In the battle against fraud, leveraging data analytics techniques is crucial. By combining big data analysis with human knowledge and intuition, fraud analytics can effectively identify and investigate suspicious activity and improper transactions related to financial fraud.

Fraud analytics serves a dual purpose: prevention and detection. With the ability to predict future fraudulent behavior, businesses can better manage risk, detect fraud schemes in real time, and enhance their detection capabilities.

In this article, we will provide an overview of fraud analytics, its value to businesses, the inner workings of the process, and the key benefits it offers. Additionally, we will explore the potential of graph analytics in further improving the speed and efficiency of fraud analytics.

Fraud analytics is a multidisciplinary field that leverages the power of big data analysis techniques to detect, prevent, and predict fraudulent activities, particularly in the financial sector. It involves the collection and analysis of large sets of data, looking for patterns, discrepancies, and anomalies that could indicate fraudulent behavior.

Manual fraud analysis techniques exist, but it’s far more common - and effective - for organizations to use various technologies for fraud analytics. Those tools can include:

- Big data analysis: Processing vast volumes of transaction data.

- Machine learning and AI: Enabling predictive modeling and adaptive fraud detection.

- Network analysis: Understanding complex relationships between entities.

By leveraging these technologies, fraud analysts can identify suspicious activities and transactions in real-time, investigate them further, and take appropriate actions to prevent further fraud.

The benefits of fraud analytics are far-reaching. They can help organizations reduce their financial losses due to fraudulent activities, protect their brand reputation, and comply with regulatory requirements. It can be applied to a wide range of fraud typologies, including identity theft, account takeover fraud, or insurance fraud, just to name a few.

The world we’re living in isn’t the same as it was ten years ago, or even five years ago. The ways we do business and bank have changed profoundly. All kinds of transactions happen online and across multiple devices.

Think about banking specifically. Financial services have moved increasingly online and customers can access their bank accounts from anywhere:

- Mobile apps

- Online portals

- Phone banking

- Physical agencies

This diversification of banking platforms increases risk since it opens new avenues to fraudsters. Banks must walk a fine line to balance good customer experience with security.

Without additional controls and detection systems put in place, accounts may also be easy for fraudsters to access. Login credentials are easily available for purchase on the dark web. Financial institutions need additional controls and tools to protect customer accounts when a username and password no longer suffice to prove someone’s identity.

The environment of increased fraud risk coincides with an increase in regulatory pressure around not only fraud, but also corruption, money laundering, and financial crime in general.

Fraud prevention and detection is like an arms race. As fraud techniques evolve - and they evolve quickly - financial institutions put new measures in place to meet those new challenges. And then the fraud techniques evolve once again.

Fraud analytics are a powerful solution that helps solve these challenges.

Fraud analytics can help combat a wide range of fraud types, ensuring financial institutions and other organizations stay one step ahead of fraudsters. These are some of the types of fraud that fraud analytics can identify and prevent:

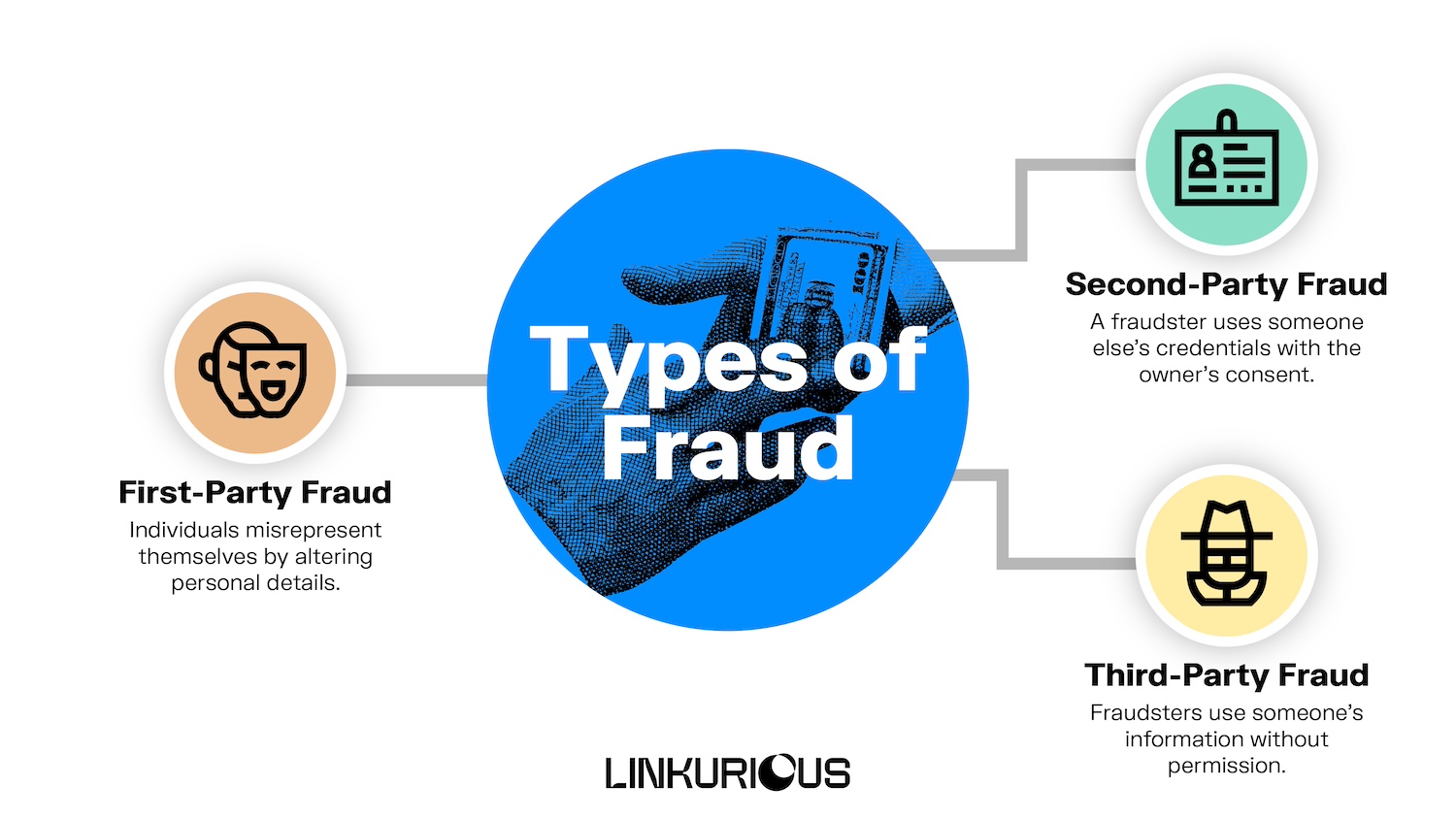

- First, second, and third-party fraud: Fraud committed by individuals or groups either directly involved in a transaction (first-party), indirectly (second-party), or through false identities (third-party).

- Money mule fraud: Fraudsters recruit individuals to move stolen funds or launder money on their behalf.

- Account takeover fraud: Criminals gain unauthorized access to customer accounts, often by stealing login credentials.

- Procurement fraud: Fraud involving the manipulation or misappropriation of funds in the procurement process.

- Synthetic identity fraud: Creation of fake identities by combining real and fabricated information to carry out fraudulent activities.

- VAT fraud: Manipulation of VAT refunds or overstating business expenses.

- Insurance fraud: Fraudulent claims made against insurance policies, often involving falsified losses.

- Digital banking fraud: Fraudulent activities carried out via online or mobile banking platforms, often targeting weak security points.

- Buy now pay later fraud: Misuse of "buy now, pay later" services, often involving false or stolen identities.

Fraud analytics plays a crucial role in identifying these fraud types, helping businesses and financial institutions respond quickly and effectively.

Answering important questions about users and user behavior today requires the use of big data.

Every transaction, whether legitimate or fraudulent, leaves behind a digital footprint. Banks have access to data about the device someone is using, their IP address, historic usage, transaction patterns, and more.

However, collecting this data is just the first step. The challenge is in making sense of it: identifying suspicious activity while minimizing disruptions for legitimate customers. This is where fraud analytics comes into play.

Fraud analytics uses advanced data processing techniques to detect hidden fraud patterns, predict threats, and improve decision-making in real time. By analyzing big amounts of data, fraud analytics enables organizations to go beyond traditional rule-based detection and identify complex fraud schemes.

The volume of this data makes manual fraud detection processes inefficient. Traditionally, financial institutions and other organizations fighting fraud have used systems based around simple rules. Rules-based systems are time savers that have eliminated a lot of manual work, but they also have some major drawbacks:

- High false positive rates: Legitimate transactions often get flagged, frustrating customers.

- Limited adaptability: These systems struggle to detect evolving fraud techniques and complex schemes.

Fraud analytics strengthens detection capabilities by combining:

- Data mining: Collects valuable insights from large datasets.

- Machine learning and AI: Continuously improves detection based on past fraud patterns.

- Advanced algorithms: Identifies anomalies and hidden fraud networks.

By using fraud analytics, organizations can identify patterns and anomalies that provide insights to detect suspicious activity, better understand fraud threats, and strengthen anti-fraud defenses.

Fraud analytics has the potential to deliver a lot of value to financial institutions. Three main benefits are:

- Analytics tools can enhance rules-based systems and other tools, constantly improving detection and controls. In other words, analytics help fraud leaders get more value from both their data and their existing technology.

- It’s easier and faster to find hidden patterns using analytics. By analyzing even the smallest bit of data, this method can identify patterns that would have otherwise gone undetected.

- Finally, because fraud analytics centralizes your data, it can break down data silos that keep you from seeing the full picture.

To get the most out of fraud analytics software, it’s essential toimplement best practices that ensure effective detection and prevention. Here are a few best practices to help businesses maximize their fraud detection capabilities:

- Continuous monitoring: Real-time alerts allow businesses to spot unusual transactions as they happen, enabling a quick response before fraud can escalate.

- Data integration: Fraud detection becomes far more accurate when data from multiple sources is integrated. Combining transactionlogs, device information, IP addresses, and historical patterns creates a more comprehensive view of customer behavior.

- Hybrid systems: While traditional rule-based fraud detection systems are useful, they can struggle with more advanced fraud tactics. By combining these systems with AI-powered analytics, detection becomes more accurate and effective.

By applying these methods, businesses can more effectively respond to emerging threats and protect both their assets and their customers.

Selecting the right fraud analytics software is a key step in protecting an organization from fraud. With so many options available, it’s important to find a solution that not only meets the current needs but also adapts as fraud tactics evolve. Below are key factors to consider when selecting the most suitable software for fraud detection:

- Scalability: As fraud techniques become more sophisticated, the volume of data to process will likely increase. The chosen fraud analytics software should be capable of handling large datasets without a decline in performance.

- Easy integration: Fraud detection software should integrate seamlessly with existing systems. An easy integration allows businesses to gain insights from their data without disrupting operations or requiring extensive training on new systems.

- Customization: No two sectors have the same fraud challenges, and fraud analytics software should be customizable to address those specificities. Whether it's fraud analytics in banking, insurance fraud detection, or payment fraud analytics, the software should offer flexibility to solve the unique business needs.

By considering scalability, integration and customization, businesses can ensure they select a software solution that not only detects fraud efficiently but also grows with the organization, providing long-term protection against evolving fraud tactics.

Fraudsters are always finding new ways to exploit vulnerabilities, but fraud analytics is also continuously evolving. In the coming years, we can expect significant advancements that will improve the accuracy of fraud detection, make systems more adaptive to new tactics, and provide faster responses. Here are some of the trends that are shaping the future of fraud analytics:

- Graph analytics expansion: Integrating more sophisticated graph models to enhance fraud detection by revealing hidden relationships and complex fraud networks, helping to spot suspicious activity that traditional methods might miss.

- Integration with emerging technologies: Blockchain and real-time data processing will help create secure transaction records and enable quicker fraud response strategies.

By staying ahead on these trends, businesses and organizations will be in a much stronger position to outsmart fraudsters.

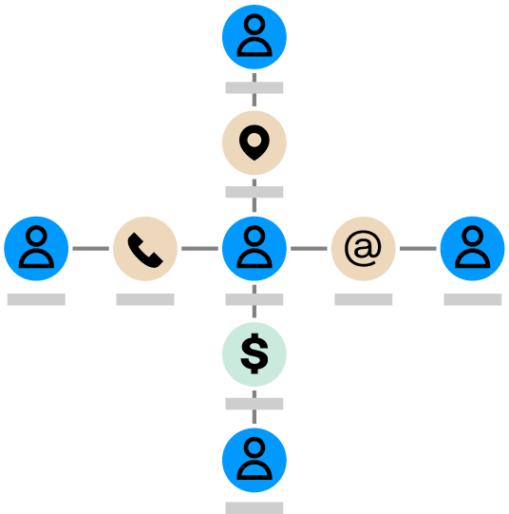

Graph technology can be a powerful tool when applied to fraud analytics. It enables analysts to identify relationships and patterns within large and complex datasets. Graph data structure lends itself particularly well to this. A graph data model structures data as nodes - individual data points like a name or an account - and relationships, or edges - like a person having an account. The graph model is flexible, so it’s easy to add new data as needed.

In the context of fraud analytics, graphs can be used to represent the connections between entities such as individuals, accounts, and transactions, as well as the attributes of those entities.

Graph algorithms quickly find within your data the answers to many of the questions that arise in a fraud investigation. It uncovers patterns, discrepancies, and anomalies within data that might otherwise go undetected. It’s easy to see if someone is connected to a politically exposed person, who might be the ringleader of a group of fraudsters, or if one fraudster is actually part of a larger network.