Evaluating the economic impact of a graph analytics platform for AML, anti-fraud and financial crime

If you work in risk management, you know that all too often, bad actors are staying one step ahead through innovative schemes and technology. Organizations must adapt faster than ever before to protect their customers and their organizations. Whether it’s preventing fraudulent activity or addressing anti-money laundering/counter-terrorism financing (AML/CFT) regulations, organizations find themselves needing to rethink their risk management strategies with investments in technology and human resources. But those investments can be expensive: 98% of financial institutions report an increase in financial crime compliance costs. Organizations are now facing a new challenge: increasing productivity and efficiency while improving the cost-effectiveness of their risk management programs through new skills and new technology.

Graph technology has evolved and matured over the past decade to deliver high performance and business value across a variety of industries and use cases. But it’s quickly proving its worth for uncovering complex financial crime schemes, which is our focus in this article. You can perform a similar analysis for other use cases. In the case of AML/CFT and anti-fraud, graph analytics platforms offer big benefits:

- More effective detection of bad actors and schemes such as synthetic identities, smurfing, money mules, shell company structures etc.,

- Faster, more intuitive exploration and investigation of suspicious networks,

- The ability to uncover hidden connections at multiple levels, and more.

But we know that listing off benefits isn’t good enough. If you’re considering adopting a graph analytics platform or deciding to expand your investment to strengthen your anti-financial crime arsenal, it’s important to be able to actually measure the comprehensive value it brings to your team and your organization.

This article is meant to help you do just that. Using customer feedback - and our years of experience - we’ve put together a list of practical evaluation criteria for your graph analytics platform and methods to measure the economic impact. We also look at some of the qualitative benefits of graph: the elements that are hard to put a number on, but that still carry important weight in evaluating the performance and benefits of a solution.

A word of caution: make sure you’re thinking holistically about your solution and comparing apples to apples. Whether you’re starting with your messy data, your data lake, or your database, be sure you’re comparing an equivalent tech stack with similar components to understand the total cost of ownership of your graph analytics platform and your legacy solution. In the case of this article, for the sake of simplicity, we’re considering a graph analytics platform to comprise:

- a graph database,

- a graph analytics library,

- entity resolution, and

- a graph visualization component.

To understand the economic impact of your graph analytics platform for AML and fraud detection and investigation, there are several criteria you can use to understand the quantitative benefits and actually put a number on them. The main criteria we’ll look at here are:

- Investigation time

- Detection rate

- False positive rate

- Increased knowledge of evolving patterns

One of the easiest ways to calculate the economic impact of your graph analytics platform is looking at investigation time. (To rely on the old but relevant cliché, time is money.) How much faster can analysts conclude their investigations using graphs?

Working with spreadsheets and different databases, the time to insight may depend on analyzing one line after another or hopping between data sources. The process can be long, and investigators may feel they lack a single source of truth.

With a graph analytics platform, on the other hand, investigations tend to take far less time. By visualizing complex relationships between entities in one place, analysts can more quickly identify suspicious patterns and anomalies. Eliminating the need to access multiple data sources and systems, combined with the ability to intuitively visualize data, can significantly reduce investigation time.

In terms of economic impact, decreased investigation time can limit the need to bring on more analysts, in turn reducing operational costs. Since compliance departments are considered cost centers, it can be crucial to optimize the cost of labor.

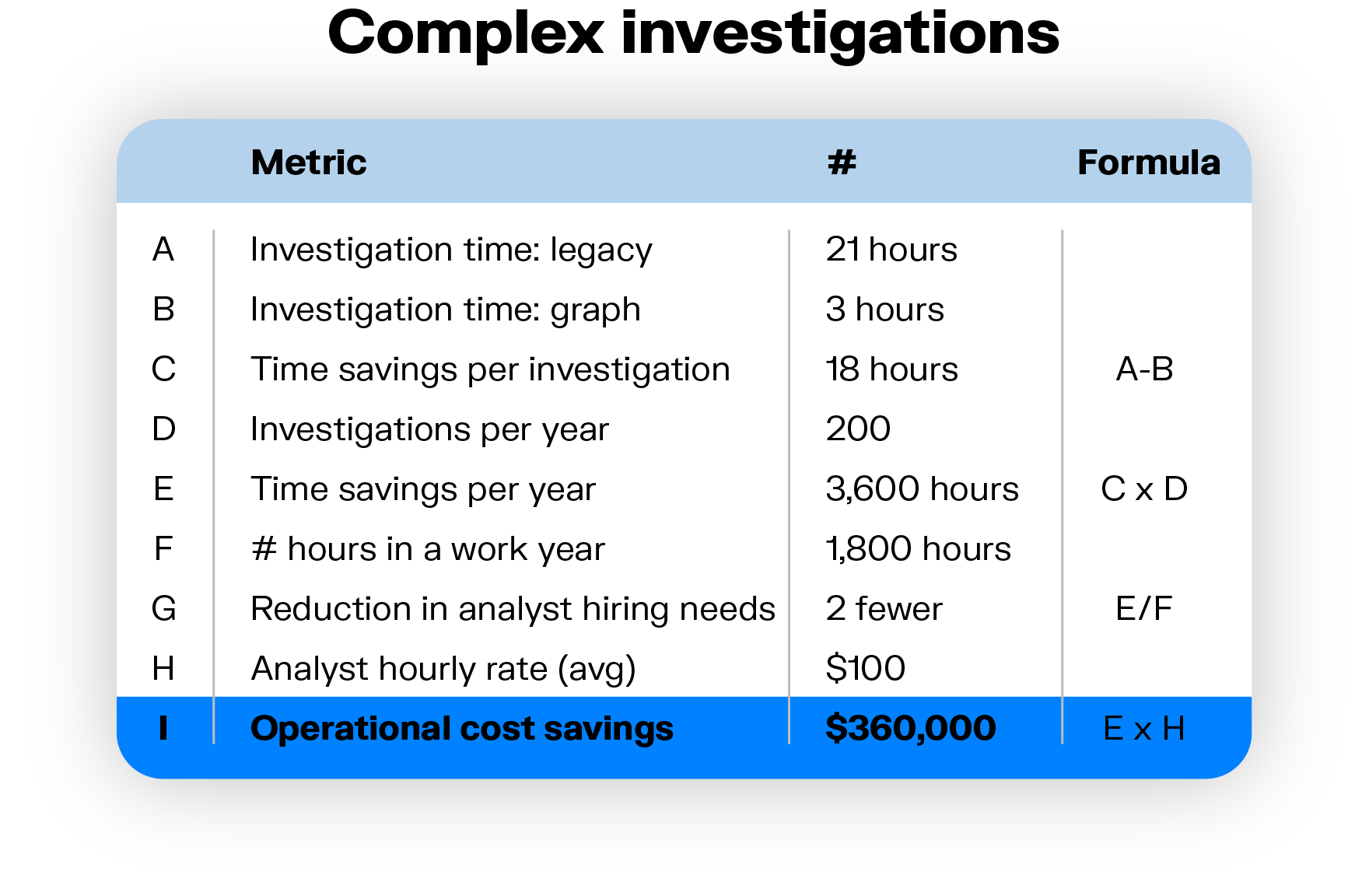

Here’s an example of how to calculate the impact of faster investigations, comparing a legacy solution versus a graph solution. We’ve filled in the table with sample estimates (based on client feedback) for a complex investigation to better illustrate the impact of improved investigation time.

On time to insight, one Linkurious client noted, “ROI has been largely positive: +33% productivity gain, 2 full-time equivalents earned.”

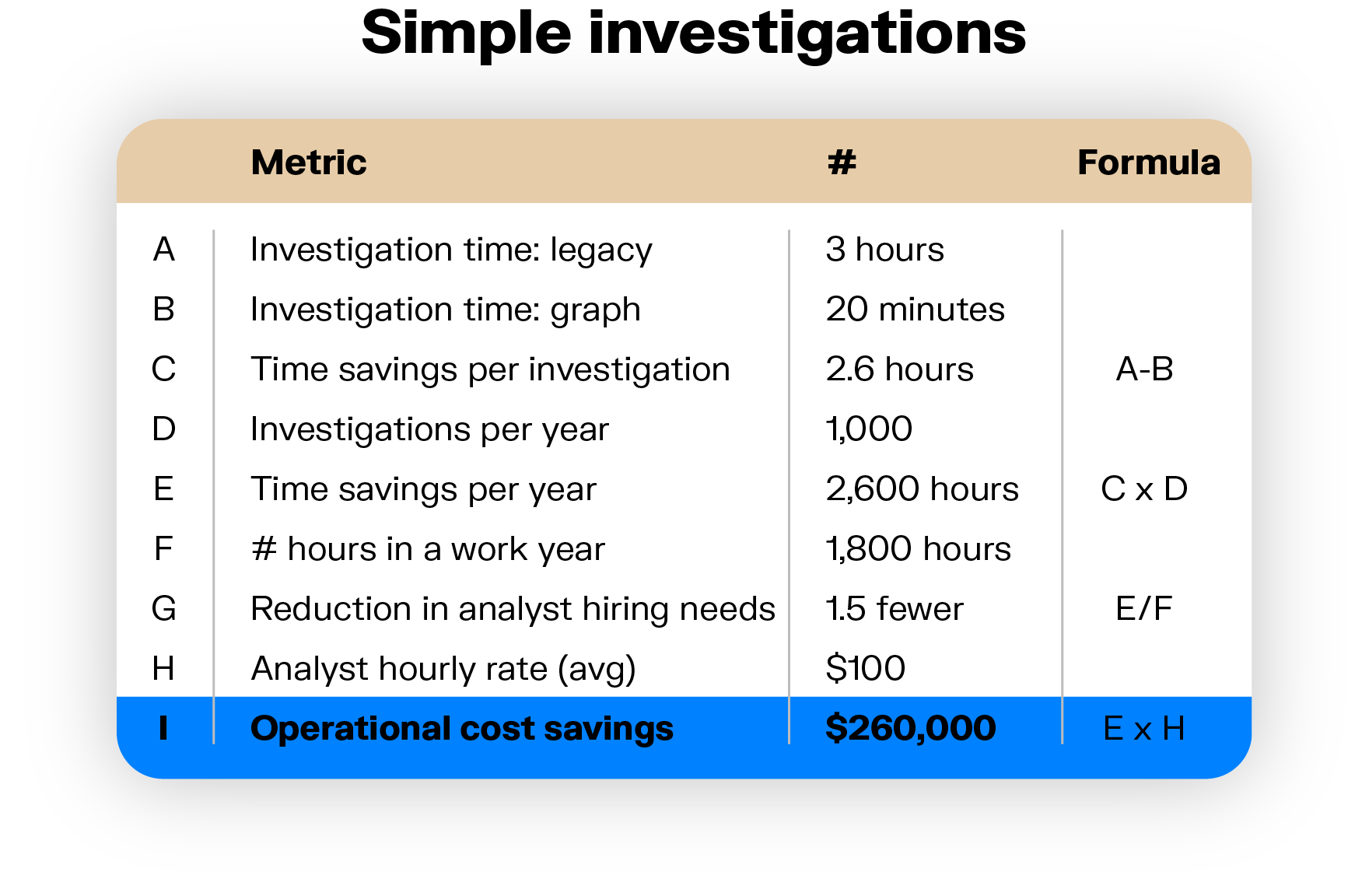

You can also perform this exercise for simpler, less time-consuming investigations:

For financial crime use cases, detection rate is an essential consideration for evaluating the impact of your graph analytics platform. Depending on your specific use case, this might include detecting suspicious activity linked to money laundering or detecting networks of fraudsters. In the example below, we’ll focus on fraud detection, which is easier to quantify as compared with compliance issues.

To understand how your graph analytics platform has improved your detection rate, you can compare the instances of fraud detected on a weekly or monthly basis to the fraud detected with your previous tools. Let’s look at an example:

Legacy solution: Average detection rate of 20 cases of fraud per month.

Graph solution: Average detection rate of 30 cases of fraud per month.

- 30 - 20 = 10/20 = 50% improvement in your detection rate

You may be able to put a dollar amount on the money saved due to improved detection rates. Say the average fraud detected would have cost your organization $100,000. If we take the above improvement in detection rate:

- 30 - 20 = 10 * $100,000 = $1,000,000 in prevented fraud.

Detection systems generate high volumes of fraud and AML alerts that must be processed by teams of analysts. A high false positive rate translates to lost time for the analysts who may spend hours or days investigating those false positives, at the cost of missing or delaying the identification of illicit activities.

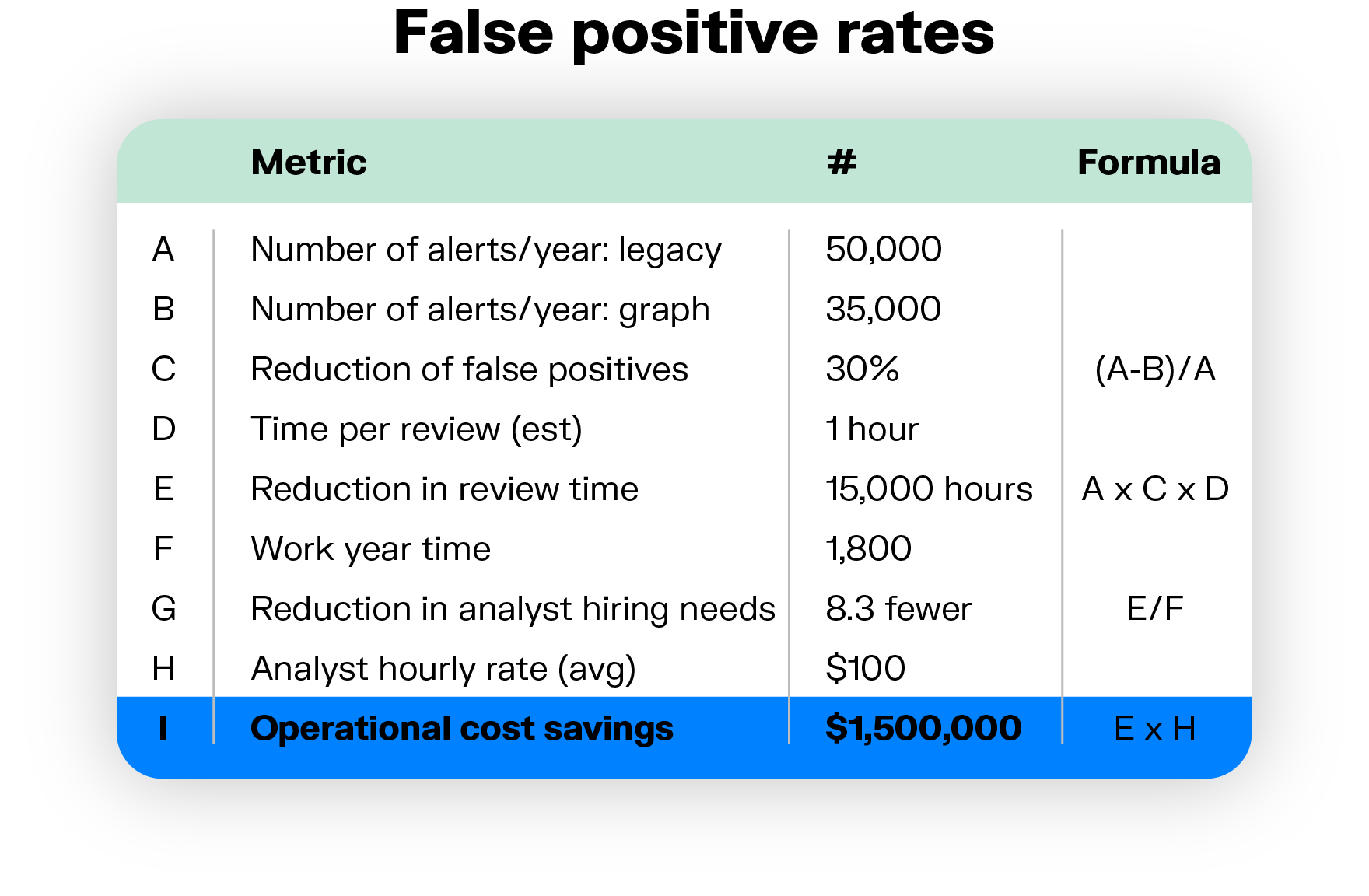

Say you have 30% fewer false positives using a graph analytics platform than you have with your legacy solution. That’s a 30% reduction in the number of inherently fruitless investigations your analysts will be conducting. Analysts can then use that time to close more cases in the same timeframe, and spend more time on more complex (and potentially more costly) cases, improving operational efficiency.

You can calculate the impact of a lower false positive rate using this table, which we have populated with sample data:

One of the principal benefits of a graph analytics platform is faster, more intuitive investigations of connected data. Organizations use it to get to the bottom of their complex, connected data more quickly - and to understand suspicious patterns within their data as they evolve. This translates to an increased, accelerated knowledge of the full scope of evolving illicit behavior.

Quickly understanding evolving patterns is essential for financial crime use cases: fraudsters and money launderers constantly innovate to get around safeguards. A system that helps identify new patterns more swiftly decreases risk and increases avoided fraud.

“I can clearly see the connections I could have missed,” writes a Linkurious customer on their use of graph. “There's such a huge leap for us when looking at the networks and understanding their connections.”

With anomalies and patterns that evolve quickly, decreasing the learning curve and being able feed new patterns into your workflows to detect future incidents faster can translate to cost savings in the form of avoided risk.

For example, you can evaluate how long it takes you to pinpoint a new pattern of complex fraud with your legacy system, versus how long it takes with your graph analytics platform. By multiplying the difference by the amount that fraud typology would cost your organization, you can arrive at an estimated cost savings of avoided fraud.

Beyond quantifying the economic impact of your graph analytics platform, graph solutions may come with important qualitative benefits that are more difficult to assign a dollar value to, but that still hold concrete value for your organization. We wanted to briefly touch on some of these qualitative benefits.

Organizations are increasingly turning to data in their decision making. But not all data analytics tools are created equal, and not all of them are equally helpful in making contextual decisions.

Graph analytics platforms offer a solution that can help you explore and analyze the connections between various data sources, enabling you to understand relationships in unprecedented ways. And by layering in a visual component, the analysis behind decisions becomes explainable and intuitive. When fighting financial crime, speed and accuracy can make all the difference: the faster you can conclude an investigation, the more likely you are to avoid fraud losses or running afoul of regulators due to undetected money laundering activity.

“The team recorded a drastic decrease of the average investigation process duration, leading to quicker decision executions and faster regulatory reporting transmissions,” writes one Linkurious client of the decision-making process using a graph analytics platform.

Some graph analytics platforms, like Linkurious, offer robust collaboration features to decrease friction, ensure team workflows run smoothly, and make the most of collective intelligence to advance complex investigations. Collaboration tools critically help reduce overlap in data exploration or investigations, in turn decreasing time wasted by analysts.

For example, your organization may have three fraud investigators working on what looks like three different fraud rings. Using a graph analytics platform, it may become apparent that these three colleagues have actually identified one big network. Using sharing and collaboration features, they can work together, connecting the dots, visualizing and analyzing the different points of interest, directly in their graph tool workspace in a collaborative manner.

As mentioned previously, graph technology can work well with other software - including artificial intelligence (AI) and machine learning (ML) technology. In fact, graph analytics can enhance AI/ML algorithms. How?

- Graph data can be ingested into machine learning algorithms, effectively providing greater analytical accuracy and faster insights.

- Graph increases the explainability of machine learning, demonstrating why an AI system arrived at a certain decision.

Adopting a graph analytics platform can therefore help you get more out of your investments in AI technologies.

The various benefits listed in this article - improved detection rates, fewer false positives, more efficient investigations - also come with the benefit of improving your organization’s standing with regulators. Being able to demonstrate innovation and continuous improvement helps foster a positive relationship with regulators.

See how Ria Money Transfer improved its relationship with a European regulator through the adoption of a graph solution.

Your firm’s relationship with its customers can improve with the adoption of a graph analytics platform, giving you a competitive advantage. Fewer false positives and shorter investigation processes result in fewer delays and disruptions and less friction on the customer side. Ultimately, positive customer experience means improved customer acquisition and loyalty.

Finally, a positive side effect of the benefits delivered by a graph analytics platform is improved employee experience. By removing part of the manual and repetitive tasks of processing alerts and investigating suspicious activity, analysts’ job satisfaction can improve. Happier employees generally means a higher degree of loyalty and less (costly) employee turnover.

Investing in a graph analytics platform can yield significant returns across multiple dimensions, from measurable economic benefits like reduced investigation times and improved detection rates to less tangible advantages such as enhanced decision-making and optimized team collaboration. By carefully evaluating both quantitative metrics and qualitative impacts, organizations can make informed decisions about implementing graph solutions that not only optimize operational efficiency but also provide deeper insights into complex data relationships.

A spotlight on graph technology directly in your inbox.