Fighting public sector fraud: How graph technology helps government agencies combat fraud networks

When it comes to fraud in the public sector, the stakes are particularly high. Large amounts of taxpayer money are at risk, and organized groups of fraudsters actively work to evade taxes or exploit government systems to line their own pockets.

Fighting back against these sophisticated fraud schemes presents big challenges for investigators and analysts in government agencies. They often rely on multiple data sources that may be stuck in silos, making it difficult to draw the connections needed to uncover complex fraud networks and recover public funds.

Graph technology is emerging as a game changer in this fight against fraud. This article looks at how graph analytics can transform public sector fraud investigations and presents a real-life case study where consulting firm DataExpert delivered a graph-based solution to a major European government agency, with impressive results.

The impact of public sector fraud is staggering. This type of fraud can take many forms, such as:

- Tax evasion

- Corruption

- Social benefits fraud (unemployment benefits, Covid loan fraud, etc.)

- Health care fraud

- Procurement fraud

- VAT fraud

- And plenty more.

We can put estimates on the financial impact. According to the United Nations, global corruption costs at least $2.6 trillion each year. European countries lost an estimated 824 billion euros in 2015 due to tax evasion. And in the US, the amount lost to tax fraud is an estimated 458 billion dollars: resources that could have been invested in public services, infrastructure, and programs that benefit citizens. And beyond the financial loss, public sector fraud erodes citizen trust in public institutions.

The situation is becoming even more challenging as fraud techniques evolve rapidly. Fraud is also becoming more prevalent overall, with generative AI throwing fuel on the fire, helping fraudsters scale operations. As one example, the use of synthetic identities for fraud is growing, with an estimated $20 to $40 billion lost annually to fraud linked to these fake identities.

To effectively combat this growing and increasingly sophisticated fraud, government agencies need something they too often lack: context. Understanding the full picture of how fraudsters operate - and putting a stop to fraud schemes - requires seeing beyond individual transactions or isolated red flags.

Creating a comprehensive understanding of the context around people and companies often proves difficult for government agencies, despite having access to vast amounts of data. Several factors contribute to this challenge.

Data silos are deeply embedded in government culture. Some agencies experience legal constraints accessing or combining data in the way they need. Beyond these constraints, organizational politics create additional obstacles. Within agencies and across different departments, turf wars often determine who gets access to which data, further fragmenting the information landscape. And no matter the reason for siloed data, the result is the same: a negative impact on efficiency and difficulty making connections across datasets.

The technology infrastructure of many government agencies reinforces the data silo problem. Most public agencies rely on outdated systems based on relational databases and siloed applications. These legacy systems weren’t designed to handle the complex, interconnected analysis required to detect and investigate sophisticated fraud rings.

Budget constraints and resource limitations make it difficult to improve these systems. Technical teams are already stretched thin, and limited budgets restrict agencies’ ability to invest in new technologies or comprehensive system overhauls. Agencies may also lack skilled analysts and investigators to cope with the scale of the fraud they are faced with.

These challenges combine to create an acute need for practical solutions that can integrate data sources, detect suspicious activities, and empower investigators to work more efficiently.

The fraud challenge extends across virtually every area of government operations. Different types of agencies face distinct but related fraud risks, all requiring sophisticated detection and investigation capabilities.

- Financial Intelligence Units (FIUs) must process suspicious activity reports related to money laundering and terrorism financing (AML/CFT). These reports often contain subtle patterns that only become clear when viewed in context with other data sources.

- Tax agencies lead the fight against tax evasion, dealing with increasingly complex schemes designed to hide income and avoid obligations. These agencies need to identify patterns across multiple taxpayers and trace connections between seemingly unrelated entities.

- Employment agencies, health agencies, pension agencies, and others allocate vast sums in benefits payments. They may also provide grants and subsidies (think of the government loans made to businesses during the Covid-19 health crisis). They've become prime targets for sophisticated criminals who commit large-scale fraud by exploiting program vulnerabilities and creating false identities or circumstances.

- Many countries have dedicated anti-fraud or abuse agencies focused on combating political corruption and other forms of public sector misconduct. These agencies often need to trace complex networks of relationships and financial flows.

All these organizations share a common challenge: they're fighting financial crime and need new solutions that can deliver context and keep pace with evolving criminal tactics.

Graph technology offers a fundamentally different approach to fraud detection and investigation. Unlike traditional database systems that store information in separate tables, graph technology is designed to capture and analyze relationships between entities.

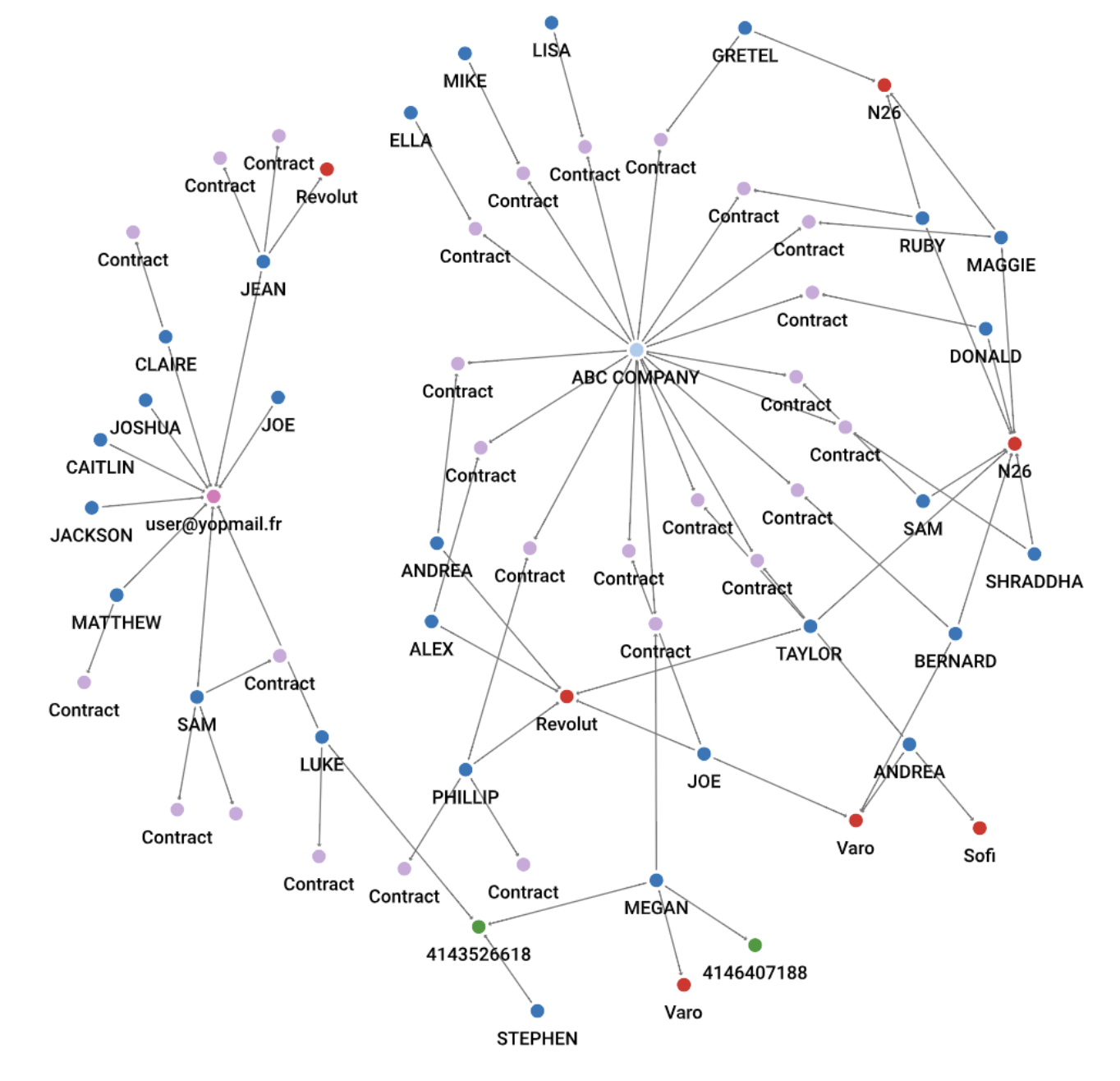

This approach is particularly well-suited for complex fraud cases because criminal activity rarely happens in isolation. Fraudsters typically work in organized networks, operate under multiple identities, and use sophisticated structures and schemes to dissimulate wrongdoing. Graph analytics excels at connecting these dots and quickly exposing patterns that would be difficult or impossible to detect using traditional methods.

Graph analytics provides several key benefits for public sector agencies.

- Abuse reduction: Detecting criminal schemes that would otherwise go unnoticed, directly curbing fraud and saving taxpayer money.

- Resources optimization: Allowing analysts to spend less time chasing data and more time making informed decisions. Graph analytics platforms work alongside existing tools rather than replacing them entirely, maximizing the value of current investments.

- Citizen experience improvement: Enabling agencies to automate and accelerate decision-making processes. This reduces wait times for legitimate benefit recipients and builds trust in public services by demonstrating effective stewardship of public resources.

Real-world implementations of graph-based solutions are demonstrating positive results for major government agencies. In a recent webinar, the firm DataExpert shared their experience building a solution using the Linkurious Decision Intelligence platform. They worked with a European government institution to implement this solution in their fight against fraud, tax evasion, and money laundering.

The agency’s analysts had access to substantial amounts of data, but their investigation processes were frustratingly manual and limited in its effectiveness. Analysts worked with long lists of individual companies flagged by basic, rule-based filters from isolated systems. They received sparse information such as “unusual VAT pattern” or “mismatch in reported income” without any context or prioritization guidance.

Each case was treated as standalone, with no link analysis or understanding of broader patterns. Analysts had to work blindly through these lists, with no systematic way to prioritize their efforts. As a result, they lost valuable time and missed important connections and patterns that could have accelerated their investigations.

To address these challenges, DataExpert developed a comprehensive graph-based intelligence platform. The solution incorporated three primary features that proved game-changing for the agency’s fraud-fighting capabilities.

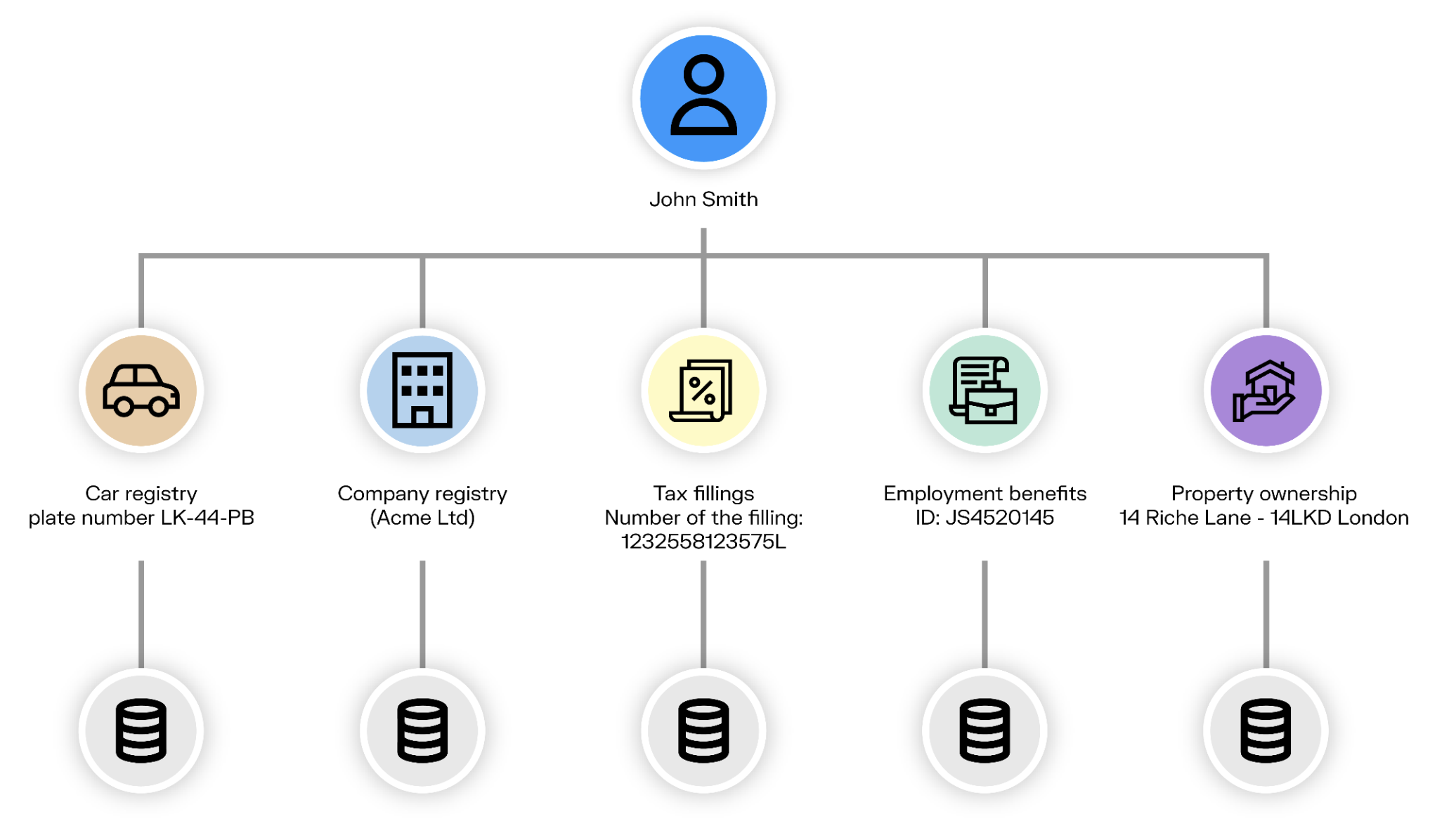

- Unified data access. The platform securely integrates with multiple systems including tax databases, benefits registries, business registries, and property ownership records. This integration effectively breaks down data silos and provides analysts with real-time access across all relevant data sources from a single interface.

- AI-powered case targeting. The platform performs sophisticated analysis including link detection, pattern recognition, anomaly detection, and cluster risk scoring. Rather than presenting analysts with raw data, the system provides a ranked list of cases with clear reasoning for prioritization. This helps analysts focus their efforts on the most promising investigations.

- Visual intelligence and collaboration capabilities. Analysts can visualize complex networks of relationships, explore connections between different cases, and share insights across departments. This visual approach helps investigators work faster and collaborate more effectively, breaking down traditional barriers between different teams and agencies.

The transformation in the agency's fraud-fighting capabilities has been dramatic. The graph-based approach has provided the context needed to accelerate investigations and recover lost revenue. The new system enabled analysts to cross-reference data across multiple sources including tax records, social databases, business registries, crime databases, and real estate records.

More importantly, it reveals hidden relationships that were previously invisible. The system can identify connections such as shared accountants, common employers, duplicate addresses, and shell company ownership structures. These relationship insights often prove crucial for understanding the full scope of fraudulent activity.

The platform has also enabled prioritization based on network risk, anomalies, and historical fraud patterns. Instead of working through random lists, analysts could focus on cases most likely to yield results. Perhaps most valuably, the system provided analysts with clear reasons for flagging cases, not just red flags without context.

This comprehensive approach has transformed the agency's fraud investigation capabilities, enabling more effective use of analyst time and significantly improving their ability to detect and stop complex fraud schemes.

Watch the webinar for the full case study and a demo of the graph platform:

A spotlight on graph technology directly in your inbox.