For organizations fighting financial crime, understanding the full context around your data is critical. But your analysis will only be as good as the quality of the data in your possession. That’s where entity resolution comes into play. A powerful entity resolution solution will bring you a more accurate understanding of the context and make you more efficient in spotting potential risks. This becomes especially important as organizations mature and add more third-party data sources to their anti-financial crime arsenal.

In this article, we’ll take a look at why entity resolution is so important, and some of the associated challenges organizations face today. Then we’ll dive into how to build a scalable, future-proof entity resolution solution integrating graph visualization and analytics for faster, more informed decision-making.

Entity resolution consists in the process of identifying whether the records from one or multiple data sources represent the same real-world entity, despite having been described differently, and then linking those records. Entity resolution may also be recognizing when records are not in fact the same despite having been described similarly.

For example, the Christina Webber living at 17 Fernwood Ave. may be the same entity as Chrissy Webber with an address listed as 17 Fernwood Avenue. On the other hand, Robert Smith Sr. and Robert Smith Jr. will be different entities despite sharing the same address and a very similar name.

The more precise the entity resolution, the more accurate your understanding of the context around your data will be, and the more effective you will become at spotting potential risk. “Advanced entity resolution can play a massive role in improving organizations’ data quality, and with better data quality, organizations can effectively visualize and leverage connected data to make real-time decisions,” says Anthony Farinha, VP of Business Development and Partnerships at Senzing, an industry-leading software company that focuses exclusively on entity resolution.

While entity resolution has a clear use case in the financial services and compliance sector, it can be a major asset in many industries that handle large amounts of data. Sectors ranging from healthcare to information services to the public sector may greatly benefit from an entity resolution solution.

A quick explainer on entity resolution by Senzing

We’ve covered more about entity resolution in a past article that you can read here.

When you’re working with large amounts of heterogeneous data, resolving the entities within comes with some big challenges. Let’s take a look at some of the major ones organizations deal with when searching for the right entity resolution solution.

Internal data sources are often siloed. A financial institution may have different databases for credit card account holders, mortgage accounts, etc., each with different data formats. Data fields may also be different between different databases. For example, one may contain names as a single field, whereas another may break out first and last name. This effect is compounded when you start enriching internal data with third-party sources such as watchlists or ownership databases, as these will also have a different format.

There are plenty of potential variations people may include in the data they provide: they may use a nickname instead of a legal name, include or drop a middle name or initial, write a phone number with or without a country or area code, etc.

The first name, middle name, last name way of writing a name used in many western countries isn’t the default everywhere. Furthermore, data written in other alphabets, such as Arabic or Chinese, or transliterated from another alphabet, can make it difficult to match up data records.

Spelling errors or typos will naturally lead to variations within the data, and possible differences between records referring to the same entity.

Most things aren’t permanent, and data is susceptible to change over time as people change their names, move addresses, change telephone numbers, etc.

Finally, some people input false data. This may be deliberate uses of fake or stolen identities like drivers’ licenses or national ID cards. Some people may have more innocent reasons for using false data, simply wanting to obfuscate their identities to marketers.

Graph technology by itself can drive a lot of value with limited difficulties in terms of entity resolution. Particularly in cases where you’re focusing on internal data - such as KYC or transaction data - graph analytics provides algorithms such as weakly connected components and cosine similarity that are suited for the detection of potential duplicates. (We did a webinar showing how this works - watch the replay here.)

As an organization matures and wants to enhance their anti-financial crime arsenal, the question of integrating third-party data - such as sanctions lists or company registries - arises. That’s when it makes sense to add advanced entity resolution capabilities

There are a few ways to approach an entity resolution solution that meets more complex needs. A fully customized solution will be costly and require lots of engineering work. You can buy a packaged solution instead, but this still requires a significant build and integration effort, and may come with restrictions that make it difficult to customize.

This is why Linkurious has partnered with Senzing and Aptitude to provide a modular solution that combines entity resolution and graph analytics. Together we provide a seamless integration of Linkurious Enterprise’s graph visualization and analysis capabilities with Senzing’s best in class entity resolution technology. The end result is a solution that fully meets your needs and that works with your existing architecture while keeping costs manageable. A joint solution like this is also easier to adapt to any new requirements, and it can easily scale with your data.

As an example, we’re going to look at how Senzing, an API for developers that makes it easy to integrate entity resolution into workflows and architectures, can be combined with graph technology including Linkurious Enterprise to create an automated entity resolution solution. Such a solution can be especially powerful to facilitate perpetual monitoring for suspicious activity by financial institutions.

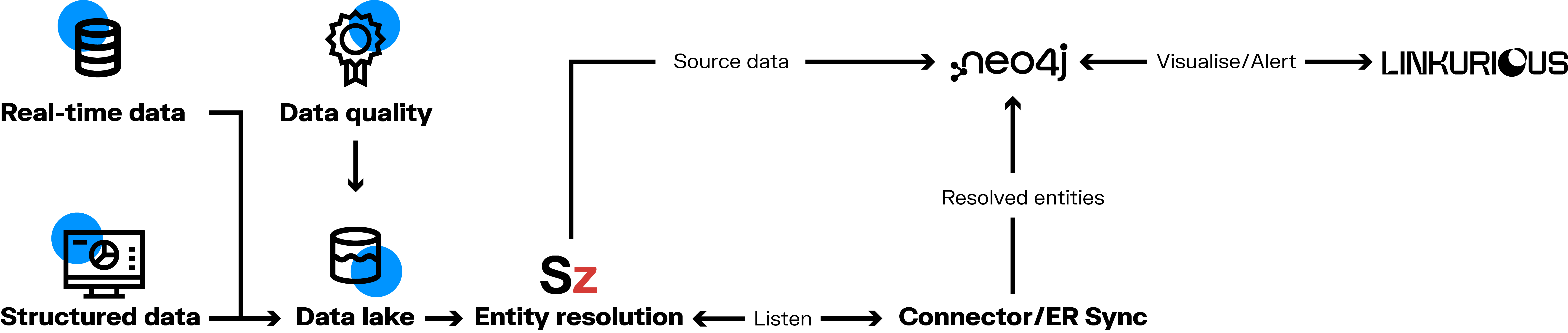

First, data is ingested from both internal and third-party sources according to the types of data you need to work with, and a data model is applied.

Senzing ingests that data and creates a single customer view. There are several advantages to using a tool like Senzing. Its entity-centric learning approach is more accurate and flexible than data matching, and it gets better with more data and context. It’s self-learning and self-correcting so it gets smarter over time, as you ingest more data. New data records may cause an entity to un-match records based on new insights, for example. Results in Senzing are also explainable: it provides analysis tools that let you understand why and how records are matched or linked - or not - helping you trust your data when making decisions.

Since Senzing requires minimal data prep, the time it takes to add data sources is much less than what is typically required with other systems.

Graph visualization and analytics has emerged as a powerful solution for understanding the context around even the most complex scenarios. This technology makes it easy to explore the context around entities to detect complex patterns like money mules or sanctions evasions, and to identify risky connections such as links to shell companies.

Once your data is resolved in Senzing, it can be ingested into a graph database, and explored using a tool like Linkurious Enterprise, an off-the-shelf data visualization and analytics software that leverages graph analytics to enhance each step of the investigation process. “When you combine entity resolution with graph visualization, understanding how entities are related to one another offers a significant superpower for data-intensive applications,” says Anthony Farinha of Senzing.

Effectively, with data processed through Senzing, you can have a high level of confidence in the quality of the data you’re exploring and alerting through Linkurious Enterprise. Whether you’re identifying politically exposed persons (PEPs) or getting to the bottom of a complex ownership chain, having high-quality data in your graph will result in fewer false positives and more confident decisions.

To learn more about empowering your anti-financial crime journey with tools like Senzing and Linkurious, watch our recent joint webinar with Aptitude, available as a replay here.

A spotlight on graph technology directly in your inbox.