this type of fraud.

First-party fraud may be either opportunistic - carried out by an individual - or organized, perpetrated on a larger scale by a fraud ring. Organized fraud in particular can lead to major losses, both because criminal rings are able to defraud organizations out of large sums of money and because they employ professional tactics to fly under the radar and evade detection.

There is a wide variety of first-party fraud schemes. These impact financial institutions, credit companies, and retailers especially, but many types of organizations, public and private, can be the targets of this type of fraud.

- Bust-out fraud: First, a fraudster applies for credit. Over time - months or years - that person builds their credit profile on that account, securing more and more credit. Eventually they max out their credit and “bust out”, disappearing completely.

- Chargeback fraud: A customer buys something with a credit card, and then claims to their credit card company that the payment was fraudulent in an attempt to fraudulently get back the funds.

- Fronting: This is when an individual uses someone else’s identity to access a service or open an account to give themselves an unfair financial advantage. A person may use someone else’s identity to obtain lower insurance rates, for example.

- Goods lost in transit fraud (GLIT): After ordering something online, a consumer may claim those goods were not delivered in order to gain a fraudulent refund.

- De-shopping: This is when a consumer buys something, uses those items, and then returns them for a refund.

- Government loan fraud: First-party fraudsters may misrepresent information about themselves to benefit from government loan or stimulus programs. This type of abuse was frequent with the Paycheck Protection Program (PPP) set up during the Covid-19 pandemic.

- Application fraud: Fraudsters exaggerate their income or provide misleading details on loan or credit applications to secure better terms.

- Loan stacking: This refers to individuals applying for multiple loans or credit lines simultaneously within a short period to obtain more credit than they would otherwise be approved for.

- Buy-Now-Pay-Later (BNPL): After taking out BNPL financing, the person decides not to repay the debt.

- Check kiting: In this case, someone takes advantage of the time delay in check processing by depositing a check into multiple accounts and withdrawing funds before it clears.

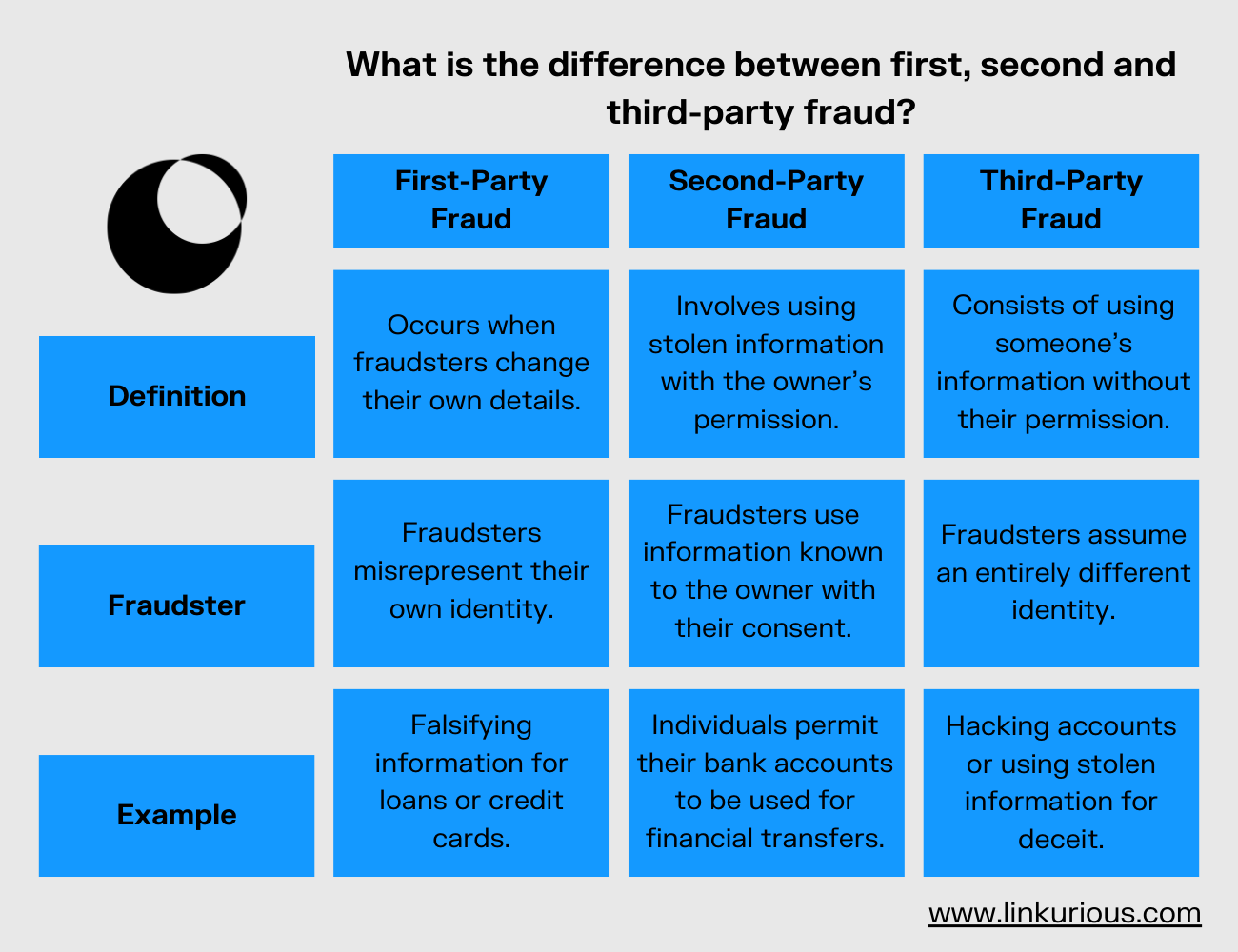

The key difference between first-party and third-party fraud comes down to identity. In first-party fraud, individuals intentionally misrepresent themselves, often using false or synthetic information.

Third-party fraud, on the other hand, involves a fraudster exploiting a stolen identity without the victim's knowledge or consent, which can include tactics like phishing, account takeovers, or unauthorized transactions. Unlike first-party fraud, where the person committing the fraud is directly involved, victims of third-party fraud are frequently unaware until financial damage has already occurred.

Second-party fraud is also common, where someone uses another person's identity with their knowledge, often for things like money laundering or setting up mule accounts.

First-party fraud negatively impacts the bottom line of any financial institution or other business. But detecting this type of fraud can be especially challenging since fraudulent behavior and transactions can closely resemble normal customer behavior. Identifying fraud early and automatically, investigating cases quickly, and putting in place preventative measures can have a positive impact on an organization’s operations. A next-generation fraud analytics solution that breaks data out of silos and effectively analyzes relationships and connections can be an important asset to accelerate first-party fraud detection and investigation.

Learn more about using new analytics technology to fight back against fraud in our ebook.