Building an end-to-end decision intelligence solution: expert insights on how to tackle financial crime head-on

In order to effectively combat financial crime, financial institutions need to understand the complete context around their clients. Pinpointing fraud and money laundering risk means being able to quickly and accurately identify suspicious behavior. However, navigating the overwhelming amount of available data can feel like searching for a needle in a haystack.

We interviewed financial industry data analytics experts Sameem Jaffrey, Co-founder and Director at Aptitude Global, and Alan Brown, Chief Technology Officer at Aptitude Global, about some of the big challenges organizations face in efficiently managing risk today - and the best ways technology can help meet those challenges. Aptitude Global is a specialist provider of data solutions for financial institutions and other clients in regulated industries.

We also explore how a modular technology solution combining advanced entity resolution with graph visualization and analytics that integrates with your existing architecture can empower you to get an accurate, end-to-end view of your customers to better mitigate risk. We’ll look at an example of an innovative contextual decision intelligence solution created through the partnership between Linkurious and Aptitude Global.

“Three crucial aspects have evolved significantly requiring organizations to revisit how they are tackling financial crime,” explains Sameem Jaffrey, Co-Founder and Director at Aptitude Global.

“First, there is a growing sophistication and proliferation of bad actors leveraging technology and techniques specifically designed to target known or perceived weaknesses. Innovation is not a one-way street. Criminals know how to exploit the march toward electronic payments, digital authentication and organizations keen to reduce friction at onboarding.

“Second, we see continuously increasing pressure from regulators to prove organizations are compliant and can demonstrate the adequacy of their systems and controls. That means huge fines, sanctions and negative publicity for anyone seen to be deficient.

“Finally, there has been an exponential increase in the cost of compliance. Many organizations (especially in financial services) now spend more of their discretionary budget on financial crime than any other aspect. Efficiency and sustainable benefits is the only way forward.”

Identifying financial crime risk comes down in a large part to getting the full picture of the context around your customers. Context is what enables you to detect complex patterns like networks of money mules, sanctions evasion schemes, and more, and to identify entities with risky connections: shell companies, associations with known fraudsters, etc. Financial institutions have a lot of information at their disposal to identify their customers.

“Customers can be identified in many ways. For example, by their personal attributes such as name and date of birth or their contact information such as addresses and telephone numbers,” says Alan Brown, CTO at Aptitude Global. “However, they can also be identified by behavioral information such as transaction details and even their personal or professional networks. Gaining deep insights into a customer’s identity lets you baseline and model what is normal for a customer profile and then through continuous monitoring of changes to this information design alerts that flag deviations from normality that may signify a risk to either you as a business or to the customer themselves.

“Risks also take many forms, such as fraud and financial crime risks where the customer may be a victim, or perpetrator, or even a financial risk e.g. of payment default. Combining a wide variety of regularly updated customer information such as confirmed cases of fraud, money laundering and payment defaults allows models to be accurately trained to provide automated risk management.”

There are several key issues that often prevent financial institutions from seeing the full picture of their customers - and any potential risks associated with them.

Poor data quality. Many organizations aren’t investing enough in entity resolution to ensure their data is clean, up to date, accurate, reliable, and trusted. Without effective entity resolution, you can be left with duplicates across the system, making it impossible to truly understand customers and the relationships within the data.

Inefficient processes. Plenty of organizations still rely on manual processes for capturing customer information and assessing their risk. These manual processes are time consuming and let potentially suspicious activity slip through the cracks.

Lack of external data monitoring. Customers don’t tend to inform their banks when their circumstances change, leaving financial institutions to proactively monitor these evolutions. It can be years before important changes surface, at which point it may be too late.

Tools that miss the full context. Automatic rules-based detection systems save precious time and manual work for investigators, but traditional detection and investigation tools don’t show the full context. Without technology like graph visualization and analytics - which quickly finds indirect connections and hard-to-spot patterns - you can miss the full picture.

These issues can lead to several associated problems, including high volumes of false alerts, spiraling costs, duplicated effort across teams, regulatory fines and reputational damage. And all the while fraud and financial crime still persist.

“Financial crime remediation programs are typically a scale challenge whereby the number of remediation cases is so large that conducting Customer Due Diligence (CDD) checks manually is impractical from both a time and cost perspective,” says Alan Brown. To manage their data backlog, many organizations take a manual approach to complete outstanding CDD checks. “Many organizations feel that it is necessary to outsource remediation to third party consultants because they lack both the internal capacity within their own BAU Operations teams or the technical capability to create a more automated solution.”

This doesn’t address the underlying data issues, however. A different approach relies on automation. “By investing in the infrastructure to automate remediation checks, not only are companies able to address large percentages of the remediation backbook in an automated manner, they are also investing in the technology infrastructure that can be used as part of an ongoing due diligence solution, meaning that future remediation programs will not be required.”

By bringing regular feeds of internal and third party data, adopting a risk-based approach instead of periodic reviews, and investing in an intelligent data platform enabling you to fully understand your customer, you can gain long-term sustainability in your anti-financial crime approach.

Let’s take a deeper look into different approaches to decision intelligence solutions aiming at mitigating financial crime and compliance risks.

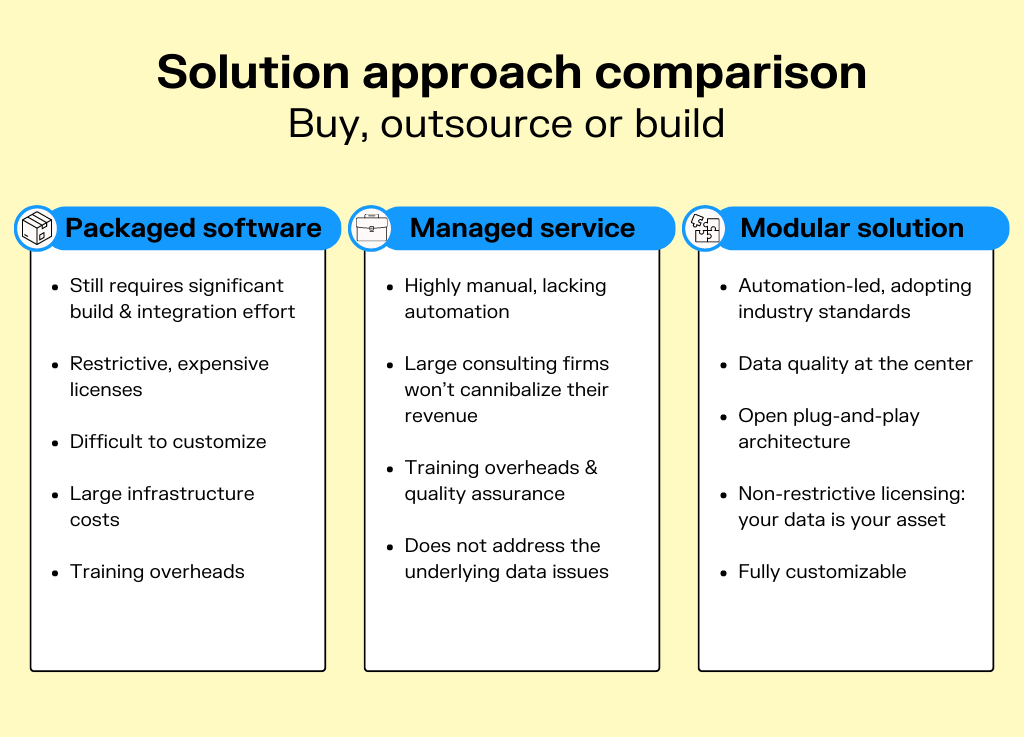

There are a few different approaches to gaining contextual information with network link analysis to manage financial crime risk and make informed decisions. Three common approaches are: using a packaged decision intelligence solution, leveraging managed services relying on external consultants, or using a modular solution combining existing technology solutions.

On the surface, a packaged decision intelligence solution such as Quantexa, Nice Actimize or SAS would seem like the best option. These can come with some key drawbacks, though: they still require a significant build effort, they are difficult to customize, and the licenses can be restrictive regarding how you can use your data.

A managed services solution is the manual remediation approach Alan Brown describes above. You’ll get the job done, but it’s costly compared to other solutions and you’ll have to keep repeating the same processes. “A wise person once said ‘Never outsource a problem - because if you do you end up with two problems: the one you originally had and now you have to manage a vendor…’,” says Sameem Jaffrey.

“But seriously, there are three principal elements to keep in mind. First, stakeholders (especially regulators) always want to see principal accountability stay with the institution regardless of how the execution is performed. Second, outsourcing often results in the atrophy of key resources and knowledge which is crucial to retain in-house. And finally, outsourcing comes with hidden costs. Anyone can pull together a fancy business case for 30%+ cost reduction through labor arbitrage and offshore outsourcing. The real costs are far higher and there is absolutely no incentive to reduce the armies of offshore analysts through rigorous and continuous automation. Managed services providers will never cannibalize their own revenue stream.”

Because the first two approaches come with some significant drawbacks, Linkurious has partnered with Aptitude Global and Senzing to provide a cost effective decision intelligence solution that combines cutting edge entity resolution and graph analytics technology with an emphasis on data quality for enhanced contextual intelligence. It provides a seamless integration of Linkurious Enterprise’s graph visualization and analysis capabilities with Senzing’s best in class entity resolution technology and Aptitude’s deep experience in innovation. The end result is a highly customizable, flexible and interoperable solution that fully meets your needs and that works with your existing architecture while keeping costs manageable. A modular solution like this is also easier to adapt to any new requirements, and it can easily scale with your data.

A modular decision intelligence solution to tackle financial crime like the one engineered by Aptitude Global, results in significant efficiency and accuracy improvements when detecting cases of fraud and financial crime and analyzing and managing risks in a client's network. A modular solution is a cost-effective alternative to other contextual decision intelligence solutions such as Quantexa.

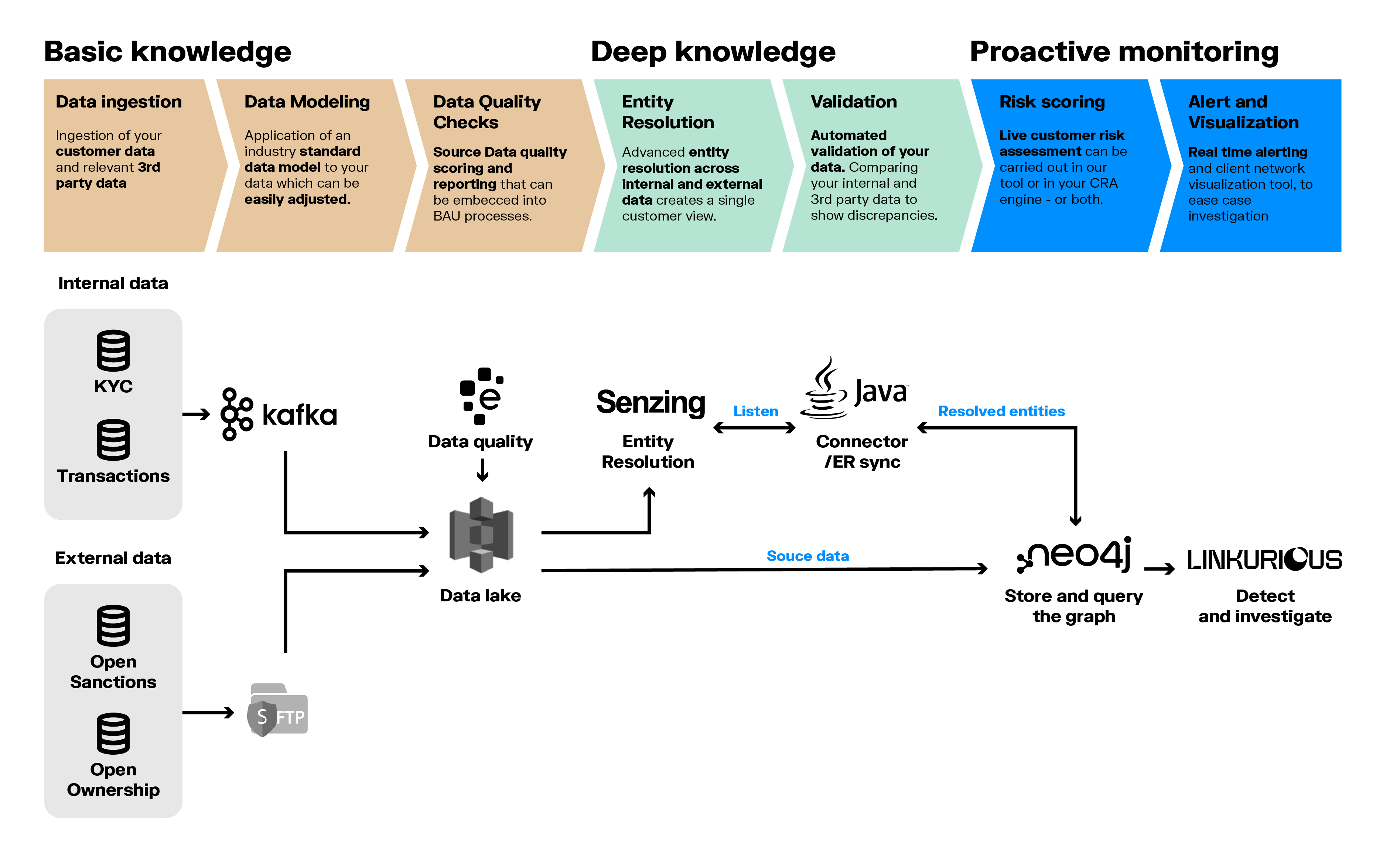

The end-to-end modular solution can be integrated with your existing anti-financial crime architecture. The 7-step process begins with data ingestion from both internal and third party sources. From there, the data is modeled - the data model can be changed to adapt to your organization’s needs. Data quality checks are integrated into the process to help with the entity resolution process.

Advanced entity resolution is performed using the Senzing API. Working on both internal and external data, this creates a single, highly reliable customer view. Following automated validation of your data, it can be integrated into a graph database like Neo4j. From there, you can apply risk scoring using the tool of your choice, alerting, and graph visualization for case investigation.

Graph visualization and analytics makes it easy to explore the context around entities to detect complex patterns like money mules or sanctions evasions, and to identify risky connections such as links to shell companies.

Software like Linkurious Enterprise graph intelligence solution helps both technical and non-technical users visualize and analyze insights hidden in complex connected data. In the modular solution with Aptitude Global, Linkurious’ technology is used to improve decision-making with a deep understanding of the context around a client or a transaction, to optimize operations with remarkable graph powered detection capabilities. It helps identify and mitigate risks that might otherwise go undetected using traditional methods.

“Financial criminals use intelligent and sophisticated means to hide their illicit activities. They are aware that most companies lack the capability to sufficiently monitor customer behavior across a large number of disconnected systems and applications,” says Alan Brown. “ bringing data together from payments systems, CRM tools, credit files, financial returns, corporate registry data, PEPs, sanctions & embargo lists, fraud databases as well as corporate ownership and shareholder information can be daunting.

“Using graph technology, this data can be modeled to clearly identify both known and unknown relationships between natural persons, legal entities and their activities and highlight how data both relates and differs across sources. Graph algorithms can be used to identify bad actors, for example money mules or incidences of identity theft. Giving analysts the ability to execute these detection rules automatically and visualize and explore the results means less time is spent organizing and preparing data and more time applying their vast experience to identify genuine cases of fraud and financial crime.”

To learn more about how to efficiently combine best-in-class technologies in graph, entity resolution, and visualization to optimize the fight against financial crime, watch our recent joint webinar with Aptitude and Senzing, available as a replay here.

A spotlight on graph technology directly in your inbox.