Money laundering is a crime that involves concealing the origins of money obtained through illegal activities so that it appears to have come from legitimate sources. It is a massive global problem: the United Nations Office on Drugs and Crime (UNODC) estimates between 2% and 5% of the global GDP is laundered each year. And those funds allow criminal enterprises to continue financing their illicit operations.

While techniques vary - and frequently evolve - there are several common schemes bad actors use to launder dirty money. This article provides an overview of some of the most prevalent methods, including smurfing, trade-based laundering, the use of shell companies, and gambling. Understanding how money laundering works is the very first step in helping both authorities and regulated industries crack down on financial crimes and disrupt dangerous criminal organizations.

Money laundering is defined as the process by which a person or a network of criminals work to conceal the true source of illegal proceeds. Money laundering is a crime in its own right, but the illicit funds being laundered are also associated with crimes such as fraud, corruption, drug trafficking, etc.

When left unchecked, money laundering can have serious consequences, impacting the economy and providing funds for drug dealing, human trafficking, corrupt officials, and more. Laundered funds may also be used for terrorist financing. For banks and other regulated industries, non-compliance with money laundering regulations can also come with a steep price in the form of fines.

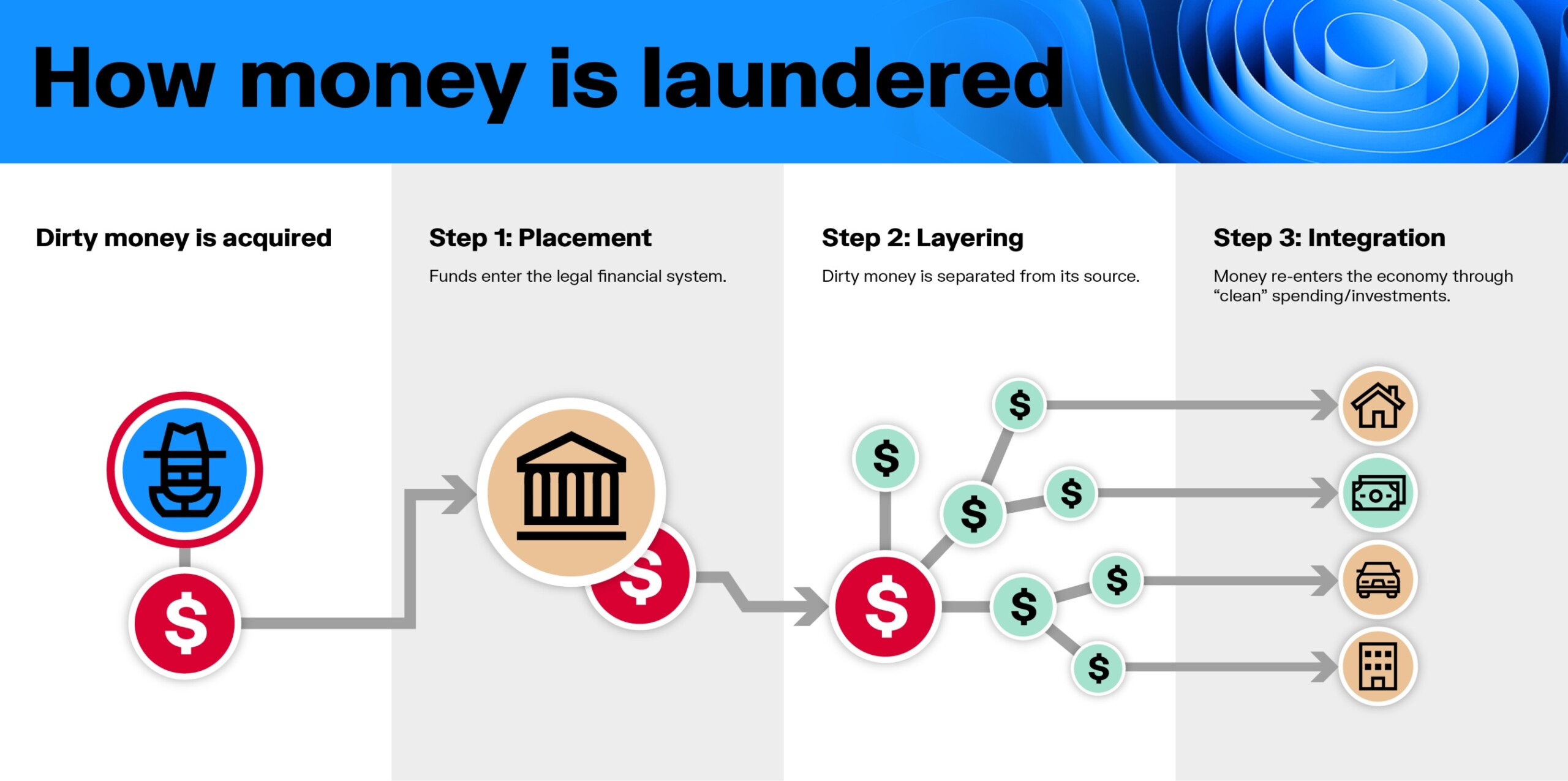

The money laundering process typically (but not always) takes place in three steps.

- Placement. In this first step of the process, funds enter into the legal economy. Funds may be placed through a business, or cash may be deposited in a bank account in small increments - sometimes using money mules - so the transactions do not appear suspicious.

- Layering. Next, money is separated from its source. Layering can involve many steps and transactions, many entities, and many countries, making it difficult for AML investigators to understand where the money came from.

- Integration. At the integration step, the money has effectively been cleaned and appears legitimate. It can now be used like any other funds.

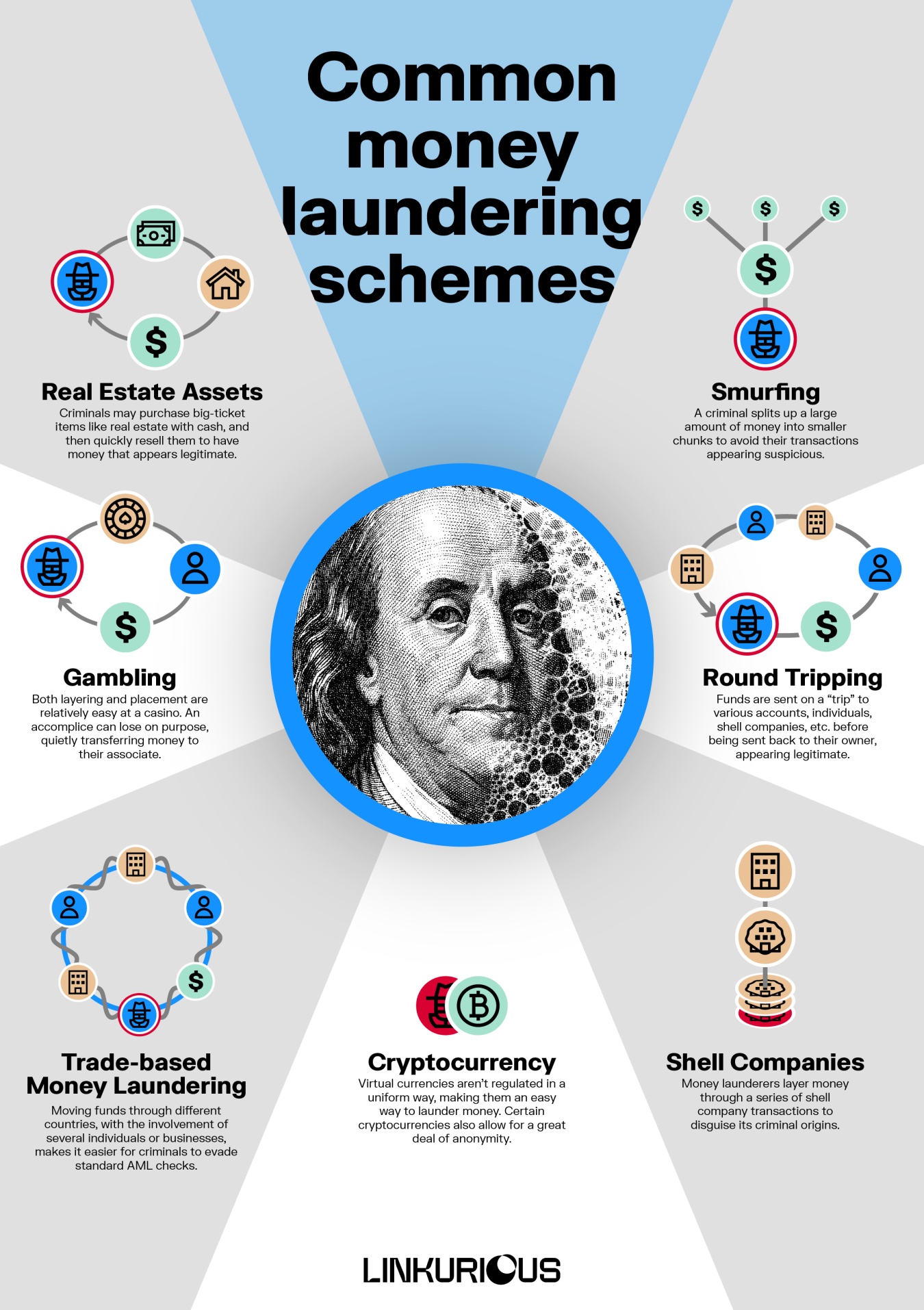

Criminals use many different tactics to conceal the origin of illegal funds. While it would be nearly impossible to write an exhaustive list, here are some of the most common money laundering schemes.

This money laundering scheme is when a criminal splits up a large amount of money into smaller chunks to avoid their transactions appearing suspicious. Financial institutions are obligated to report transactions above $10,000, so depositing a large amount of criminal proceeds simply isn’t an option. By enlisting the help of associates, friends, or relatives, sometimes in several countries, a criminal can have those individuals deposit smaller amounts into their accounts and then have that money wired to his own account. This may be facilitated by the use of money mules.

This is when funds are sent on a “trip” to various accounts, individuals, shell companies, countries with low regulatory standards, etc. before being sent back to their owner with a shiny veneer of legitimacy. The idea is to create a complicated path that’s hard to follow. It’s easy for analysts and investigators to miss a step in this complex journey of criminal funds, making them difficult to trace back to their original source.

Shell companies exist only on paper and have no real operations or assets. Money launderers will layer the money through a series of shell company transactions to disguise its criminal origins. For example, a shell company may "buy" a service from another shell company owned by the same criminal network. Or dirty money might be sent through shell companies as "payments" for fictitious goods and services. Shell companies make it extremely difficult for authorities to trace the true source of the money. Many criminals register shell companies in countries with lax regulations and privacy laws to better hide their activities.

For a long time, cash was king for criminal activity, but that’s no longer the case. Virtual currencies like Bitcoin are not regulated in a uniform way, making them an easy vehicle to launder criminal proceeds. Certain types of cryptocurrency also allow for a great deal of anonymity. This money laundering scheme has emerged recently, and regulators and financial institutions are now trying to keep up.

This scheme takes advantage of the complexity of international laws and regulations. A money launderer may manipulate invoices or the value of goods in order to move money around and give it the appearance of being legitimate. Moving funds through different countries, with the involvement of several individuals or businesses, makes it easier for criminals to evade standard AML checks.

Since lots of cash moves through casinos, both online and offline, it can be a natural place for illicit money to be laundered. Both the layering and placement steps of the money laundering process are relatively easy at a casino. With two accomplices sitting at the same table, one can lose on purpose, quietly transferring money to the other.

Cash can easily be made to look legitimate through reselling assets. Criminals may purchase big-ticket items with cash, and then quickly resell those items to have money they are able to actually use in their bank account. Real estate is one of the most common vehicles for this type of money laundering, but luxury cars and other such items are popular placements for illicit funds.

One of the keys to detecting money laundering schemes is identifying specific red flags and anomalies that may indicate suspicious behavior. Here are some of the common red flags to look out for:

Transactions that deviate from a customer's typical behavior warrant further investigation. Such transactions may include unusually large amounts or deposits of multiple smaller amounts that were likely structured to avoid reporting requirements.

Transactions involving large sums of cash, particularly if they are structurally designed to avoid reporting requirements, are often associated with money laundering schemes.

Transactions involving high-risk countries with weak anti-money laundering laws or a significant presence of criminal activity certainly don’t systematically indicate suspicious activity. However, transactions from such countries warrant extra scrutiny to be sure no criminal activity is going on.

Certain industries and products have a higher risk of being used for money laundering, such as the jewelry and precious metals industry, the art market, and the gambling industry. Transactions involving these industries or products should be closely monitored to flag any suspicious activity.

Multiple changes to account information or beneficiaries, especially rapid or frequent changes, along with inconsistent or incomplete information warrant closer examination.

By flagging these warning signs early on and taking the necessary steps to investigate them, financial institutions and other organizations can take proactive measures to mitigate risk and prevent money laundering.

Criminals’ number one goal is to effectively hide money with illicit sources. New money laundering schemes emerge all the time. Banks, financial institutions, and other regulated businesses need to constantly monitor data and patterns to catch new schemes when they emerge.

Traditional AML approaches use relational databases to store data. Looking for patterns within data stored in tables is time consuming and requires a lot of manual work. It’s also easy to miss connections within the data that might be a money laundering red flag.

Low level signals within your data can be the key to detecting new money laundering schemes. Linkurious decision intelligence platform can help you detect those signals, offering a swift, precise, and intuitive way to explore your data and the relationships within it.

Learn more about money laundering schemes and how to combat them: